In the 1960s, the slogan “Make Love, Not War” became a rally cry for anti-war protestors, but also typified their free love expression. They used the slogan to explain the harshness of the situation in Vietnam and to be countercultural to the capitalist and traditional way of life they saw in American society. While this was countercultural for its time, a recent Goldman Sachs piece titled “Why Technology is not a bubble” shows how today’s circumstances are contrary to rationale. (Source: Goldman Sachs, “Why Technology is not a bubble” published June 4, 2018.) Their work shows a contrast between the pricing of stocks to the economic value of populations. It is our opinion that this looks to be extreme. As we unpack this contrast, we will learn the hippies of the 60s were only partly right. They were right about war. However, for today’s venture capitalists and technology investors, making love would be a waste of time relative to global dominance via the capitalization of individual stocks. Future world tyrants, take heed.

Invert, always invert: Turn a situation or problem upside down. Look at it backward. What happens if all our plans go wrong? Where don’t we want to go, and how do you get there? Instead of looking for success, make a list of how to fail instead—through sloth, envy, resentment, self-pity, entitlement, all the mental habits of self-defeat. Avoid these qualities and you will succeed. Tell me where I’m going to die, that is, so I don’t go there. —Charlie Munger

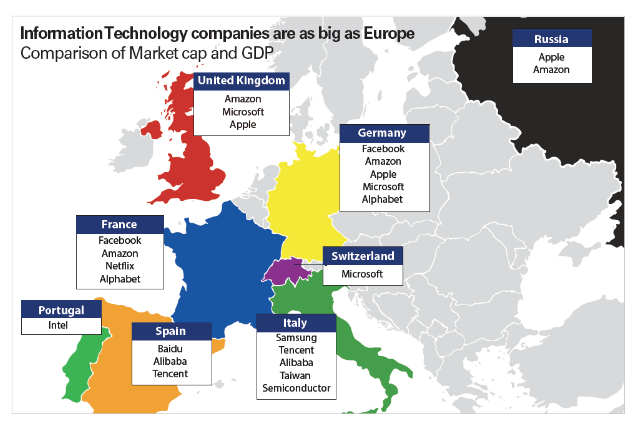

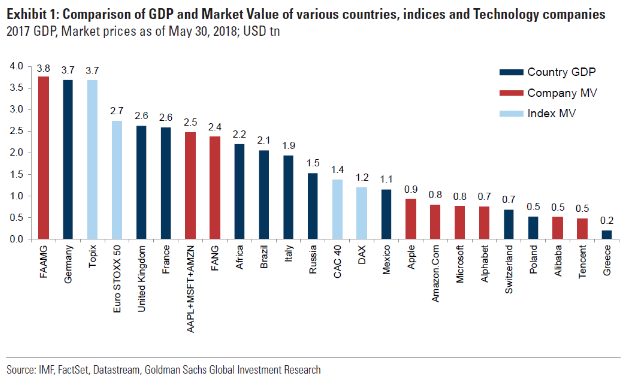

In most cases war tackles the conquering of people and land. To invert as Munger recommends, we took a keen interest in two charts from Goldman Sachs comparing the Gross Domestic Product (GDP) of various countries of Europe to the market capitalization of technology stocks today.

On its face, this picture should cause an investor to think and begin to invert today’s circumstances. Would someone want to own all of Facebook, Amazon, Netflix and Alphabet or would they rather own the year’s income for the entire country of France? This highlights how large the market capitalizations of certain global technology companies are. Why would the tyrant of the future need to take over land and people when they could do it in a non-hostile fashion via stocks?

In the bar chart above, Goldman Sachs broke out the disconnection of the market cap of these global tech companies, relative to European countries and their stock markets. The simplest way of inverting this, as Charlie Munger would say, is to ask the question, which would be more valuable for us economically? Would we rather own Facebook, Amazon, Apple, Microsoft and Google together, or would we rather gain all the economic income from Poland, Switzerland, Mexico and Russia in the next 12 months? It’s just like the Aflac (AFL) commercials. The nice thing about income is that it’s not dependent on valuations. As Yogi Berra said, “They give you cash, which is just as good as money.”

Another way to look at this is to focus on large Asian technology stocks that are glamorous today. Would you rather have the entire income of Spain next year than Baidu, Alibaba and Tencent? We make few assumptions about the future to understand the income of Spain next year. In the valuation of these Chinese Internet companies, there are more factors or inputs that we’d have to be right about. We believe this is a great way to invert today’s mania to practice ignorance avoidance as it pertains to allocating capital as common stock investors.

Ignorance avoidance is the number one thing that Munger has historically commented on as it pertains to the success of Berkshire Hathaway over the last 50 years. One item that must not be overlooked is how regulation could creep up on these beloved technology companies. Put another way, what if the individuals and businesses that comprise the income of those various European countries decide they need more power relative to these U.S. and Chinese technology companies? Once again, this reinforces why we’d rather have Germany’s GDP next year. Like the recent movie, The Post, reminded us, there was a war brewing in Vietnam long before people were aware. The same can be said today of the global dominance these technology companies have been allowed.

As the former CEO of WPP, Sir Martin Sorrell, recently said in Cannes:

Alibaba and Tencent are also half a trillion dollar companies. So the big seven, what I call the Seven Sisters because there are analogies to the Seven Sisters oil companies of the Rockefeller days, these companies are huge.