Shorter-Term: Prices Stable

On a shorter-term basis, the market is focused on the degree to which the United States will use sanctions to squeeze Iranian oil exports. That could limit overall supply and drive up prices.

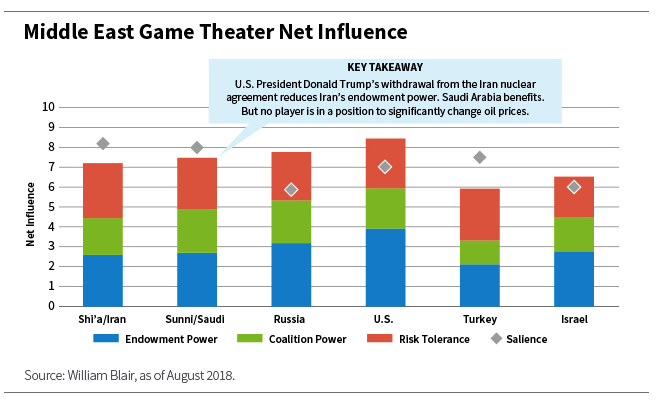

But when we look at our Middle East game theater, we believe the aggregate supply and demand balance is likely to remain fairly stable—in part because we saw this playbook a few years ago with respect to Iran.

One thing that’s different now is that the European Union is not fully on board with the sanctions, so we expect a bit less pressure on Iran than in the past. At the same time, China and Russia are likely to be fairly opportunistic, increasing imports to Iran.

Add the likely increase in production from other OPEC nations including Saudi Arabia, and the sanctions are counter-weighted such that we expect a stable balance.

As a result, we believe there is a low probability (about 25 percent) of Iran’s crude oil and condensate exports declining by more than 1 million barrels per day at any time between now and the end of 2018.

It is also worth noting that we have seen a pickup in global energy sector earnings and expect it to continue. The sector has undergone a massive investment-driven cycle, with improved technologies leading to more elastic supply.

We are currently emerging from a trough in which companies re-equilibrated cost structures, and are seeing increased earnings and expectations as a result. We account for this in our current valuation expectations.

Brian Singer, CFA, partner, is a portfolio manager and head of William Blair’s Dynamic Allocation Strategies team.