Hedge fund professionals are expecting year-end bonuses to climb 39 percent at the end of this year, according to a survey of 500 buy-side investors. That view may be too optimistic, said a partner at the firm that did the polling.

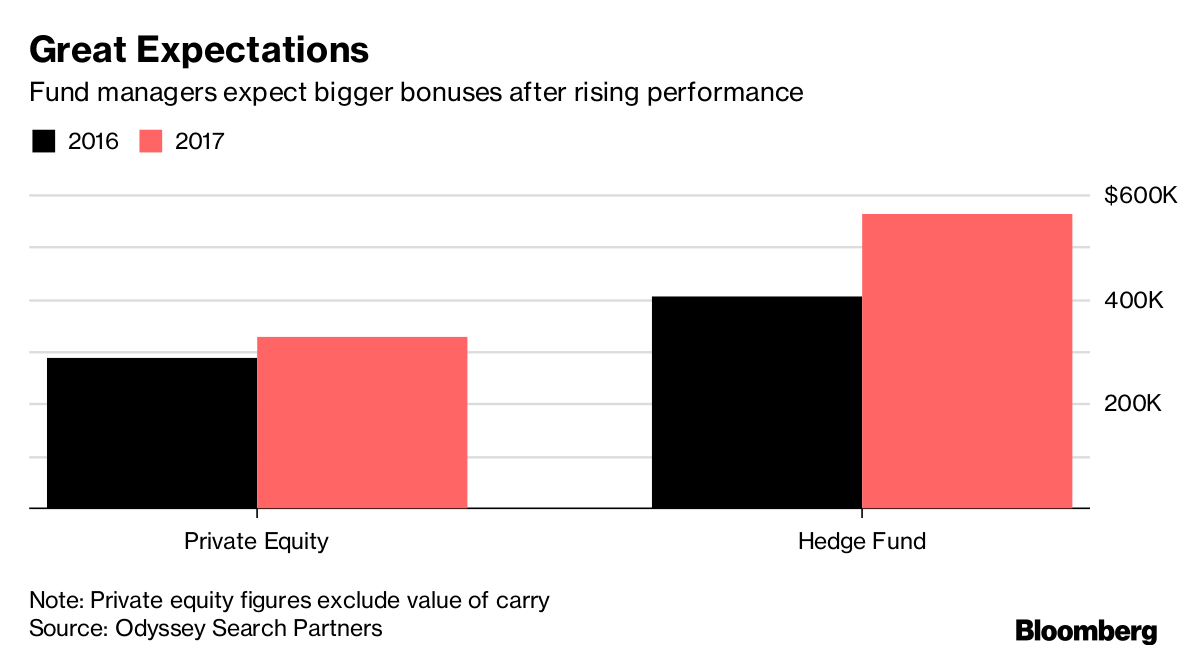

Respondents on average said they’re looking for bonuses rising to $562,000 from $405,000 a year earlier, recruitment firm Odyssey Search Partners said Monday in a statement. Sector heads, partners and portfolio managers expect a 79 percent rise to $1.38 million.

Hedge funds climbed about 6 percent through the end of November, compared with a 2.8 percent rise for the full year of 2016, according to indexes tracked by Hedge Fund Research. The S&P 500 Index rallied more than 18 percent this year through Nov. 30. The average hedge fund has lagged behind the stock market every year since 2009, prompting institutional investors to slam the industry for fees they say are too high given the performance.

“With assets not substantially increasing and with fees continuing to be under pressure, it may be wishful thinking that the bonus pools would have swelled so considerably,” Anthony Keizner, partner at Odyssey, said in an email.

Private equity professionals are expecting a 14 percent bonus bump in 2017, according to a separate Odyssey survey of 500 personnel. Principals are expecting increases of 8 percent to $355,000, while carried interest is expected to be valued at $3.2 million. That’s the amount the employees are likely to get once profits are shared after the investment period is completed, which is usually five years on average.

“Hedge fund people get their bonus every year,” Keizner said by phone. “On the private equity side, money is held in a five-year fund, and only when those businesses are exited, the people involved will get a percentage of the deals they work on.”

“Hedge fund people get their bonus every year,” Keizner said by phone. “On the private equity side, money is held in a five-year fund, and only when those businesses are exited, the people involved will get a percentage of the deals they work on.”

This article was provided by Bloomberg News.