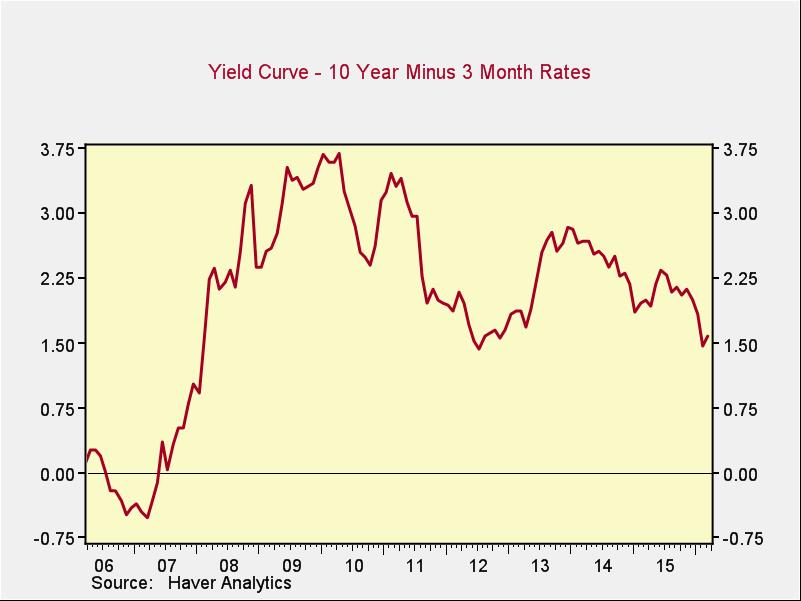

Yield Curve (10-Year Minus 3-Month Treasury Rates)

Signal: Green light

Rates for the 10-year Treasury remained relatively stable over the past month, while 3-month rates dropped, and the spread between long-term and short-term rates widened accordingly. Although the spread remains at healthy levels, as with other metrics, the trend over the past couple of months has changed from positive to negative, and it has now extended long enough to suggest this may be a fundamental negative shift. This month’s recovery is a positive sign, but we'll need to keep an eye on this indicator.

Consumer Confidence: Annual Change

Signal: Yellow light

Consumer confidence increased this month, but due to base effects, the year-on-year growth rate declined slightly below last month’s disappointing figure. Although we track consumer confidence on a year-to-year basis, the moderation of the decline, as well as the actual increase on the month, suggests this trend may be stabilizing. The year-on-year growth rate remains well above problematic levels, and the risk is somewhat less than last month suggested. Nonetheless, the current below-zero level (despite recent positive news) suggests this metric isn't out of the woods, and it will remain a yellow light until we see an actual recovery.

Conclusion: Signs of stabilization

Although a continued slowdown remains quite possible based on the data, a slowdown is not a recession. And again, the improving data indicates the slowdown may be lifting. One very positive fundamental is the continued strength of employment—the most important of the indicators—as supported by the bounce back in the ISM Non-Manufacturing Index.

Overall, though risks certainly remain, they appear less threatening and less immediate than they did last month, and current conditions still warrant a green light for the economy as a whole.

Brad McMillan is the chief investment officer at Commonwealth Financial Network, the nation’s largest privately held independent broker/dealer-RIA. He is the primary spokesperson for Commonwealth’s investment divisions. This post originally appeared on The Independent Market Observer, a daily blog authored by McMillan.

With the exception of consumer confidence, all of the major indicators have shown improvement, suggesting that recent downward trends may be moderating and possibly even reversing. If so, the current slowdown may abate.

Economic Risk Factor Update: April 2016

April 6, 2016

« Previous Article

| Next Article »

Login in order to post a comment