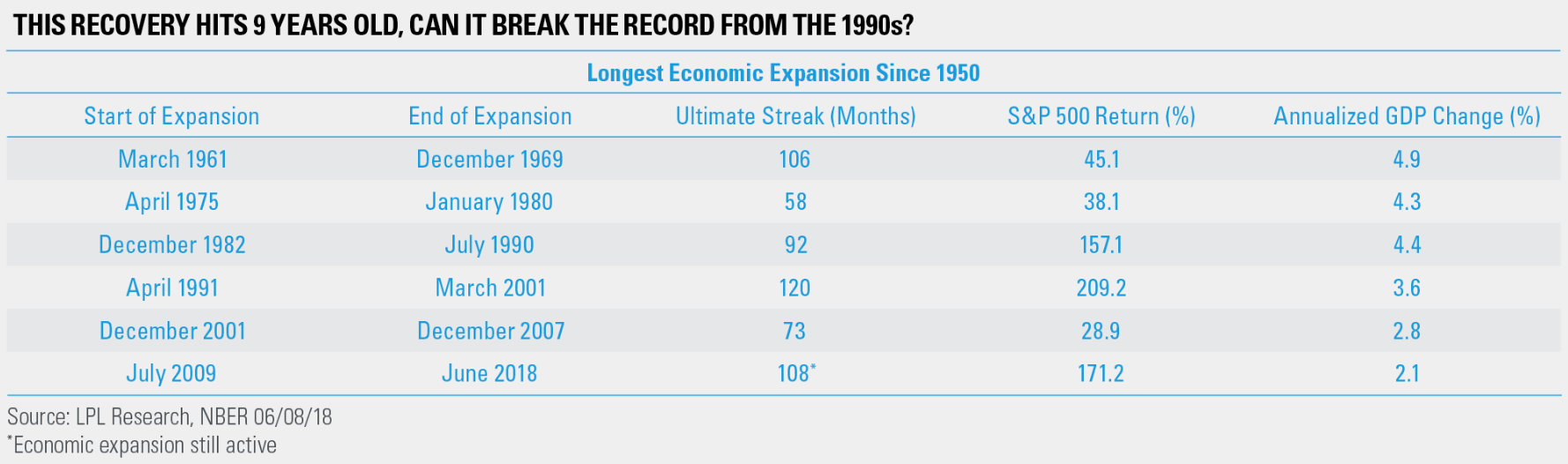

This month, the U.S. economic expansion officially turns nine years old. Last month, it topped what was the second-longest expansion in the 1960s, with only the record 10-year expansion from the 1990s standing in the way.

For starters, consider that going clear back to the Civil War, the United States has never gone a full decade without a recession (the 1990s expansion straddled the century mark). Is there a chance this could be both the first decade to go without a recession and set the streak for the longest expansion? We like the odds.

As LPL Research Senior Market Strategist Ryan Detrick explained, “Here’s the catch: Bull markets don’t die of old age; they die of excesses. We aren’t even seeing wage growth over 3 percent yet, and overall inflation remains tame. In our view, this economic recovery could have at least a few years left thanks to strong corporate profits, continued growth in the services and manufacturing sectors, and a tailwind from fiscal policy.”

The LPL Chart of the Day shows that this is now the second-longest economic expansion on record, but the economic growth seen during this expansion leaves plenty to be desired.

Ryan Detrick is senior market strategist for LPL Financial.