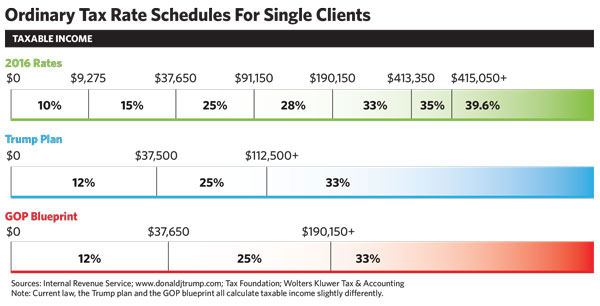

Income tax rates could drop in 2017. President-elect Donald Trump campaigned on lower rates, and a Republican-controlled Congress awaits him on Capitol Hill.

It’s too soon to know whether any new legislation might resemble Trump’s September 2016 tax plan, the House Republicans’ tax-reform blueprint, a happy marriage of the two, or something else again.

Nevertheless, “there are strategies clients can implement by year-end that, in most cases, have little downside and significant potential upside,” says Boston CPA Michael Antonelli, a partner at Edelstein & Company LLP.

With today’s 39.6% top ordinary rate possibly dwindling to 33% under both Trump’s plan and the GOP blueprint, deductions may be more valuable this year to the biggest earners. For them, accelerating write-offs into 2016—ever mindful of alternative minimum tax consequences, of course—could yield substantial savings.

Moreover, Trump has proposed capping itemized deductions at $200,000 for a couple filing jointly and $100,000 for single filers. “A client who could be affected and who was planning to make charitable contributions over the next two or three years may want to accelerate them into 2016,” Antonelli says.

Deferring income to 2017, when tax rates may be lower, could also benefit top-bracket clients.

“If a client is selling an S corporation or a partnership, they may be better off closing the deal in 2017 if a significant portion of the gain will be taxed as ordinary income due to the existence of inventory or receivables,” Antonelli says, “or if there are passive investors in the business who will get hit with the 3.8% net investment income tax.” Both the Trump and GOP plans nix the 3.8% Obamacare surtax.

Higher Rates Ahead For Some

Deferring income to 2017 could be dicey for single clients making between $112,000 and $190,000. They would pay a lower rate next year if the Republican blueprint is enacted, but a higher one in Donald Trump’s America.