Besides access to modern medicine, good health care also requires proper nutrition and exercise, cozy shelter, familial warmth, adequate transportation, taxes (of course), etc. If we could strip away the cost of good health from all the other stuff we spend money on, how much would we really need to ensure it till the day we die?

There Must Be A Way Out Of Here

One idea that has piqued the interest of advisors and their risk-averse clients is fixed annuities, which can be used to match health-care expenditures. But to use these instruments in effective ways, advisors must first start stripping out the bare essential holistic health-care costs that clients are likely to pay for the rest of their lives in retirement.

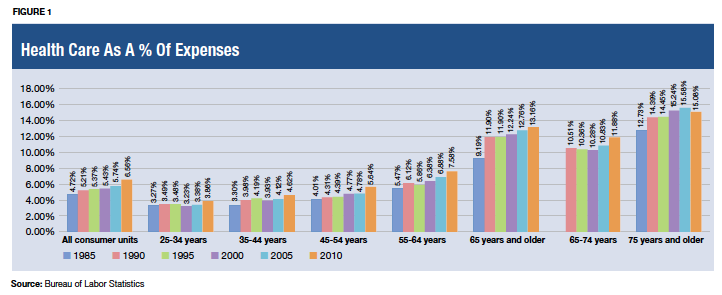

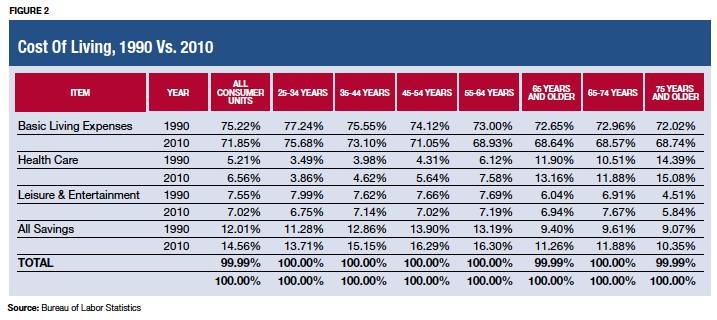

For example, as someone ages from age 65 to 95, health-care costs will change as he consumes more and faces inflation. What will be the all-in costs for the first 10 years (the go-go years)? For the next 10 (the slow-go years)? Or the last 10 (the no-go years)? If we can deduce these costs, then we can start buying fixed annuities to cover our essential health-care needs for, say, any one of these decades.

Fixed annuities work much like Social Security. The monthly checks arrive just in time. They can also offer health-care inflation riders so the annuitant maintains his purchasing power. The only difference is that the instrument is purchased from a private company. You can buy into them anytime before the payout begins. You are usually locked into a term of at least 10 years.

Other varieties of annuity will not do for problems like tackling health-care costs. Not that the large sellers haven't come up with variations. They often start by building fixed annuities and then add unknown ingredients to the bundle and give it names like "structured notes," etc. that can turn scary. Just as term life insurance protects clients against the risk of a premature death, fixed annuities protect their beneficiaries and help them match and anticipate future cash-flow needs. If you step out of this realm into variable annuities, indexed products, etc., you are in trouble.

Somnath Basu is a professor of finance at California Lutheran University and the director of its California Institute of Finance. Dr. Basu also serves as a professor of the Helsinki School of Economics' executive MBA program. He's involved with financial planning organizations including the National Endowment for Financial Education, the CFP Board of Standards, the International CFP Board and the Financial Planning Association.