[When it comes to growth opportunities for institutional asset managers, many industry researchers have reported that distribution executives think the biggest opportunity moving forward is in the RIA channel. Asset managers will likely dedicate more resources to RIAs over the next three years in line with their consistent growth of market share. According to Cerulli Associates’ projections, as the wirehouse channel continues to cede market share, independent and hybrid RIAs will collectively account for 30.6% of advisor-managed assets by 2025.

This distribution channel is deemed as still an open ocean, but it comes with its challenges – lacking uniformity, each firm is unique requiring a firm-by-firm strategic partnership with the ability to create and maintain customized models and, oftentimes, it is not a plug-and-play deployment.

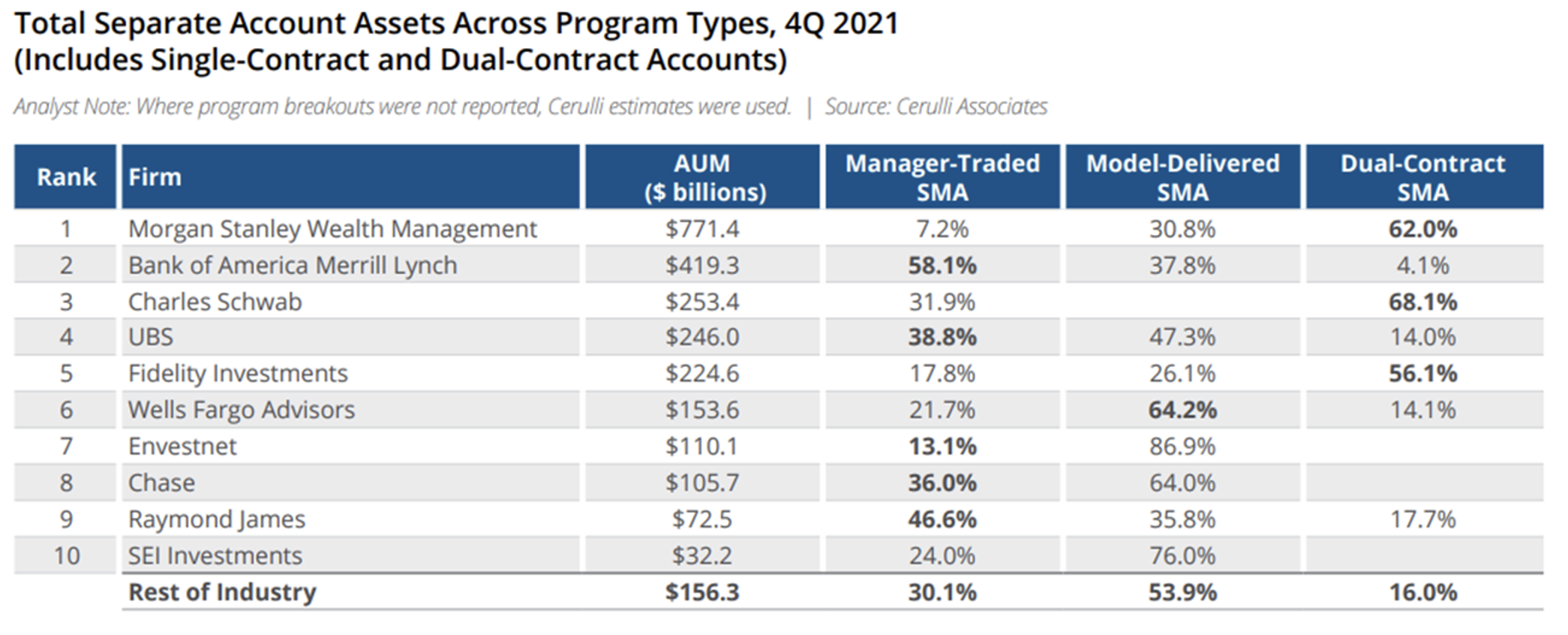

In pursuit of this channel, asset managers have embraced model delivery to separate account platforms and TAMPs, but a large percentage of Assets Under Management (AUM) remain manager-traded. With the latter, the manager needs to have the infrastructure to contract directly with RIA clients individually and do the trading, reconciliation, and reporting. It is a challenge because many are not wired to handle a large volume of retail sized accounts across RIAs. Most institutional asset managers are just not operationally set up to directly engage with individual RIAs.

To learn more about these asset manager challenges, opportunities and how financial technology is playing a major role in this evolution, we reached out to Institute member Robert Battista SVP, Vestmark Advisory Solutions. Their capabilities with their Vestmark Manager Marketplace and a highly experienced trading team offer the ability to basically replicate the model delivery experience for asset managers who are expanding their engagement in the RIA space.]

Bill Hortz: Can you give us a current lay of the land of the opportunities and challenges for asset managers in the SMA space?

Robert Battista: Most large asset managers established themselves by serving institutional investors and continued to grow their business by entering the retail market, primarily through distributing products through large- to medium-sized broker dealers. Shelf space at large retail-focused wealth management firms is highly sought after because it provides distribution to many advisors and clients through a single set of pipes. However, a combination of factors such as industry consolidation, overly saturated product platforms, and increasing shelf space fees are driving asset managers to find new sources of retail AUM growth. The RIA market is enormous in aggregate, so it is extremely attractive, but it is highly fragmented and presents a number of challenges.

Most asset managers prefer to serve the retail channel through model delivery, which enables the manager to deliver a model to a centralized source such as a TAMP. Many RIAs access SMAs through TAMPs, but these platforms often lack the flexibility and customization RIAs demand, and they often carry heavy fees. In some instances, the additional layer of fees may cause RIAs to reconsider outsourced investments because the all-in cost to their clients is just too high. A large portion of SMA assets remain manager-traded, but most asset managers do not have the capability or desire to manage a high volume of retail sized accounts.

Hortz: Can you share with us a better understanding of the operational issues at play?

Battista: Many RIAs seek direct relationships with asset managers. Advisors that have chosen to run their business in the independent channel often seek to offer tailored solutions to their clients. For asset managers to compete for this business they will need to invest in sophisticated technology that enables them to manage customized relationships at scale.

In addition, managers need to establish custodial integrations with their chosen technology so they can manage portfolios with accurate account level information, conduct daily reconciliation, and offer flexible reporting. The daily management of these tasks can take up meaningful resources and most asset managers would prefer to focus their efforts on true value creating activities such as managing portfolios and relationships.

Hortz: How are you redesigning your different capabilities to address asset managers’ pain points in this market?

Battista: Vestmark has a strong reputation for providing sophisticated portfolio management software that enables some of the industry’s largest wealth management firms to scale their managed account platforms. Our platform currently supports over $1.5 trillion in assets and we work with 6 of the 10 largest managed account sponsors.