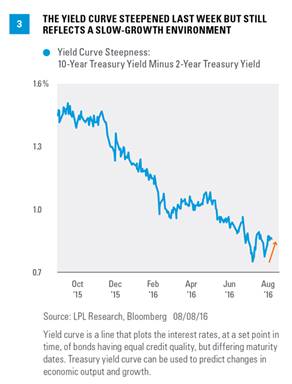

The yield curve steepened modestly in response to the stronger jobs report, a shift that reflects better growth expectations. However, the yield curve remains flat when viewed over a longer-term perspective [Figure 3] and is below the 25-year average of 1.2%. The yield curve slope remains positive and a substantial distance away from turning negative or inverting, but still reflects a slow-growth environment.

AUCTION ACTION & OVERSEAS INVESTORS

In the typical post-employment report lull, economic data are limited over the next two weeks and the bond market may take its cues from auction demand. Foreign demand, in particular, will be scrutinized closely as overseas purchases have played a key role in Treasury strength in 2016. Overseas investors’ cost to hedge U.S. dollar currency risk has increased over recent months and may impact demand. The Treasury will sell new 3-, 10-, and 30-year securities over consecutive days starting Tuesday, August 9, 2016, as this publication goes to print. Longer-term 10- and 30-year Treasuries will be a better test of investor demand.

CONCLUSION

On a longer-term basis, the pace of economic growth and Fed rate hike prospects will hold greater influence over the path of bond yields, but last week’s overall mixed message did little to alter the current environment. Economic data have yet to indicate a substantial acceleration that might warrant higher yields.

Until then, global central banks remain bond market friendly, as last week’s aggressive action by the BOE illustrated. The BOE announced additional stimulus consisting of a rate cut, increased government bond purchases, the start of corporate bond purchases, and a bank lending program. The bold move helped boost long-term bond prices and reinforced the bond-friendly stance of global central banks.

We continue to suggest a relatively neutral bond exposure, consisting primarily of high-quality intermediate bonds given the absence of notable value. Still, investors hoping for even better value and higher yields may have to wait longer.

Anthony Valeri is fixed-income and investment strategist for LPL Financial.