Key Points

• The firing of James Comey adds to doubts about President Trump’s ability to accomplish his major legislative goals.

• For equities, positive and negative factors appear slightly balanced to the upside.

• We encourage investors to stay with a progrowth investment stance.

President Trump’s firing of FBI Director James Comey dominated the headlines last week, but investors generally ignored the drama. After rising for three weeks, equities fell slightly with the S&P 500 Index declining 0.3%.1 Treasury yields declined somewhat but remain near recent highs.1 And the U.S. dollar rebounded after falling for four straight weeks.1

Weekly Top Themes

1. Consumer spending appears solid, despite high-profile problems at department stores. Consumers may be moving away from brick-and-mortar retailers, but are spending online and on travel, restaurants and other experiences.

2. Jobs growth should continue, but the pace may be less robust. Slowing corporate profits and labor market shortages are headwinds for job creation.

3. Investors may be overly complacent about inflation. Inflation remains moderate, but we expect it to increase. Wage growth in particular appears due to climb: With unemployment at a 10-year low of 4.4%,2 we think it is only a matter of time before wages climb as labor sources diminish.

4. The U.S. deficit is rising sharply, presenting a roadblock for tax reform. Over the next 10 years under current laws, the federal budget deficit is projected to soar from $559 billion to $1.4 trillion, representing an increase from 2.9% to 5.0% of GDP.3 These numbers would likely grow with increases in fiscal spending. Rising deficit levels will likely complicate the president’s plans to reduce taxes and/or or increase infrastructure and defense spending.

5. The Comey dismissal casts additional doubt on President Trump’s ability to accomplish his goals. Regardless of how events unfold, changing stories and communications confusion cast doubt on the discipline and political acumen of the White House. From an investment perspective, last week’s events are another reason to be skeptical of the president’s capability to deliver on his major legislative goals, especially regarding a significant overhaul of the tax code.

Positives (Slightly) Outweigh Negatives

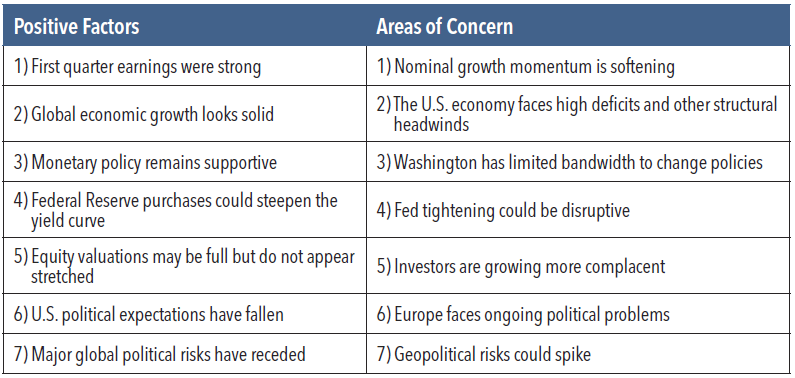

Over the past couple of months, equity markets have largely treaded water and remained in a consolidation mode. We have seen some notable shifts (such as European equities outperforming dramatically and energy and resource-related stocks lagging), but overall, investors appear to be awaiting a catalyst to cause a breakout. Positive and negative factors appear pretty well balanced, as seen in the following list adapted from J.P. Morgan:4

Overall, we believe the positive factors should moderately outweigh the negatives. Absent a recession and/or sharp decline in corporate earnings, we see no reason to expect a significant downturn in equity markets. And neither of those prospects appears likely. Near-term risks and some softening of economic data could limit stock prices on the upside, but we think we are more likely to continue the consolidation phase rather than experience a notable correction.

Over the longer term, we expect to see modest improvements in global economic growth, a solid backdrop for corporate earnings and a gradual pickup in U.S. interest rates. Together, this looks to us like a recipe for equities outperforming bonds and cash. As such, we encourage investors to stay with a pro-growth investment stance and specifically favor stocks over bonds, fixed income credit sectors over government-related areas and non-energy and resource related areas of the global equity market.

Bob Doll is chief equity strategist at Nuveen Asset Management.

1 Source: Morningstar Direct, as of 5/12/17

2 Source: Bureau of Economic Analysis

3 Congressional Budget Office

4 Source: J.P. Morgan Research, May 15 “Bull vs. Bear Debate”