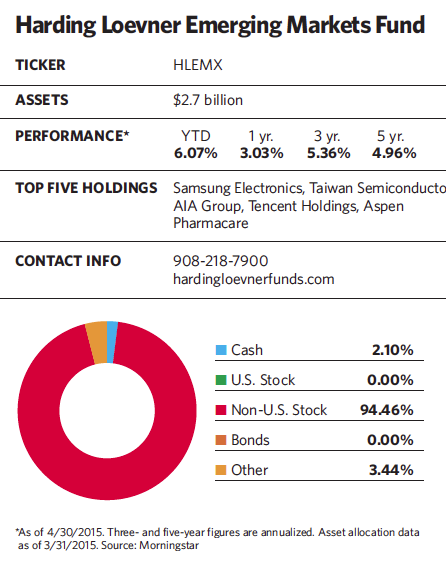

After nearly four years of disappointing performance, many investors have fallen out of love with diversified emerging market funds. G. Rusty Johnson, co-lead manager of the $2.4 billion Harding Loevner Emerging Markets Fund, thinks it may be time to think about a reconciliation.

“The market has been focusing on the negative developments in emerging markets, which have been very real and numerous,” he says. “But there is also room for optimism. The emerging market pendulum seems to be swinging in the right direction.”

Such a swing would be welcome relief for emerging market investors plagued by setbacks since the markets peaked in 2010. For several years, slower growth, corruption and pollution have dominated headlines about China. Last year, Russia and other emerging market economies tied heavily to commodities were hit hard by falling oil prices and OPEC’s surprise decision not to curtail production. In Brazil, adverse political developments contributed heavily to the sharp falls in the country’s currency and stock market. And the strengthening of the U.S. dollar against many emerging market currencies meant that foreign currency returns translated into fewer dollars for U.S. investors.

Johnson says some of those headwinds show signs of abating. At some point, the dollar’s unprecedented run will moderate. Countries such as China and India, which make up a large swath of the MSCI Emerging Markets Index, should continue to benefit from low oil prices because they free up disposable income for citizens of these increasingly consumer-oriented economies. Areas hit hardest by low oil prices, such as Russia and a few countries in Latin America, make up a much smaller percentage of the index and the fund than those that stand to benefit from them.

Some countries are seeing progress on the political and regulatory fronts as well. In China, which represents about 23% of the MSCI Emerging Markets Index, a new government is improving economic efficiencies, addressing government corruption and tackling pollution through financial and tax policies that favor natural gas and mass transportation over cars. In India and Indonesia, equity markets responded favorably to the election of reform candidates.

To some, positive trends for emerging markets go beyond structural and political reforms. In a March article in Canadian newspaper The Globe and Mail, wealth manager Thane Stenner noted that over the last two years investors have been pulling huge amounts out of emerging markets equity funds. To contrarian investors like him, such pronounced and prolonged outflows indicate “it’s generally a time to buy before the asset comes back into favor.” He also pointed out that over the past 25 years the market has only been down three years in a row during the period between 1999 and 2001, and the subsequent upturn was sharp.

Even if stock prices recover, political and economic improvements are moving forward at a different pace around the world, a trend that has become particularly pronounced over that last couple of years. In countries such as China and India, political reforms and lower oil prices sent markets higher in 2014, while oil exporters such as Russia have suffered severe market losses.

Unlike some emerging market funds, this offering usually doesn’t make big country or regional bets in an attempt to cash in on these differences, since those bets can sometimes backfire. According to its latest fact sheet, country weightings landed no more than 8 percentage points above or below the benchmark index weighting. In terms of sector exposure, the fund is slightly overweight to the benchmark in health care, consumer discretionary and consumer staples stocks and underweight in commodity-sensitive materials, utilities and energy companies. The underweight position in the last sectors came from weak returns as well as the sales of select energy positions late last year, including Brazil’s Petrobras and Ecopetrol of Colombia.

EM Contrarian: Headwinds Should Abate

June 2015

« Previous Article

| Next Article »

Login in order to post a comment