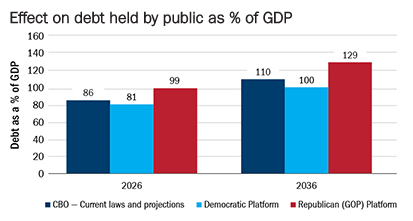

Prospects for debt sustainability look better under Clinton’s plan according to the Tax Policy Center. Debt as a percent of GDP would fall to 81% by 2026 due to the cumulative effect of tax increases on revenues versus the CBO’s estimate of 86% based on current law. Trump’s plan reduces taxes significantly but does not score well using standard measures. Without those tax revenues, debt–to-GDP would rise to 99% by 2026 and to 129% of GDP by 2036. Those estimates improve modestly using the Tax Policy Center’s dynamic scoring model. That model assumes meaningful benefits to economic growth and tax revenues with a 3% reduction in debt-to-GDP in both years for the GOP plan.

Takeaways for investors

Changes to tax policies are likely regardless of who wins in November. But it’s questionable how much change can actually be effected considering an expected divided government even if Trump wins. The changes outlined in both platforms would likely benefit middle-to-lower income taxpayers and help consumer spending. Clinton’s plan would increase taxes for wealthier households either from higher overall tax rates or fewer deductions. Trump’s plan to reduce taxes across the board would cause debt metrics to deteriorate. His plan could also impact demand for municipal bonds in future years, as lower tax rates may reduce the pressure to shield income from taxes. Business tax reforms are a mixed bag leaning slightly negative, but could benefit domestic-oriented consumer industries. While neither candidate appears to be targeting changes to Social Security that would hurt current or near retirees, future retirees may see changes under a GOP plan. Any changes to Medicare appear manageable for current enrollees who fall below the national income target. Finally, changes to the ACA program are necessary, but swing toward either further supports with costly subsidies to insure sustainability or a more extreme overhaul or repeal. There will be more uncertainty near term with a Trump win versus Clinton. But hopefully, there will be more clarity and discussion of the issues during these final weeks of the campaign.

Marie Schofield, CFA, is chief economist and senior portfolio manager at Columbia Threadneedle Investments.