Single-family offices are popular vehicles for extremely wealthy families, helping them with both the financial and non-financial aspects of their lives. If a family can’t afford its own single-family office (or doesn’t want the burden of overseeing one) they might turn instead to a multi-family office, which offers some of the same advantages. Wealthy families and individuals with a net worth of $10 million or more are strongly interested in receiving the benefits of such an arrangement.

And RIAs have noticed. The popularity of the multi-family office has turned the heads of registered investment advisors and other professionals (from accountants to lawyers to insurance agents) who are increasingly advertising themselves as having these structures themselves. Some are taking the idea seriously, but a large number of them are just adding some services (many of them poorly outsourced) or simply reworking their promotional materials.

If advisors really want to meet the demand of the wealthy for these shops, they must be able to deliver the array of their expertise in the context of more highly supportive relationships.

Capabilities And Expertise

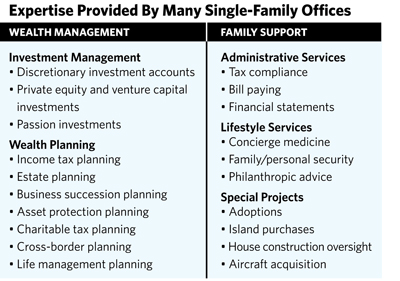

Traditional single-family offices tend to provide two major categories of expertise—wealth management and family support. Wealth management consists of investment management and wealth planning. Family support tends to include administrative and lifestyle services as well as special projects.

Within all these categories, there are a number of different services or products. For example, there are various ways to manage money just as there are various wealth planning specialties. Administrative and lifestyle services are also umbrella categories for numerous products and services. The term “special project” can mean just about anything. The sheer scope of possibilities and combinations ensures that unique and thorny issues can be addressed in new and wholly customized ways by single-family offices without deviating from the basic operating structure.

Multi-family offices can have comparable capabilities and deliver equivalent experts to wealthy families and individuals.

The Three Core Elements Of High-Performing Family Offices

RIAs that are primarily focused on investments will have to make subtle changes in their business models if they want to convert to multi-family office models. All single-family offices and multi-family offices are characterized by the following three elements:

• The human element: They require a deep understanding of wealthy family members. This level of understanding transcends the knowledge that the vast majority of professionals have of their clients. Without knowing what the personal interests of wealthy family members are, the advisor’s ability to deliver superior results is usually impossible. An advisor must uncover the needs (including the unstated needs), wants, and preferences of wealthy family members.

• A cohesive team: Single-family offices rarely have all the expertise the super-rich family requires in house. Outsourcing has become the norm to ensure that the office has state-of-the-art capabilities and that they are cost effective. Today, the most successful multi-family offices are also outsourcing. However, all family offices build and actively manage cohesive teams. This is not about knowing other professionals and making introductions. Instead, the multi-family office coordinates a set of specialists on behalf of family members. There are specific methodologies both single and multi-family offices employ to build and manage their teams.

• Systematic processes: In order to get the best results, both types of office must be process oriented to help family members achieve their agendas. One thing they can do is stress-test—make sure that the actions a wealthy family member takes or is considering will produce the desired outcomes.

Again, these offices help the wealthy achieve their particular interests. They never sell product. There is no persuading of anyone to do anything. There is no influencing. By having a deep understanding of wealthy family members, the office should be able to match up its expertise to family members’ agendas.

Implications For RIAs

Moving from an investment orientation to a comprehensive holistic solutions approach is certainly not for all RIAs—or probably even most of them. There are very successful RIAs who should stick to investment management.

But RIAs who transition to a multi-family office model will be able to offer a much more diverse and extensive menu of services and products, usually as a result of the cohesive team they’re establishing and managing. More important, an RIA should become more intensely focused on the human element, developing a deep understanding of its wealthy clients.

Those RIAs willing to make these changes will find a very powerful way to both add considerable value to clients and build significant practices.

Russ Alan Prince is president of R.A. Prince & Associates. Brett Van Bortel is director of consulting services for Invesco Consulting.