A donation to a worthy cause during the holidays gets you a warm feeling, a tax deduction and maybe a better world for the kids. Some hedge fund managers give for an additional reason -- to get money-making assets.

A check to the right charity buys access to cocktail parties and galas where they make lucrative connections and raise money, according to a recent study by university researchers.

“As the charities raise funds, these guys are raising funds as well,” said Vikas Agarwal, a professor at Georgia State University’s business school who wrote the study with professors Yan Lu of the University of Central Florida and Sugata Ray of the University of Alabama. “Maybe investors get some trust and comfort when they see these guys doing good things.”

The researchers, who analyzed 6,642 donations made over 22 years through mid-2016 by 667 hedge fund managers, found the probability of poorly performing funds making a charitable contribution was almost double that of relatively well performing ones. Managers with the lowest net flows were also much more likely to make a gift, a finding that defies the notion that people flush with cash are more charitable.

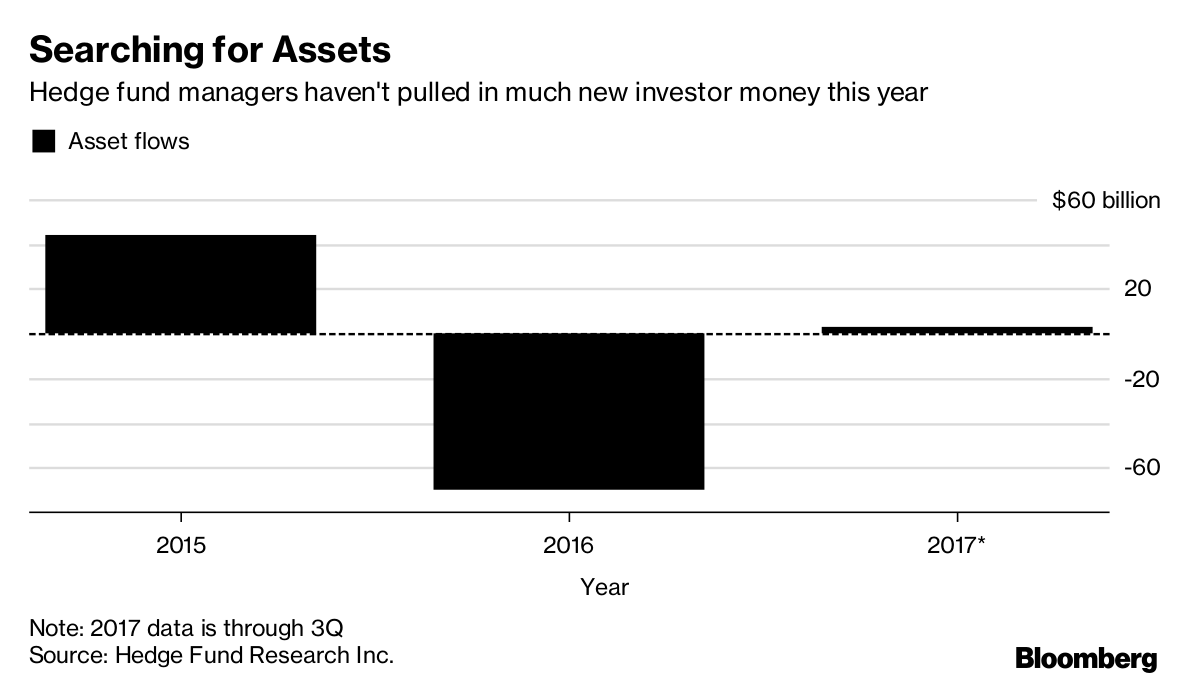

As the hedge fund industry tries to stem the outflow of assets, donations seem to help. The gifts, which averaged $325,000, were followed the next year by about 9 percent more in annualized net flows compared with those who didn’t contribute, the study found. And one-time donations -- presumably designed to make a splash -- were more effective than recurring donations.

Managers win even more assets with donations to marquee institutions where their hedge fund peers are also likely to give, such as the Clinton Foundation, Columbia University and New York’s Metropolitan Museum of Art and Museum of Modern Art. They in particular attract the kind of high-net worth people to which managers want exposure. Gifts to these institutions were followed the next year by an increase in net flows of almost 11 percent, the study found.

Win-Win

At a time of public wariness of Wall Street, the study would seem to support the stereotype of the hedge fund manager who puts making money first. “These guys are the most self-serving people on the planet,” said Erik Townsend, himself a hedge fund manager at Fourth Turning Capital Management.

But some insiders see it as a win-win -- charities get money and managers get access to money.