Kurt Baker, a Millennium Management alumnus and former head of Morgan Stanley’s Asia prime brokerage, is seeking nearly $3 billion in capital commitments for a multi-manager hedge fund firm to rival the likes of Citadel in the region, according to a person with knowledge of the matter.

Baker is in advanced talks with several potential investors to back his Hong Kong-based, Asia-focused firm, named 30th Century Partners, said the person, asking not to be identified discussing private information. It plans to start trading in June 2024 with eight to 10 investment teams.

The majority of the firm’s investments will be in Asia, with India, China, South Korea, Taiwan, Hong Kong and Japan its largest markets, the person added. It will trade Southeast Asia and Australia from time to time, while some of its investment strategies such as macro trading will have a global reach.

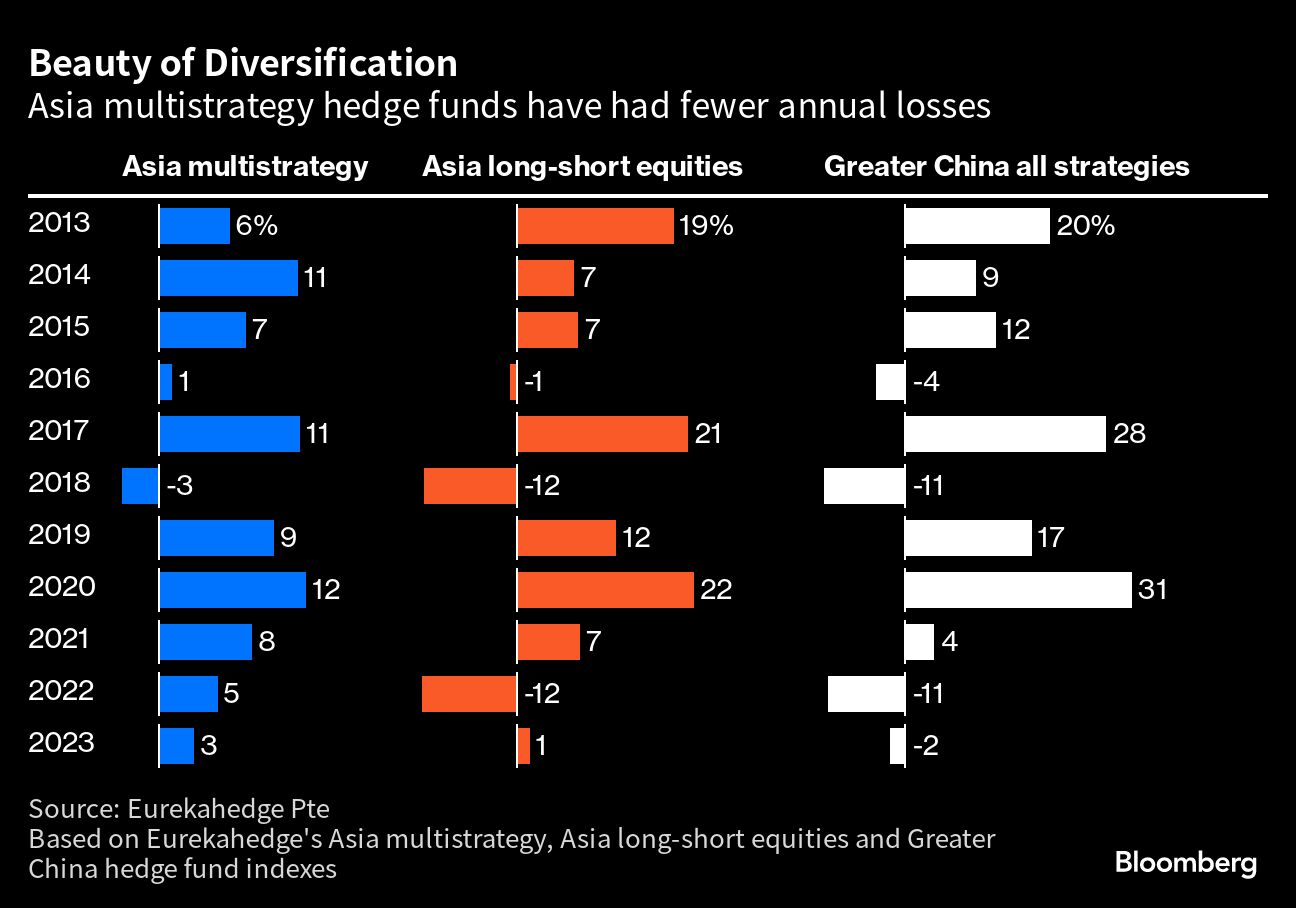

Firms that employ pods with various investment approaches, focusing on different asset classes and geographies, are gaining traction in a region populated by mostly smaller rivals with narrower investment scopes. China- and technology-focused hedge funds suffered heavy losses in recent years, highlighting the benefit of diversification in an age of heightened macroeconomic, geopolitical and regulatory uncertainties.

Multistrategy hedge funds in Asia had a single annual loss, a 3% decline in 2018, over the past decade. Regional peers that only trade stocks were down in three of those years, while China-focused hedge funds lost money in four — two of those double-digits.

New hedge fund starts have slowed globally since 2021 and liquidations have jumped. But so-called multistrategy platforms like Millennium and Point72 Asset Management have continued to expand, helped in part by their ability to pass through certain costs to investors, including compensation and research.

“A $3 billion capital raising target sounds ambitious for an Asian launch but is achievable over time,” said Will Tan, Singapore-based managing director at recruiting firm Principle Partners Pte. “Performance is key but some innovation in areas such as talent retention, compensation structure and collaboration among teams will help attract investors.”

Polymer Capital Management, led by former Point72 Asia head Angus Wai, grew assets to $4.5 billion by May, four years since it started trading, according to a document seen by Bloomberg News. It assembled about 100 investment professionals by then.

Baker is considering an arrangement that will allow the firm to tap capital committed by investors as trading opportunities arise, instead of quickly deploying billions of dollars, which would drag down returns, the person added.

On the stock front, it will have teams that trade with low net exposure — the difference between bullish and bearish wagers. It will hire equity arbitragers who may bet that spreads between different share classes of the same companies, or between targets and acquirers in merger situations, will disappear. They may also exploit changes in stock volatility after a period of dislocation.

In fixed income, it will have teams trading rates, credit and foreign exchange, including macro portfolio managers that try to make money from broad trends across those markets.

It also aims to recruit for systematic strategies, including quant traders and those using the so-called “statistical arbitrage” approach that can exploit relative price movements of thousands of securities.

“Running a multistrategy platform takes in-depth knowledge of a wide area of expertise,” Tan said. “Investors will be looking for someone who has previous experience managing and growing a platform successfully. We have very limited talent in Asia with this expertise.”

Baker, who left Morgan Stanley in 2008, was Asia head of business development at Izzy Englander’s Millennium from 2013 to October 2021, helping to recruit and evaluate investment teams in the region. That was followed by a stint as a special adviser to the business development team until December.

Baker has hired a chief risk officer, a chief technology officer and a chief data scientist for the firm, said the person.

This article was provided by Bloomberg News.