Over the last seven years, investors have been challenged to find decent investment income in a low-yield environment. For some, multi-asset income funds are providing at least a partial solution to the drawn-out investment income drought.

Fredericks says that in a low interest environment, many investors have been moving up the risk ladder to increase yield by extending maturities or moving down the credit quality ladder. But those strategies could backfire when rates begin turning upward.

As the name implies, these funds use a variety of different investments and strategies to generate yields in the 3% to 6% range. Some invest in a mix of stocks and bonds that stays the same over time, while others tap a broader array of securities and change their allocations to adjust to market conditions. Some employ currency and interest rate hedging strategies, while others do not.

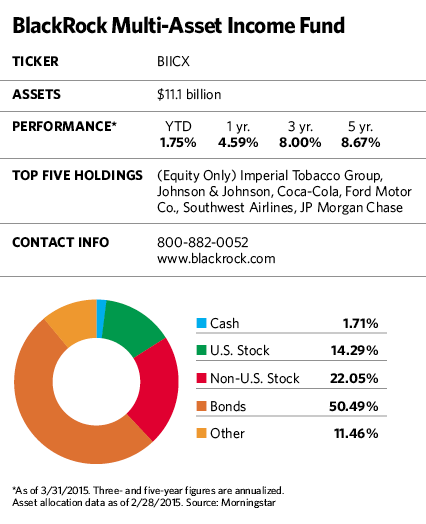

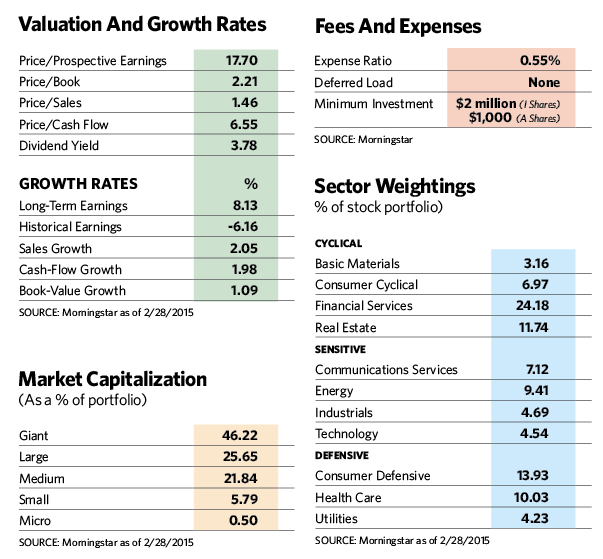

Launched in 2008, the $11 billion BlackRock Multi-Asset Income Fund (BIICX), one of the largest members of the genre, takes a highly active approach that involves a lot of moving parts. Depending on market conditions and his outlook for component asset classes, fund manager Michael Fredericks adjusts allocations among a variety of income-producing investments such as dividend-paying stocks, high-yield bonds, preferred securities, government bonds, floating-rate notes, master limited partnerships and real estate investment trusts. He also hedges with instruments such as currency or interest rate futures contracts when conditions warrant, and may sell covered call options on securities in the portfolio to generate additional income.

A multi-asset portfolio can lower that risk by spreading bets among different asset classes with low correlations to each other. While he acknowledges that even a broad spectrum of income-producing assets could lose value in a rising rate environment, he believes that the diversification and hedging strategies make his portfolio less vulnerable to interest rate risk than a narrower band of fixed-income securities.

“The world has changed a lot since the old days when building portfolios around nine equity styles, then bolting on some bonds, was sufficient,” says Fredericks. “The fact that the fund has reached $11 billion shows that many investors agree on the need for a more diversified approach to income. And over the last few years, some of the best income opportunities have come from outside the bond market or in areas that are difficult for investors to gain access to through individual securities such as preferred stock.”

In his view, active management is also critical. “It is not enough to identify income-producing asset classes, construct a portfolio and take a step back. You need to tactically move a portfolio around to capture changing income opportunities.”

Fredericks says some advisors use the fund to replace some of their higher risk equity allocations and a similarly-sized portion of low-yielding fixed income. For example, advisors might sell 5% of their stock positions and 5% of their low-yielding bond positions and replace them with a 10% allocation to the multi-asset fund. Investors who have too high an allocation to cash or traditional bond strategies could simply replace some of those allocations with a flexible income strategy. Others might use the fund to fill in for securities that have done well over the last several years, such as high-yield bonds or real estate investment trusts, but are now vulnerable to a downturn. Or the fund could substitute for more volatile income producers such as master limited partnerships.

Fighting The Income Drought

May 2015

« Previous Article

| Next Article »

Login in order to post a comment