Jed Weiss has been the portfolio manager at the Fidelity Advisor International Growth Fund since it launched in 2007. In a sense, it’s his baby.

“I have three legitimate babies ages 13, 10 and 8,” Weiss says, “but this is my professional baby and it’s been wonderful watching it grow up, too. It’s 15 and not quite ready to drive, but it’s been with us for a while.”

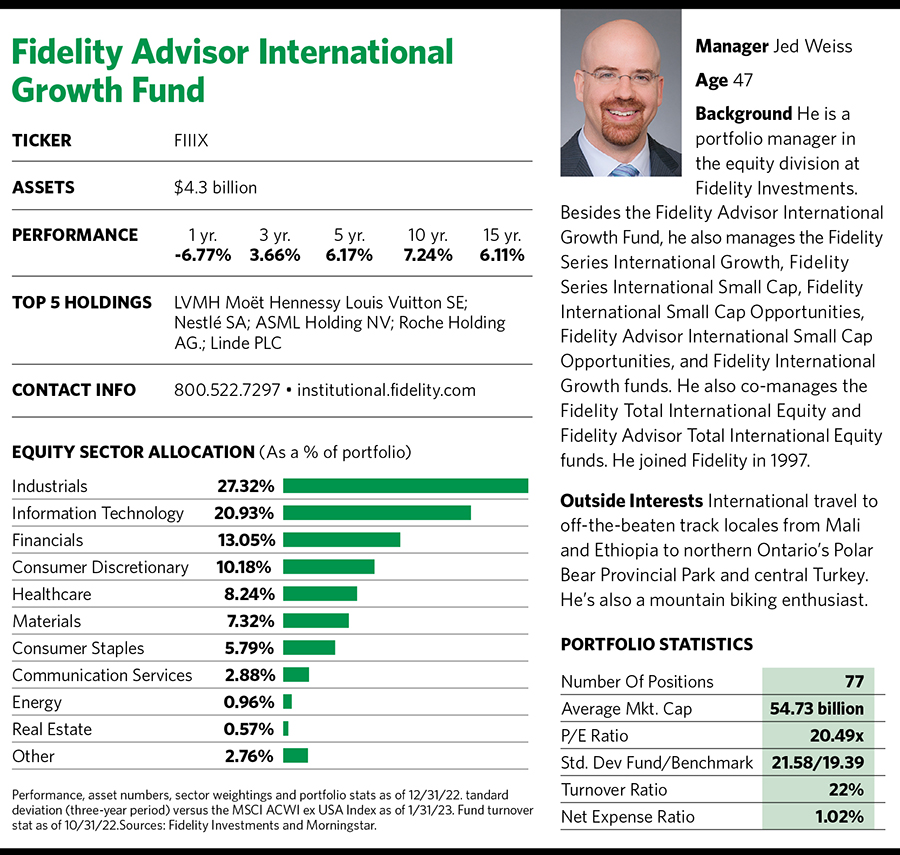

He’s driven the fund to impressive results since its birth, garnering top-quartile annualized performance for the 15-, 10-, five- and one-year periods within its foreign large-growth category, according Morningstar. It slipped to the top half of its peer group during the three-year period, even though its 3.66% average annual return during this period (through February 7) topped the category average by 90 basis points.

In a report, Morningstar analyst Jack Shannon noted that Weiss takes a distinctive approach to fund management. “Weiss views portfolio construction differently than a lot of peers; he shuns typical geographic, sector or industry groupings and instead takes a more nuanced approach that focuses on the sources of companies’ revenue and costs,” he wrote.

Shannon further stated that Weiss’s investment style often wades into pricier waters, but the emphasis on the quality of each holding’s business model helps temper the risk. “Jed Weiss’s process leads to a consistent portfolio of high-quality companies, though he pays a premium for them,” he wrote.

Weiss sees it differently. “This isn’t a growth at any price fund,” he says. “Valuation is an important part of my process, but it’s valuation based on my earnings forecast, which might be different than the Street’s forecast.”

He adds that certain metrics make the fund look more expensive than the index, but the fund also demonstrates faster growth, higher returns and better balance sheet indicators than the index. “You’re paying up a bit for quality,” he says.

Also, he says that in many cases he looks at earnings on a three- to five-year cross-cycle basis, which means the earnings estimate he has might be different than what’s found on third-party market data sites. “My sweet spot for investing is multi-year structural growth stories, high-barriers-to-entry businesses, and attractive valuations based on my earnings forecast,” he explains. “One of the ways I check that is pricing power in real terms at every point in the cycle.”

Currently, he points out, there’s a big focus on whether companies can pass through cost inflation to their customers. The companies he looks for can maintain their pricing power in real terms in any economic environment.

“I tend to run relatively concentrated funds because I look for multi-year structural growth stories and high-barriers-to-entry businesses, and those don’t tend to change that often. That leads to low turnover at 20% to 25% over time.”

And low turnover typically means lower tax exposure for investors.

Portfolio Construction

Weiss has specific investment criteria that winnows down his investable universe, and that helps inform the Fidelity analysts he works with so they know exactly what he’s looking for. “I want to make sure that names coming my way fit into my process,” he states.

He explains that in some cases an analyst will pitch him an idea and they’ll work through what the company’s earnings power is and the valuation associated with that. In other cases, it’s a name that he comes up with either through conversation with a company or through a screen or a document he’s read. Then he’ll call the analyst covering that sector and global region, and they’ll contact the company together. Weiss says he travels roughly 15% of the time for work, and he’s often joined by Fidelity analysts from relevant offices when they visit overseas companies.

“I’m blessed that Fidelity has a fabulous research staff around the world where we’ve had on-the-ground presence in a lot of these countries for decades,” Weiss says. “And that’s a real leg up regarding both corporate and governmental relationships. If you’re investing in companies in a regulated industry, it helps to meet the proper regulatory authorities in that country. And it’s helpful to have the Fidelity name behind you when companies are weighing whether to spend the time with investors.”

He adds that having a huge research department around the world boosts the investment opportunity set. “The more folks you have turning over stones, the more likely it is you’ll find gems,” Weiss says.

Repositioning

But sometimes gems can get tarnished, like in 2022 when nearly all financial assets hit the rocks. And perhaps no asset class was hit harder than growth-oriented equities. The Fidelity Advisor International Growth Fund recorded a 23.21% loss last year. While that bested the fund’s category average by a little more than 200 basis points, it trailed the fund’s bogey, the MSCI EAFE Growth Index, by 52 basis points.

“Portfolio construction is a very important part of my process, and I think in years like last year with tremendous volatility and the markets going haywire, winning by not losing can be valuable,” Weiss offers. “I’m pleased that the fund didn’t materially underperform the index in a very difficult year.”

Of course, el stinko financial markets like last year’s present opportunities to reposition an investment portfolio. Weiss says that in the second half he gravitated toward buying more pro-cyclical names and selling more defensive names because that’s where the relative valuations were sending him.

“Defensive stocks did very well—and cyclical, industrials and tech stocks did poorly. So the fund began to tilt [in response to that], which was more bottom-up than top-down,” he says.

Recently, Weiss has been watching companies emerge from the Covid disruption to see which ones are notably stronger than they were before. Some companies dramatically cut their cost structures in a way they likely couldn’t have done without the massive operational disruption of the pandemic. Those insights have since shaped the portfolio’s composition.

Take Safran, a French outfit that’s one of the leading makers of engines for narrow-body aircraft. Weiss notes that it can be difficult for companies in certain European countries (like France) to cut their cost structures. But Safran took advantage of the aerospace industry’s massive downturn during the pandemic to significantly slash its head count.

“Its cost structure coming out of Covid was very different than it was pre-Covid, yet the long-term demand profile for narrow-body aircraft remains intact,” Weiss says. “This is a business model with highly recurring revenue and historically strong pricing power. During Covid the stock went down, which provided a valuation opportunity.”

The U.S. Can Be Foreign, Too

The Fidelity Advisor International Growth Fund’s portfolio has a healthy dose of U.S.-based firms. In fact, the U.S. held the largest country weighting in the fund as of year-end 2022 at 19.75%–even though the fund’s benchmark had no U.S. exposure at all. (European companies represent 53% of the Fidelity portfolio and Japan 12%.)

Weiss points out that all U.S.-based companies in his fund have significant overseas operations. One example is PriceSmart, which he describes as the Costco of Central America, the Caribbean and Colombia. PriceSmart is based in San Diego, where the company’s founder, the late Sol Price, is credited with developing the warehouse club model. One of his original creations, Price Club, later merged into Costco, which was led by one of his protégés.

“Its headquarters are in San Diego because that’s where the founding family lives, but essentially all of its business occurs in emerging markets,” Weiss says. “So yes, these companies show up as U.S. securities, but they don’t necessarily trade like U.S. securities because the majority of revenue and profits occur overseas.”

Ultimately, Weiss posits, the key to his success has been the consistency of his investment process and portfolio construction throughout the 15 years he has run this fund.

“And I want to be patient, which is an important factor in the fund’s low turnover,” he says. “I’m a patient investor because I think that’s where the inefficiency lies and that’s where I’ve been able to find the best opportunities.”