Heading into retirement, one of the most important issues to address is how to best structure clients' investment portfolios to provide the income needed for everyday expenses. This is a time when outperforming a market benchmark becomes less important than maximizing the probability that clients' income will last throughout the reminder of their life. There are many ways to approach this transition from growth to income, and one of many possible strategies is to construct an equity income portfolio and live off the dividends.

One attractive point of this approach is that you don’t have to pay attention to the daily ups and downs of the market, as you are not reliant on the sale of shares for income. The same is true of a combination of stocks and bonds, where only the dividends and interest are used for living expenses. Traditionally, one of the main drawbacks of this approach is that it requires a much larger portfolio than a plan that involves a spend down of principal over time. Especially in this low interest rate environment, an income-only approach definitely requires the accumulation of more capital than in the past prior to retirement.

More Savings Are Needed, But Less Worry About Longevity

Despite the requirement for a higher level of capital, this income-only approach is popular not only because it is less market dependent, but also because it is more conservative than a spend-down plan when it comes to longevity. An approach that does not invade principal for living expenses can remain robust against outliving a retirement portfolio, and the principal itself serves as additional capital in the event of a large unexpected cash need. If clients end up not ever needing to use the principal of their portfolio, it can become a very meaningful legacy gift to their heirs, whether they are family members or their favorite charitable organizations.

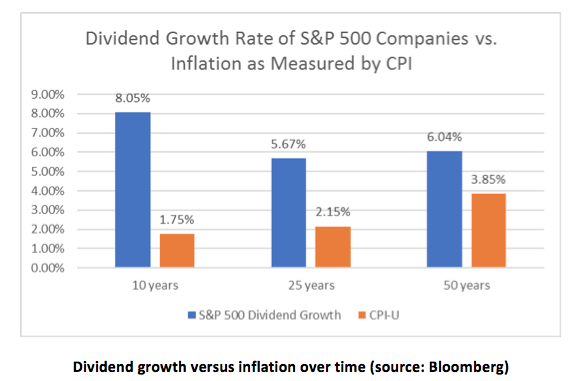

When it comes to longevity, one important benefit to an equity income approach is that their portfolios have a natural hedge against inflation as compared to a fixed income portfolio. Inflation occurs when the goods and services in the economy go up in price, so owning the businesses that provide these goods and services means that they may be able to counteract some of the negative effects of inflation. As prices in the Consumer Price Index (CPI) rise, so should the revenues of the companies that operate in the economy. As long as they own businesses with pricing power, hopefully revenues will rise at least as much as costs, allowing companies to continuing paying and raising dividends over time.

Dividend growth is perhaps the most important benefit of an equity income portfolio. It’s a built in hedge against inflation that is not enjoyed by investors in fixed income. In fact, even the average company in the S&P 500 has been able to grow dividends by 6% per year over the past 50 years, well ahead the average inflation of 3.85% we’ve seen over this period (Source: Bloomberg Annual Dividend growth of the S&P 500 and inflation 12/20).

While using this approach certainly has unique benefits, it also has unique risks. A dividend payment can be suspended at any time, and many companies did this during the financial crisis in 2008, and during the outbreak of Covid-19. When selecting companies for an equity income portfolio, balance sheet strength, stability of revenue and consistency of cash flow are very important. Specifically, I like to focus on businesses with lower-than-average debt, attractive return on equity and higher free cash flow yield. There are some companies such as Procter & Gamble that, due in part to these characteristics, did not need to cut their dividend during the two aforementioned market events. In fact, they were able to raise their dividend during both 2008 and 2020, and have actually paid the dividend every year since 1891, right through the Great Depression and every market crisis since.

While many companies do treat the dividend as sacrosanct, and are loathe to reduce their payout, it does happen, and for this reason diversification is very important. Even though picking the very best company in any one category will maximize performance, when it comes to income, I prefer to spread the risk. For example, rather than owning Coca-Cola or PepsiCo, owning both is a good way to help hedge out company specific risk. I personally think that around 40 companies are enough to provide diversification of income. While some will consider this too diversified to optimize returns, the primary goal in this case is mitigating the risk of a dividend cut.

Bonds Are Still Important

Even while a portfolio might be well diversified within the equity asset class, using an equity-only approach to income is a very non-diversified approach overall. One of the major benefits of having a fixed income component in a portfolio is that it stabilizes the portfolio during drawdowns, and therefore can be very beneficial if there is a large, unexpected expense at a time when the market has declined. In fact, if clients' retirement expenses will be larger than the income produced by their portfolio, my opinion is that they must have bonds in their portfolio. It’s important never to be a forced seller of stocks if you need access to cash during a market selloff. This is when bonds really do optimize their returns, because even though clients will likely earn much less over time in bonds than in stocks, having them available for liquidity during a market selloff is invaluable as clients can then hold on to their stocks and if needed, sell when times are better.

A Liquidity Bucket Is A Great Way To Manage Cash Flow

Another good way to mitigate the risk of a market selloff is to keep a cash reserve fund set aside, just as you would to protect against an unexpected job loss. I also recommend using a liquidity bucket approach to manage expenses. Rather than use dividends as they come in for spending, I suggest keeping one year of spending set aside, and then use dividends to maintain this balance over time. For example, if clients plan to live on $100,000 per year in retirement, they should try to maintain that balance in their liquidity account. The balance will decrease as cash is spent, and it will increase as dividends are paid. If the balance trends down over time, they will have early notice that their spending is outpacing income, and if it trends up over time, it is either because they are spending less than planned, or the companies they own are increasing their dividends faster than any increase in their spending.

If clients decide to fund their retirement using dividends, it’s very important to understand the risks. Even though bond yields are mostly lower than equity yields at the moment, having bonds in their portfolio can be very beneficial from the standpoint of diversification. Should they choose to maintain an all equity, or mostly equity income portfolio, they must be comfortable with the mindset that they will tune out what’s happening with the market, as there will likely be times when the value of their portfolio drops substantially. It’s also important not to get overly exuberant if the value inflates with the overall market. In both cases, it’s the income that is key.

Lawrence DePaulis is a financial advisor with UBS Financial Services Inc.