Two decades after then-Federal Reserve Chairman Alan Greenspan fretted about asset prices reaching unsustainable levels -- a pronouncement that caused a brief interruption in the U.S. stock rally -- his successors might be tempted to warn again markets are getting ahead of themselves.

“Clearly, sustained low inflation implies less uncertainty about the future, and lower risk premiums imply higher prices of stocks and other earning assets,” Greenspan said in a speech on Dec. 5, 1996. That comment alone has an eerie resemblance to the disinflationary climate and tumbling interest rates that have afflicted the world in recent years.

Greenspan went on: “But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?”

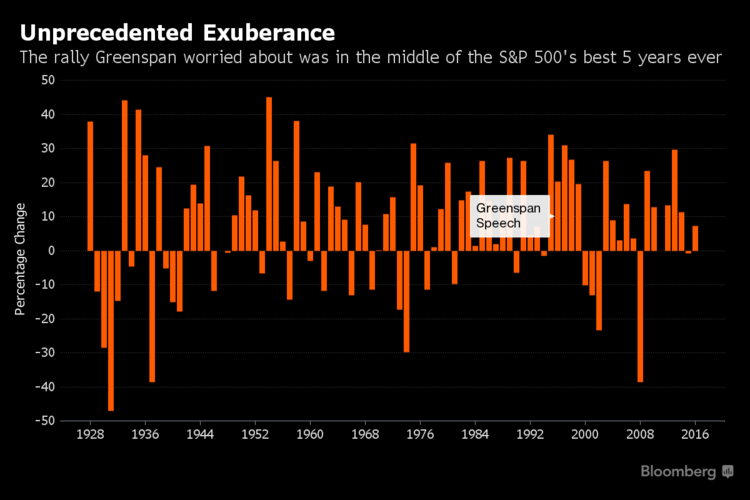

The central banker once dubbed “the maestro” was speaking as the S&P 500 Index headed for its best two-year surge in four decades, up more than 60 percent. Yet his words did famously little to halt a five-year rally that saw the gauge triple in price by the end of 1999. Treasuries meanwhile had pulled back after a jump that had shrunk the extra compensation investors were getting for holding benchmark 10-year notes to a two-decade nadir.

Fast forward to the present, and all three key U.S. equity gauges popped to records in recent weeks. Prices relative to earnings expectations are the highest they’ve been since the dot-com bubble that peaked in 2000. Shares have surged and bonds tumbled over the past month after Donald Trump’s unexpected election win.

Even after the pullback, bonds look more like the real bubble today -- the 10-year term premium only climbed back above zero three weeks ago after hitting an unprecedented minus 0.75 percentage point in July.

Greenspan himself now says he’s more worried about debt than equity, speaking in an interview with the Wall Street Journal published Dec. 3. He also recognized his warning had had little impact; and repeated his view that bubbles are almost impossible to stop once they get going.

“The philosophical thinking behind Greenspan was that the central bank was there to pick up the pieces” rather than prejudge on bubbles, said Chris Green, a veteran of two central banks who now heads economics and strategy at First NZ Capital Group Ltd. in Auckland. “We’ve moved away from that. It’s a more holistic approach that central banks have adopted with the benefit of hindsight and looking at the problems that emerged” from the Greenspan era, he said.

Some Asia-Pacific policy makers appear to have succeeded in pricking bubbles -- read about that here.

When the central bank itself is a mammoth buyer, it makes it harder to argue against bubbles. That’s the position for Fed Chair Janet Yellen, whose institution holds more than $4.4 trillion in Treasuries, the end-result of purchases some blame for pushing valuations beyond rational measures of fundamentals.