Fortune magazine published its 64th list of 500 U.S. companies with top revenue earnings, including some financial firms that were first-timers to the list.

According to Fortune, companies on its list make up two-thirds of the country’s gross domestic production. Fortune 500 companies have a total of $12.8 trillion in revenues, they employ tens of millions of people worldwide and rake in $1 trillion in profits. Companies earning high revenues aren’t necessarily earning high profits: While Walmart earns the most revenues, Apple continues to have the highest profits on the list.

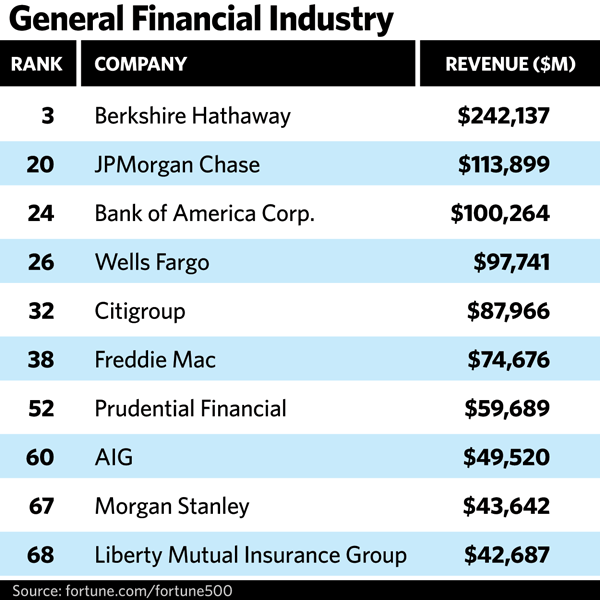

Warren Buffett’s Berkshire Hathaway fell from second to third, but it took home the title of the most profitable financial company, distantly followed by J.P. Morgan Chase and Wells Fargo in the top 10.

Berkshire also ranked high on the list of biggest employers, with 377,000 employees. Wells Fargo ranked high with 262,000 employees, along with JP Morgan Chase and its 252,539 employees.

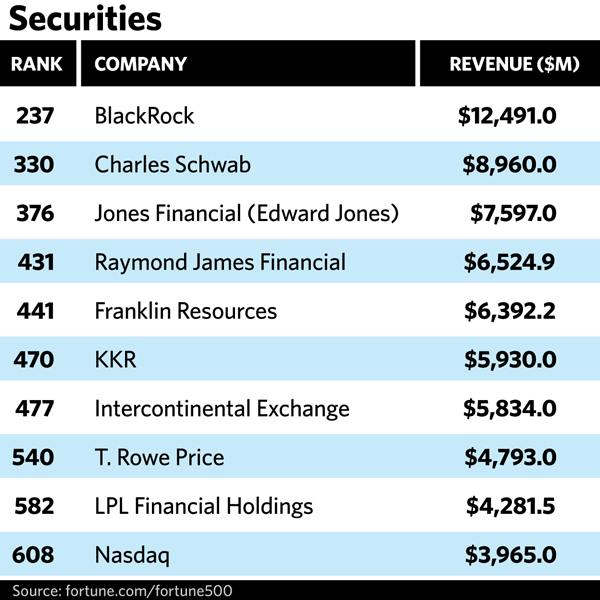

A couple of the newcomers this year are global investment firm KKR and financial services firm Northern Trust. Raymond James entered Fortune 500 status around 2015 and made the biggest jump, going from 469 in 2017 to 431 in 2018.

Out of all financial companies, Berkshire Hathaway had the largest revenues, with $242 billion. It’s made the Fortune 500 list for 24 years. J.P. Morgan Chase made the top 20 overall, but ranked second for financial companies. Like Berkshire Hathaway, J.P. Morgan has also maintained a Fortune 500 spot for 24 years. It’s seen an 8 percent revenue increase, but a 1 percent profit drop.

Another 24-year list dweller is Wells Fargo. In spite of scandals that started in 2016 and lasted into 2018, the company has been riding rankings in the 20s since 2011. This year it takes the 26 spot with nearly a 4 percent revenue increase and a 1 percent uptick in profits, according to Fortune.

In the securities industry, BlackRock topped the list with the highest rank at 237. The investment management firm had a 12 percent revenue increase and a 56 percent jump in profits since its last fiscal year. It’s maintained a steady climb up Fortune’s 500 list for the past 11 years. Charles Schwab took second place at the 330 spot. The firm has less revenue than BlackRock, but it’s saw a 17 percent revenue increase and 24 percent jump in profits.

After dropping from the 300s to the 400s in 2017, Edward Jones climbed into the 376 spot with a 14 percent increase in revenue and nearly a 17 percent rise in profits.

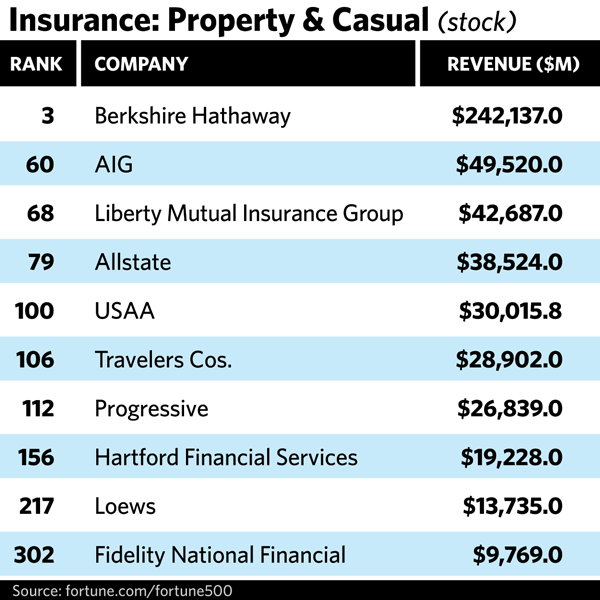

Berkshire Hathaway topped both the insurance and stock industry lists. Second place went to AIG. Even though the insurance company climbed out of a steep drop in 2009 (ranking at 13 in 2008, 245 in 2009 and then 16 by 2010), according to Fortune, it’s been on a steady decline since 2010. AIG ranked at 60, five spots lower than its ranking in 2017. Fortune reports the decline is impacted by recent and numerous occurrences of natural disasters and then a change to the U.S. tax law. Liberty Mutual, which took third in this list, had an 11 percent revenue increase but suffered a 98 percent drop in profits. “Its third quarter … was hit by the after-tax impact of a devastating hurricane season,” said Fortune.