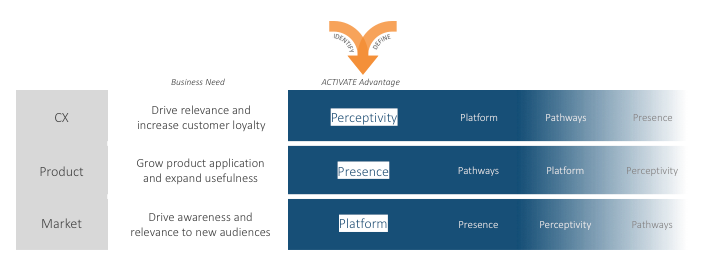

While (disclaimer) there is no one perfect means to approach disruption, incumbent Advantage Factors provide a good guide when plotted against the type of disruption and incumbent business needs.

These also help prioritize the advantages that are leveraged initially, and those which may require more effort or investment to deploy at the execution or, what we call, the activate advantage stage.

Hortz: Let’s dig into each of these execution strategies a bit more. Your report notes that 40% of survey respondents stated they would consider switching providers for a more personalized experience, which is CX Innovation/Disruption. Can you explain how incumbents would leverage their Perceptivity Advantage?

Lewis: The Perceptivity Advantage refers to the advantage over entrants that incumbents have in understanding their buyer audiences. Unfortunately, as we note in the report, there are often organizational barriers that prevent incumbent firms from tapping into this rich source of data and taking full advantage of it. The main ways to leverage Perceptivity in your execution strategies are to actively manage perceptions, fully leverage and activate insights, and to focus on the whole customer experience. Practical ways to do this are:

Hortz: Your study also talks about the Presence Advantage. Given general consumer trends and the overwhelming shift to digital due to Covid-19, does this hold true and how are incumbent companies able to leverage it?

Lewis: While the shift to digital has been amplified by Covid-19, consumers told us very recently they very much still desire human interaction. Our work highlights that presence does not have to mean face-to-face. Rather, it is about the ability of incumbent firms to deliver better omnichannel experiences that leverage the bevy of means to connect with customers. While entrants often only focus on digital, incumbents have a real advantage to deliver better services and humanize the experience — ones that entrants just cannot match.

90% of consumers expect a cohesive omnichannel experience and only established incumbent firms can deliver on these. Tactics for doing this are:

Hortz: It is curious that you state the Platform Advantage was poorly executed on by incumbents – do they just take it for granted?

Lewis: Not at all, I think the reality is incumbent firms don’t always see their Platform as the asset that it is. When looking at large global enterprise, brand becomes a beast of its own and disconnected from shorter-term efforts or initiatives. We see this brand become even less of a focus when faced with disruption and the scramble to maintain share. What is sometimes forgotten is the power of the built-in awareness of an established firm — and the trust that comes along with it. While there is always brand baggage, it is a lot easier to work with something established than to start over. In our study, we call out several cases where established firms were able to leverage their existing Platform for continued success. The ways they did this were:

• Feedback –Ensure customer feedback is collected, then leverage and demonstrate action based on this input – across the buyer journey

• Personalization – Connect better with customers and prospect buy providing them an experience tailored to their individual preferences

• Segmentation – Incumbent firms have established segmentation models of customers, so care must be taken to ensure ongoing relevance and actionability

• Customer Journey – Ensure customer journeywork is up-to-date, accurate and accounts for all channels and interaction

• Consistency – Align messaging and leverage available data to make every customer contact amplify the value of the omnichannel experience

• Coordination – Along with understanding the customer journey, communications must be coordinated to elevate the experience across channels

• Brand Activation – Directly connect brand assets to ongoing customer marketing activities – connecting on an emotional level with consumers

• Full-Service Focus – Emphasize the simplicity and seamlessness of being with a full-service provider vs. disjointed ad hoc services

• Partnership – More actively leaning into existing brand associations and partnerships that enhance customer engagement and loyalty