To see how the tax bills that passed each chamber would affect Americans across a range of incomes and circumstances, Bloomberg turned to Tim Steffen, director of advanced planning at Baird Private Wealth Management.

Steffen provided eight scenarios, from a Manhattan homeowner with a $2 million salary to a renter in Milwaukee making $40,000.

Most taxpayers would do better under the Senate bill, the results show -- but that’s for the first year. Keep in mind that GOP senators crafted their individual tax changes to expire in 2026. Most of the House bill’s individual tax changes are intended as permanent -- except for a $300 tax credit for qualifying individuals that would expire after 2022. But the Senate’s tough budget rules mean that its “sunset” provisions are more likely to become law.

These scenarios examine only wage income and pass-through business income, and how the taxes owed on those earnings would change. They don’t examine the effects of city taxes, which can make a major difference. They also don’t examine any larger economic changes that might result under certain portions of the legislation -- such as the potential for some low- and middle-income people to see higher health-insurance premiums or for investors to receive better returns based on a planned corporate tax cut.

The Multimillionaires

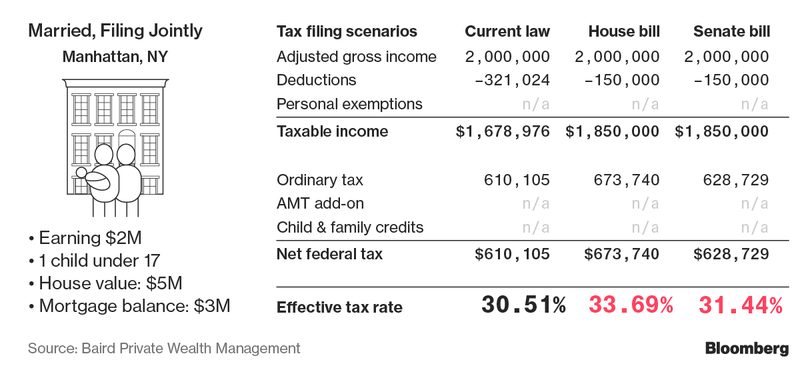

These Manhattan residents have a jumbo mortgage (at an assumed 4 percent interest rate) and take a $40,000 deduction on mortgage interest; pay property taxes of $96,250 and state income tax of $135,360; and make annual charitable contributions totaling $100,000.

The differences next to current tax law stem from new limits on deductions. The Senate bill results in a lower effective tax rate than the House -- largely because its top marginal tax rate is 38.5 percent, while the House bill retains the current 39.6 percent rate for top earners. (“Effective tax rate” means the overall, blended rate you pay as different tax rates are levied on your income at different thresholds.)

City taxes for these Manhattan dwellers would work out to almost 4 percent. Combine that with the top federal rate and top state rate, and you get a marginal rate of about 50 percent. While Congress irons out the differences between the tax bills proposed by the House and Senate, taxpayers have been living in limbo, and putting year-end tax planning on hold.

While Congress irons out the differences between the tax bills proposed by the House and Senate, taxpayers have been living in limbo, and putting year-end tax planning on hold.

Here's How Much Tax Your Clients Would Pay In Congress's Two Bills

December 13, 2017

« Previous Article

| Next Article »

Login in order to post a comment