Philanthropy is much more than making donations—it’s an effective way of sharing values across generations and illustrating personal and family interests, passions and creativity. And, of course, when charitable clients have the tools to align their philanthropic, wealth management and legacy-planning objectives, it can enhance their giving while helping forge the multigenerational connections needed to ensure dynastic wealth.

Our research and close work with family offices and financially successful families over the past two decades has uncovered some meaningful trends that (1) collectively provide historical context for the issues facing today’s philanthropic families and (2) present several opportunities for advisors to better serve and engage with their most valuable clients.

Our Early Findings (2004-2014)

In our 2004 book, Inside the Family Office: Managing the Fortunes of the Exceptionally Wealthy, we saw that many families had adopted an increasingly holistic approach to managing their affairs, creating numerous points of intersection among the various parts of their portfolio as they sought to achieve a range of investment, risk management, tax mitigation and philanthropic goals. However, many family offices felt there was room for improvement in the way philanthropy was conducted, as it did not fully reflect the personal interests and intent of the underlying family members.

The Family Office: Advising the Financial Elite, which we published six years later in 2010, revealed that as the leadership of the family moved from one generation to the next, they were likely to use the transition as an opportunity to tighten the focus of operations and streamline expenses within their family offices. Most commonly, this meant retaining investment management and related services in-house while outsourcing non-core services, such as philanthropic advisory and charitable planning. In many cases, the families still wanted and needed support for the outsourced activities but expected to rely on a carefully curated network of specialists rather than building that infrastructure within the family office.

Russ’s 2014 book, Taking the Reins: Insights into the World of Ultra-Wealthy Inheritors, explained that rising generations (those who were not yet controlling wealth but actively assuming larger and more influential roles within their family) were keen to use their resources to tackle key social and environmental issues but readily acknowledged some gaps in their own skills and experience. As such, there was high interest in learning more, meeting like-minded people, and, especially, getting more involved to improve philanthropic activities and outcomes.

Our New Discoveries (2019-2020)

Six years on, we have new research from two generations of family members with family offices that illustrates a natural evolution of the above-mentioned trends and shows that philanthropy remains an important but potentially undermanaged component of the family agenda due in part to diverging generational views.

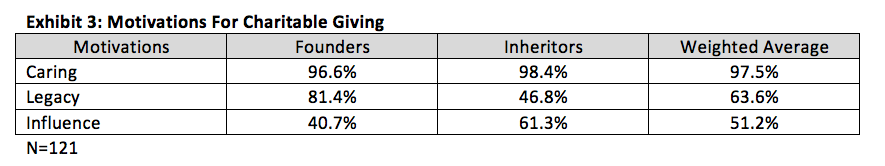

In contrast to the founding generation, who are typically focused on wealth creation, inheritors are proportionately more involved in philanthropic endeavors and expect to have even greater involvement in the future (Exhibits 1 and 2).

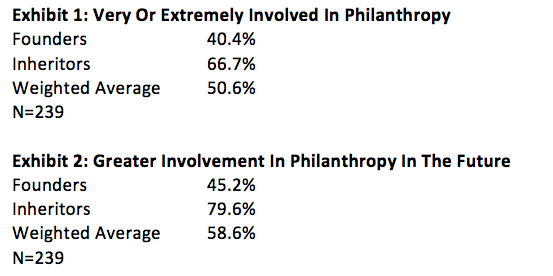

For all generations in a family office, the core motivation is helping others, but founders are more likely to see philanthropy as a means to building a personal legacy while inheritors see it as a mechanism for benefitting society (Exhibit 3).