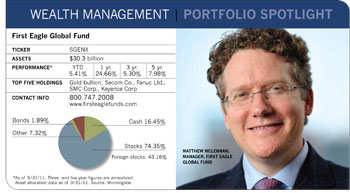

Back in March, First Eagle Global Fund manager Matthew McLennan was on his way to London when he heard the news about the earthquake and tsunami that hit Japan. "There were a lot of phone calls going back and forth in the middle of the night between myself and the other portfolio managers in New York," recalls McLennan of his conversations with colleagues Abhay Deshpande and Kimball Brooker as the cataclysmic event unfolded.

The bad news for the fund was that it had a large amount of its equity portfolio in Japanese stocks, an allocation in the high teens, when the quake hit and the Japanese stock market later tanked. The good news was that McLennan had a secret weapon: a big cash stockpile.

Unlike many mutual funds, which commit to being fully invested at all times except for a smidgen of cash to handle redemptions, it isn't unusual for First Eagle Global to have as much as 20% of its assets in cash equivalents when its manager doesn't see attractive buying opportunities.

During strong bull markets, the strategy has proved to be a drag on the fund's returns. But it has also provided a cushion in down markets, as well as a tool for jumping in on favored stocks without having to liquidate current positions. "Having a lot of cash gives us the flexibility to act quickly when stocks are mispriced relative to their prospects," says McLennan. "Buying at attractive valuations provides a wide margin of safety and helps avoid land mines."

Soon after the disaster struck, McLennan tapped some of the fund's cash reserves to add money to Japanese companies already in the portfolio that he thought were being unjustly punished for a natural disaster that could not have been predicted.

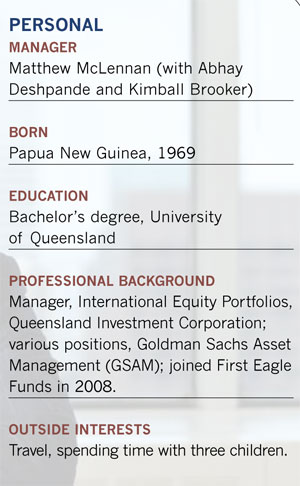

"From a human standpoint, this was clearly a tragedy," says the 42-year-old manager, who joined the firm in 2008 after a long career at Goldman Sachs Asset Management in London, where he founded a group that ran a global equity portfolio for wealthy private clients. "But it was also one of those situations where we knew there was no impairment to the basic businesses of these companies." Since then, he says, many of the Japanese holdings have returned to their pre-crisis levels.

During its 32-year history, the $30 billion First Eagle Global Fund has been known to move into investments when others ignore them or even flee. The entry point might happen with a company-specific event or series of events that investors perceive as negative. Or it can occur with an overall market decline, as was the case in Japan.

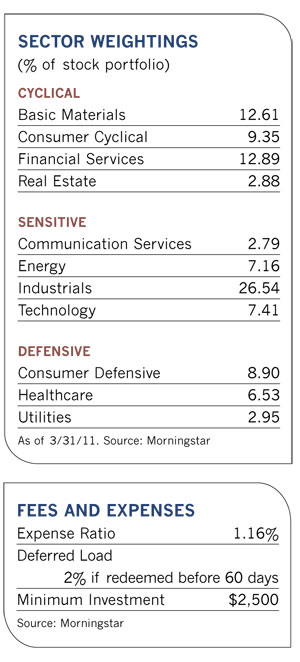

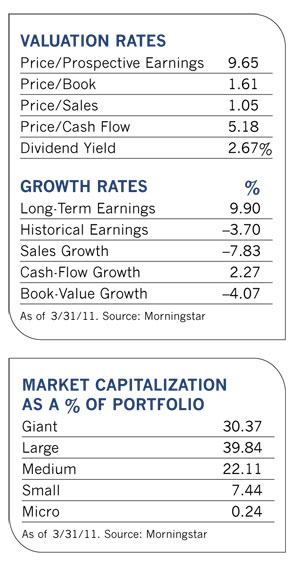

But in this fund, cheap doesn't translate into junk. Instead of focusing on low price-earnings ratios or high growth rates, the fund mainly seeks stocks that trade below estimated intrinsic value-or what a knowledgeable private buyer would pay for a business. Along with inexpensive stock prices, companies must have strong balance sheets and solid franchises.

But aside from its valuation criteria, the fund has other features that make it an odd duck in the mutual fund world. One of them is the long tenure of its first manager, Jean-Marie Eveillard, who crafted the fund's strategy in 1979, just ten years after its current manager was born. Long before anyone even knew what style boxes were, Eveillard defied them by investing in companies of any size, from anywhere in the world. The eclectic investment menu, which includes bonds and precious metals, sealed the fund's reputation for stubbornly defying pigeonholing.

That investment strategy remained seamlessly intact when longtime co-manager Charles de Vaulx assumed control of the First Eagle funds after Eveillard's retirement in 2005. But then de Vaulx resigned unexpectedly in early 2007, took a number of core analysts with him, and launched his own funds the following year. (For more on Charles de Vaulx and the IVA Funds, see "Investment Stew," November 2010.)

McLennan was brought in to co-manage First Eagle Global in September 2008 alongside Eveillard, who returned to the firm to bridge the gap left by its previous manager. McLennan was charged with keeping the fund's decades-old investment philosophy and strategy intact.

An important part of that strategy is avoiding the kinds of mishaps that can decimate portfolio value in relatively short order. For McLennan, that means buying on the cheap, straddling several asset classes, and keeping an eye on metaphorical fault lines in what he calls the "financial architecture" of world economies.

"Overall, this is a productive time for humanity, but there are a number of fault lines of concern," he says. "A glaring one is having the dollar as the cornerstone of the reserve system at a time when the U.S. is on a credit watch, its credit position is deteriorating and monetary deficits are high." In Europe, he observes, the advent of the euro meant currencies of weaker countries are propped up artificially and trade on parity with what once was the deutschmark, which represents a much stronger country. And, the enormous growth in China over the last decade could be difficult to sustain, particularly if the rampant pace of construction and infrastructure expansion slows down.

Still, he sees attractive opportunities among individual companies. And continued market volatility, he says, will give the fund windows of opportunity to move out of cash and pick up the stocks of good businesses at his preferred price of 70 cents for every dollar's worth of intrinsic value.

He used the Japanese crisis and its subsequent market decline to add to Japanese positions such as Fanuc, which specializes in industrial automation and robotic devices. "This company is like the Microsoft of the machine tool world," he says. "It has dominant market position globally, no debt and it's bought back 20% of its stock."

Shimano, another Japanese holding McLennan favors, is a world leader in high-end components for bicycles and fishing gear. "The company has no debt, has bought back over one-third of its stock in the last decade, and the stock continues to grind higher," he says.

His long-term view of the Japanese market remains favorable. "We have faith that the Japanese will recover from this situation over the long term. In fact, the Japanese have a long track record of being cohesive in their response to external shocks, be it prior earthquakes or be it oil shocks that we saw a generation ago."

The fund's largest country weighting is the U.S., where it has about one-third of its assets in stocks such as Conoco-Phillips. After the market reacted unfavorably to an acquisition the company made, McLennan built the position about a year ago based on his belief that the stock was cheap and the move was a smart way to expand. Another U.S. holding, First Energy, is an electric utility operating in several Northeastern states. It is benefiting from its expanded geographic reach after its acquisition of Allegheny Energy last year, and the stock, which is trading at an inexpensive 10 times earnings, sports a healthy 5% dividend yield.

In Europe, which accounts for 16% of assets, fund holding Heidelberg Cement has a strong position in growing markets such as Eastern Europe and Indonesia, and its quarries represent a strong but undervalued asset. "Demand for cement is below trend at the moment, but when you own an asset that has a useful life of 50 years, a couple of bad years don't have much of an effect over the long term," he says.

At 10% of the portfolio, gold bullion and gold mining companies represent "both ballast and a hedge against the fraying of the world's financial architecture." A 16% stake of cash provides an arsenal for diving in quickly when the right opportunities present themselves.

The eclecticism of the portfolio is a double-edged sword, says Morningstar analyst Bridget Hughes. On the plus side, the fund has a cautious, conservative style and low turnover that stabilizes returns. But the fund's strict value style, Hughes says, can lead to lagging performance when growth-oriented stocks stage a strong rally, and a large asset base can cause problems for a fund that often favors small and midsize stocks.

A similar fund run by de Vaulx, IVA Worldwide, closed to new investors in February when it reached $10 billion in assets. The move suggests that de Vaulx might not have been too thrilled about the continued growth of the First Eagle funds when he left in 2007.

So far, at least, fund size doesn't appear to be a hindrance for First Eagle Global. De Vaulx threw down the gauntlet last year when he told us his team is "better at picking stocks" than the First Eagle contingent. But returns between the two have been fairly similar since 2009, McLennan's first full year running the fund.

McLennan says that the fund's advisor, Arnhold and S. Bleichroeder, is not averse to closing funds when it is appropriate to do so. That happened about five years ago when markets were overvalued and new money was pouring in faster than its managers could invest it.

"We always think carefully about the right thing to do for shareholders," he says. "We would close to new investors if the opportunity set for investing becomes more challenging. But we are not at that point now. The fault lines around the world will allow us to deploy cash into windows of distress."