KEY TAKEAWAYS

· A strong July employment report caused Treasury yields to spike higher, but the broader message from the bond market has not changed.

· Improvement in economic data will need to exhibit greater consistency to exert meaningful upside pressure to bond yields.

HAS ANYTHING CHANGED?

A stronger than expected July jobs report caused Treasury yields to jump higher, but investors looking for the long-awaited rise in yields may have to wait longer. The bright spot provided by jobs offset otherwise bond-friendly developments, including a powerful policy move by the Bank of England (BOE) in response to Brexit risks and softer than expected U.S. economic data in the form of a below-expectation Institute for Supply Management (ISM) manufacturing reading and weaker economic growth, as measured by gross domestic product (GDP). Therefore, more proof is needed before yields may rise on a sustained basis, which would pose a more meaningful threat to bond prices.

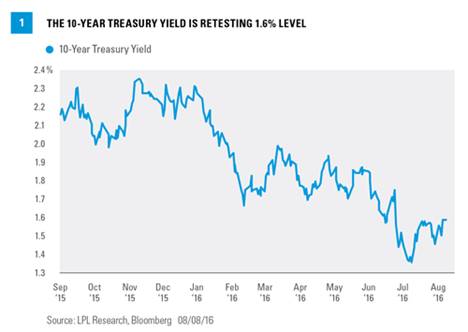

The 10-year Treasury yield rose to near 1.6% following the July jobs report, a level that brought about buying interest during July and helped support high-quality bonds [Figure 1]. Holding this technical level will help determine whether the current, sub-1.6% yield range holds, or whether the 10-year Treasury yield rises to the 1.7–2.0% yield range that characterized trading from late January to late June of this year. For most investors, such a nuanced yield environment does not materially alter the bigger picture even if further bond price gains have run their course.

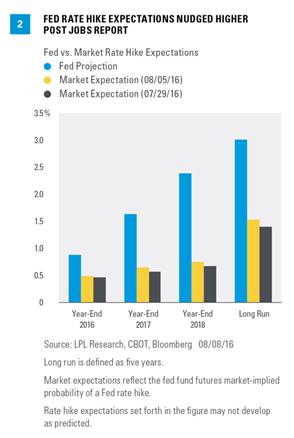

The employment report did, however, challenge very benign Federal Reserve (Fed) rate hike expectations. The jobs report helped keep bond investors “honest” and remain respectful of a potential rate hike in either September or, more likely, December 2016. Fed rate hike expectations increased for the week ending August 5, 2016, according to fed fund futures [Figure 2]. The market-implied probability of one 0.25% rate hike by December 2016 increased to 50%.

Bond investors still expect very little from the Fed over coming years. Figure 2 also illustrates that market-implied Fed rate hike expectations remain very mild with futures showing a long run rate of only 1.5%. The Fed has loosely described “long run” as a period of five years. This indicates that much of the good news for bonds is likely already priced in but shows that investors need more convincing. In short, futures still reflect expectations the Fed will raise interest rates very slowly given the sluggish global economic backdrop, and that more data will be required.

ASSESSING THE YIELD CURVE