The current state of the market for renters is akin to being in the eye of a multi-year hurricane. Rents surged in 2021 and 2022, driving a wave of apartment construction that helped to stabilize or even lower prices this year. But storm clouds already loom on the horizon — new construction has slumped and financial conditions don’t support a pickup, threatening another supply crunch in the not-too-distant future.

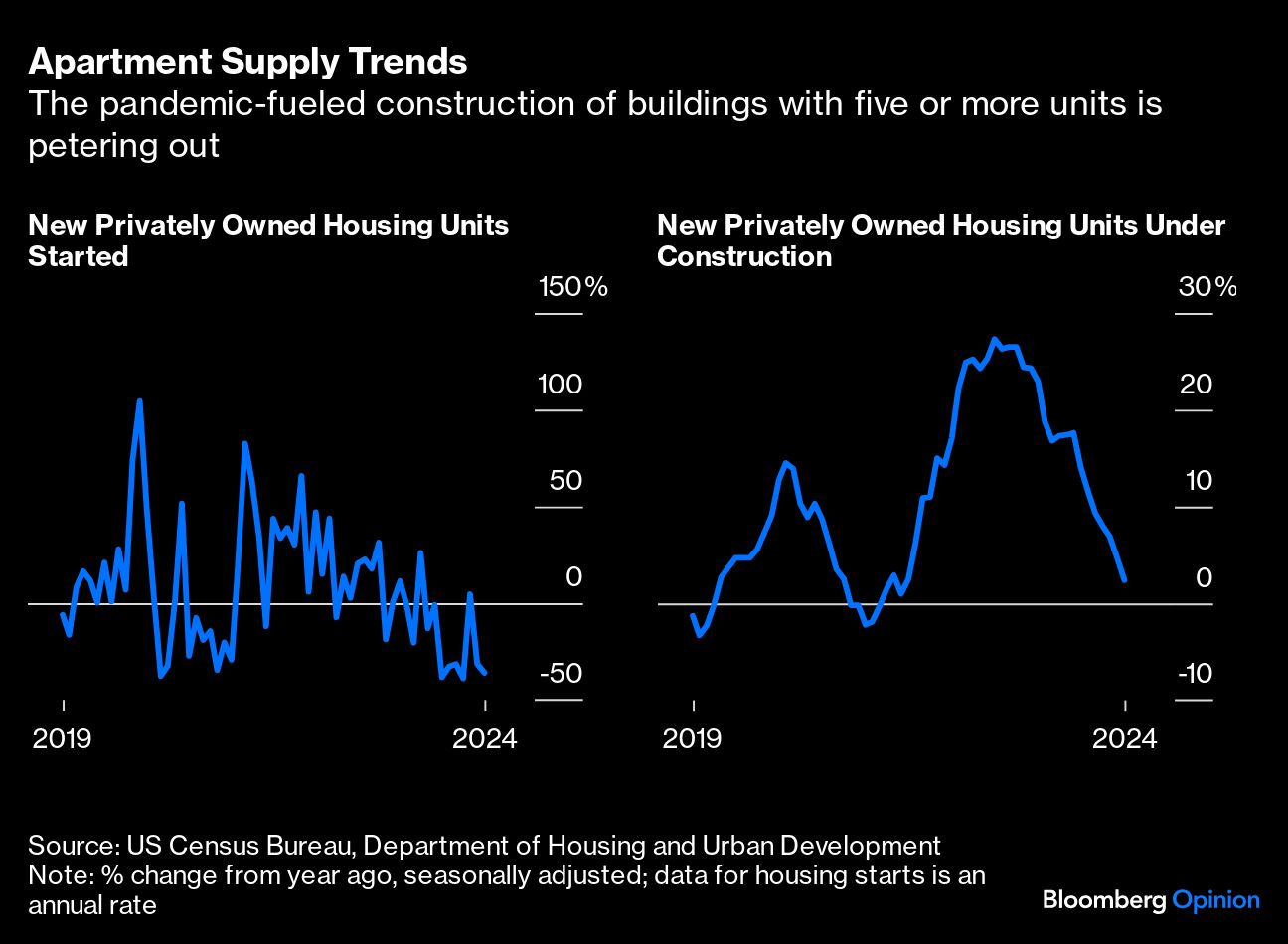

Groundbreakings for new apartments are down 35% from a year ago as high-construction metros such as Austin and Atlanta see rents decline. Building activity is also being held back by onerous funding costs and the muted stock performance of apartment REITs such as AvalonBay Communities Inc. and Camden Property Trust. This is in sharp contrast to a few years back when rents were surging, interest rates were low, and investor enthusiasm for REITs pushed some stocks up by more than 50% in 2021. Such favorable conditions meant the number of apartments under construction climbed pretty consistently to a record high last summer, ensuring that completed units will keep hitting the market over the next year or so.

But the elevated supply is now being met with a pickup in demand. Carl Whitaker of RealPage, a housing analytics firm, notes that the first quarter of 2024 was the strongest for net apartment absorption since the 2021 pandemic-related boom. The online marketplace Apartment List has shown rent growth stabilizing in recent months as well, suggesting that supply is still keeping a lid on rents, but it is no longer putting as much downward pressure as was the case a year ago.

Apartment demand is likely up for a few reasons. As with most goods and services, renters are responding to lower prices. Austinites, for example, who found roommates over the last few years due to surging rents now have an easier time affording their own places after the recent drop. Additionally, the continued lack of affordability due to a combination of high house prices and high mortgage rates is keeping some people in apartments when they might otherwise have transitioned to homeownership. Finally, elevated immigration means more people looking for housing.

That puts the apartment market in a strange state where there’s a significant level of supply expected this year, but reasons to believe that we could have a shortage as soon as the first half of 2026. At a time when the Federal Reserve is worried about price pressures, and the March Consumer Price Inflation report released this week showed elevated readings for shelter, this is a concern.

Blackstone Inc.’s recent $10 billion purchase of Apartment Income REIT tells me that investors are taking note. More deals of this kind could be a catalyst for construction down the road.

For a while now, there’s been a large valuation gap between privately owned apartment buildings and publicly owned apartment REITs, with the latter being a fair amount cheaper. Investors have been concerned that the REITs were a better reflection of the true value of apartments, with private valuations set to decline over time. The Blackstone deal sends a $10 billion signal that the private market has it right, and publicly traded REITs are mispriced. With big institutional investors betting on a recovery, the asset class should become more attractive to more skittish investors.

This isn’t going to get shovels in the ground tomorrow to stave off a 2026 apartment crunch. But a recovery in the valuation of existing apartments is a crucial step to giving developers and investors the confidence to start building again, and ensuring that whatever shortfall we end up with in a few years is as brief as possible.

Conor Sen is a Bloomberg Opinion columnist. He is founder of Peachtree Creek Investments.