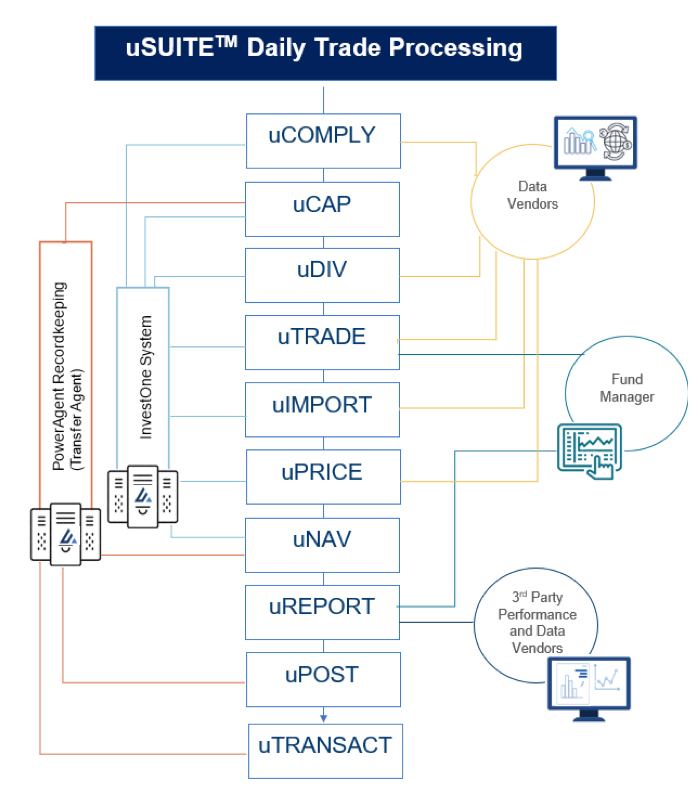

The impact of implementing our uSUITE system has aided us in helping to keep costs low for clients, connecting to our clients’ diverse and changing fintech systems, and providing the latest technologies including direct access to data for asset managers, advisers, investors, and shareholders.

Hortz: How did you develop the individual applications you built into your tech platform and what solutions do they provide?

Stevens: Initially launched in 2018, uSUITE’s underlying applications feature built-in robotic processing automation (RPA), machine-learning algorithms, and various application programming interfaces (APIs). We built and implemented each of the RPA-based uSUITE applications carefully with our compliance, operational, and development teams.

By incorporating a data and technology strategy, the various uSUITE applications developed and implemented in the past few years have helped streamline the fund accounting and investor services workflows. It has further transformed large areas of fund accounting operations to exception-based processing.

Hortz: Your uSUITE platform utilizes Robotic Process Automation (RPA). What role does it play and what are some of the benefits?

Ian Martin: The technology platform uses Robotic Process Automation to streamline massive amounts of back-end fund data processing, eliminating the need for manual intervention.

One of the most exciting impacts of the implementation of uSUITE is the advancement in our staff with respect to honing their expertise in complicated fund accounting matters. Correlated to the amount of time given back to each of our professionals, they have been able to work closely with our clients to resolve and redesign solutions for complex issues our clients are facing in their funds.

As a result, Ultimus team members have additional time to interact with our clients and understand their specific fund nuances and conditions, to drive productivity, quality, timeliness, and client satisfaction; elevating our service levels while keeping fees low. As anticipated, we see the uSUITE tools pay-off as market pressures, including fees, changing regulatory obligations, and technology, bear down both on Ultimus and our clients.

Hortz: What other technologies are playing key parts in the development of your uSUITE tech platform and how are you employing them?

Stevens: In addition to RPA and machine learning algorithms, our technology strategy has focused on the use of systems that operate with open APIs. As an important part of our strategy, APIs allow us to move with agility together on rapidly evolving fintech. The use of API systems has impacted us in several ways:

• Empowers us to choose “best in class” vendors, knowing our API strategy can seamlessly integrate cross platform data.

• Allows us to connect with our clients’ technologies quickly and cost-effectively,

• Enables our clients to use technologies of their choice as opposed to forcing them to adapt to required systems for use,