Some investors seek growth of capital, while others prefer a steady income stream. Of course, some investors want both attributes in a single product, and that’s the raison d’être of the American Funds Capital Income Builder Fund.

The fund’s stated objective is to generate current income that “exceeds the average yield on U.S. stocks generally” and provide a growing income stream through the years. The fund’s secondary objective is to provide growth of capital.

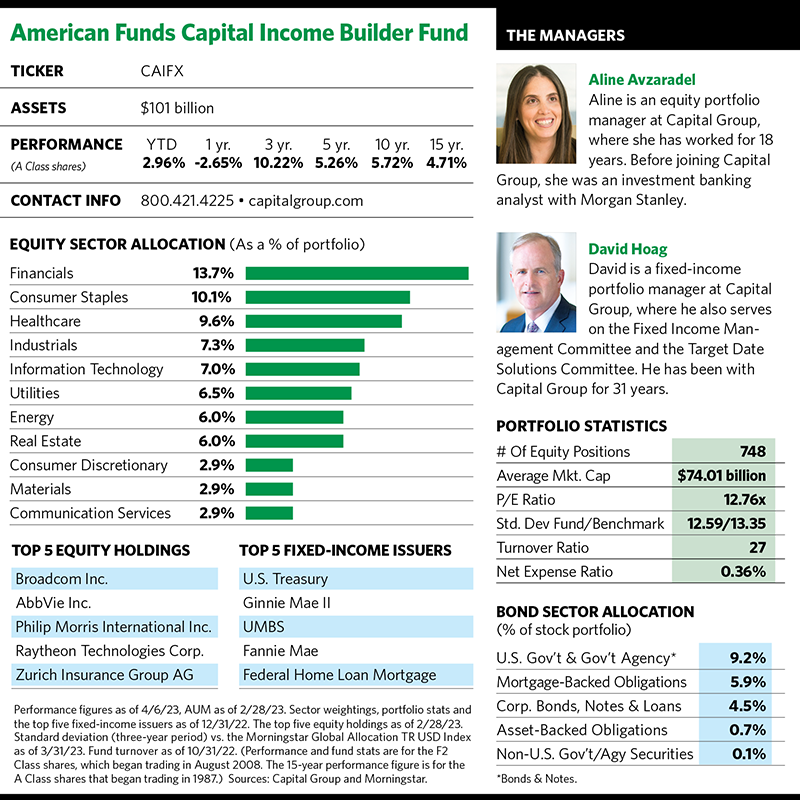

But what exactly does “generally” mean when it comes to trying to top the average yield paid by U.S. companies? “We want to provide above-average income, but it doesn’t necessarily mean we look to provide the highest yield level in the market,” says Aline Avzaradel, an equity manager and one of the fund’s 12 portfolio managers. “We aim for a combination of above-average yield and above-average growth.”

She adds that the fund’s yield target changes depending on market movements. “We have a dividend that’s distributed quarterly, and yields will vary. But it will always be an above-market yield.”

The fund’s recent 30-day SEC yield was 2.64% as of early April while the S&P 500’s dividend yield was only 1.65%. According to Morningstar analyst Greg Carlson, the fund’s pre-fee yield typically ranks in the upper echelon of global allocation funds.

As for capital growth, the fund’s average annual returns in measurable periods stretching back 15 years have consistently placed it in either the top half or top quartile of its global allocation category, according to Morningstar. And in those two measurable periods (three years and 15 years) when it was in the top half and not the top quartile, the fund’s average annual returns nonetheless topped the average annual performance of its peers.

The investment mix of this equity-income product averages roughly 70% stocks and 30% fixed income, though that ratio can differ by as much as 10 percentage points depending on economic conditions and shifting market opportunities. This allocation seeks to provide equity-like returns with relatively less volatility than global markets. The portfolio includes both domestic and foreign equities—typically large, established companies with proven records of increasing dividends. In addition to dividend-paying stocks and bonds, the portfolio may contain other income-producing securities such as preferred stocks and convertibles.

Evaluating Dividends

Capital Group, the parent company of American Funds, has a large global team of sector analysts who focus on particular industries and funnel investment ideas to the Capital Income Builder Fund’s equity and fixed-income portfolio managers. In early April, the fund had just over $100 billion in assets.

As Avzaradel describes it, on the equity side the investment process starts with the portfolio managers analyzing a company’s ability to pay a dividend. They apply internal models to assess various metrics such as its dividend payout, interest coverage, earnings quality and cyclicality. They also look at a company’s dividend payment history, which indicates how much the company and its board have supported the dividend as part of their capital allocation priorities. And the managers look at historical dividend growth to gauge whether a company has been able to maintain its dividend increases. Finally, they factor in valuations.

“It starts with the dividend and an understanding of why an analyst or portfolio manager is recommending the security, and then we overlay the valuation to decide whether it’s an attractive investment,” Avzaradel says.

One of the fund’s recent top portfolio holdings, AbbVie, exemplifies that process. The biopharmaceutical company was spun out from Abbott Laboratories in 2013 and had reaped beaucoup profits from its blockbuster drug Humira, an injectable treatment for autoimmune conditions such as rheumatoid arthritis.

AbbVie scores well on metrics for companies that can pay dividends, Avzaradel says: It generates a healthy free-cash-flow yield of about 7%, has grown its dividend every year since its spin-out from Abbott, and the payout ratio is only 50%, so it can comfortably keep paying the dividend.

“It’s a company with a great ability to pay and has shown great commitment to paying its dividend,” Avzaradel says, adding that just a few years ago AbbVie traded at a single-digit price-to-earnings multiple of about eight times amid concerns about Humira’s patent expiration. The drug lost its exclusivity in January, which made it fair game for generic competition.

“Humira was 38% of sales a few years ago, so people were concerned about what would happen next,” Avzaradel explains. “The stock traded down and was available at a good valuation.” The fund approved when AbbVie bought Irish pharma company Allergan. Avzaradel says her fund’s analysts thought Allergan’s pipeline in immunology and hematologic oncology therapies was very strong, and that “once the market looked past the Humira expiration issue, people would start to value [AbbVie’s] stock differently. It now trades at 14 times [forward] P/E.”

In other words, with AbbVie, she says, the analysts looked at a stock in 2020 and saw what it would look like in 2025, rather than getting hung up by the loss of Humira’s patent exclusivity in 2023.

“This was when we combined our view about this company’s ability to pay a strong dividend with a very attractive valuation,” she says. “The dividend yield today is 3.7%, which should grow at a high single-digit rate.”

Another recent top holding in the Capital Income Builder Fund is semiconductor and infrastructure software company Broadcom, which doesn’t fit the profile of a typical equity holding in the fund.

“The company is a little more cyclical than a consumer staples, healthcare or utility company that would typically be one of our top positions,” Avzaradel offers. “It’s a company with a very high dividend, and our analysts feel it’s less cyclical than a typical semiconductor company. The dividend yield is 3% and growing at a double-digit rate. And the valuation isn’t very high, trading at 14-15 times P/E. There’s attractive valuation and yield and growth of income, and our analysts don’t view it as cyclical as the market.”

Thinking Defensively

Capital Group employs a multi-portfolio management system with its funds. Within the Capital Income Builder Fund, the different equity and fixed-income portfolio managers have discretion over their respective sleeves. Ultimately, their decisions are oriented toward the fund’s mandate of income generation and growth of capital.

“But within that you might have different styles, and some managers are less concerned about recession so they have different sector allocations,” Avzaradel says. “That provides diversification to the fund and helps it do well over the long term.”

The fund’s dozen portfolio managers don’t focus on a particular area or areas, but instead call themselves diversified portfolio managers who evaluate ideas across various sectors. “I’m a generalist,” says fixed-income manager David Hoag. “I consume all of the recommendations coming out of fixed income across all of the asset classes CIB can invest in. We have a tremendous amount of resources to utilize.”

The fund’s fixed-income allocation is almost entirely investment-grade fare, with the vast majority invested in U.S. securities. (Foreign securities contributed more than 30% of the equity portfolio at the end of 2022.) Hoag notes that the credit quality tends to be on the higher end to keep the correlation with equities lower.

“Fixed income has a secondary role in CIB,” Hoag says. “My job is to provide income for the fund when it’s available, and to provide relative stability.”

Hoag says the fund’s recent fixed-income allocation was positioned for a slowing economy. That mirrors the overall view on the equity side, where Avzaradel describes the portfolio as being a little more defensive with a focus on companies thought to have resilient business models during times of recession, strong balance sheets and high cash-flow generation.

“In an environment of high interest rates and a tough equity market where investors put a high value on solid balance sheets and cash flows, this is the perfect environment for our fund,” she says. “That’s why it did well [in 2022 with relative outperformance of a 7% loss against a category average loss of 12.3%], and I think the fund should continue to do well because we might be in that environment for some time.”