Merger and acquisition activity among RIAs is intense and looks like it will remain brisk. Demographics reveal that many advisors are getting older, and are thus interested in selling to aggregators, which are often backed by private equity firms. Those factors, as well as increased competition, continue to give the M&A trend life.

But what happens after a sale or merger? When they look at the outcomes, how satisfied or dissatisfied are the advisors who sold or merged their firms?

To find out, we surveyed 311 advisors who had done deals within the past 10 years. These transactions could have been executed with another firm or with larger organizations such as banks or aggregators.

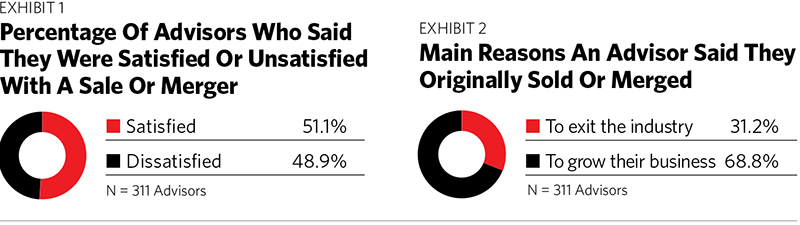

About half of the advisors were satisfied with how things turned out. But that means about half weren’t. (See Exhibit 1.)

We looked at what factors contributed to somebody’s satisfaction while also segmenting the advisors according to their core reasons for selling or merging in the first place (Exhibit 2). A little more than 30% of the respondents said they did a deal because it gave them a way to exit the advisory business profitably. They’d had no successors for their practice and could not continue working indefinitely or did not want to. Meanwhile, 70% of the advisors said they were looking for a way to significantly grow their businesses by getting support and access to services that were otherwise out of reach.

Why Satisfied?

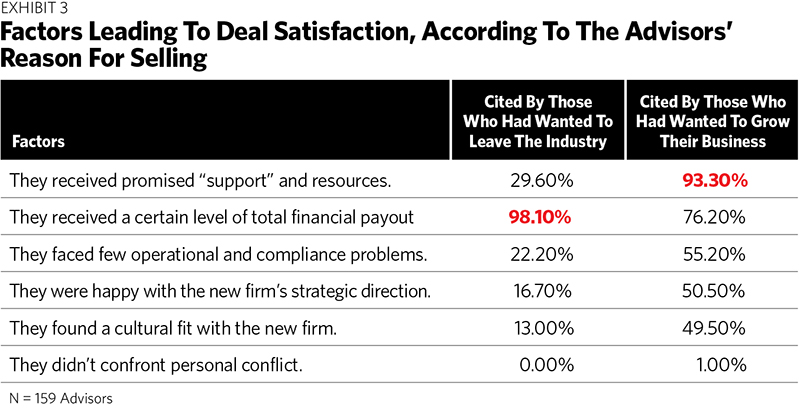

The reasons an advisor was satisfied or dissatisfied with a deal hinged on their motivations for doing one in the first place (Exhibit 3).

When it came to those advisors seeking an industry exit, for example, the most critical factor in their satisfaction was their eventual payout, including any up-front monies, earn-outs or client retention bonuses. Less important to them were operational or compliance problems, the strategic direction of their firms after the deals were done or the cultural fits with their new firms. Satisfied exit-seekers also reported no conflict with new management or other advisors.

When an advisor was seeking growth, however, the most crucial factor in his or her satisfaction was whether the acquirer or merger partner could deliver on the promise of support and additional resources. The other factors were highly correlated with the ability of the deal partners to deliver the expected value.

Why Dissatisfied?

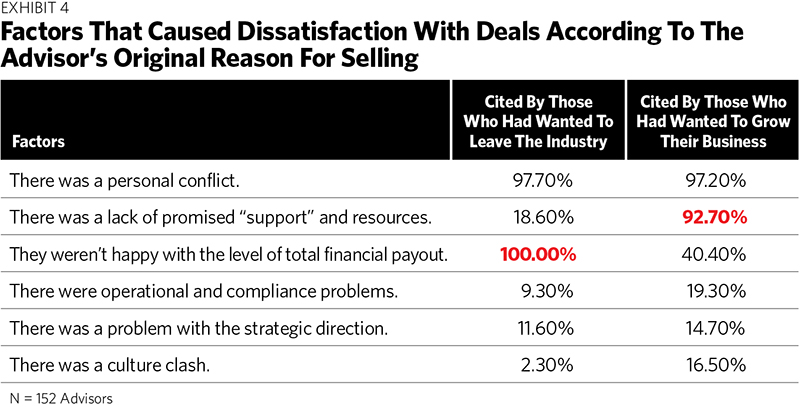

The most significant factor for advisors dissatisfied with their sale or merger was personal conflict with new management or other advisors. When expectations—or, in many advisors’ minds, “promises”—are not met, they may feel deceived or exploited. This, in turn, often leads to conflict. But beyond that problem, the expectations of the two advisor groups differed according to their motivations for selling. (See Exhibit 4).

Those looking to exit the industry were more likely to be dissatisfied as a result of their final payout. (Again, this number includes any earn-outs and client retention monies.) The advisors in this situation believed they deserved a higher final payout than they received.

When the advisors signed on for business growth instead, they were more likely to be dissatisfied if the buyer was unable to deliver the “support” or resources they said they would. For example, they might have been told they could connect with referring professionals from other fields to get new clients, but this didn’t happen. Or they were told they would have access to exceptional investment products, but these proved less than stellar. If they were unable to grow as expected and that led to a lower financial payout for their firm, that would cause them further grief.