The recent divergence between house prices and rents might thus be a case of rational calculation rather than irrational exuberance. That’s what Lara Loewenstein of the Cleveland Fed, one of the economists behind the New Tenant Rent Index, and Paul S. Willen of the Federal Reserve Bank of Boston concluded in a working paper released earlier this year, arguing that while the early 2000s boom in purchase prices “was plausibly driven by exuberant expectations, the boom of the 2020s more likely resulted from a preference shock.” In the economic model used in the paper, the preference shock is simply more demand for housing, but the empirical results also point to a shift in demand from rentals to owner-occupied dwellings. Loewenstein and Willen constructed price indexes from property-level data that separated owner-occupied from renter-occupied housing units and found that what they called the “price-price ratio” of owner-occupied to renter-occupied properties rose in 2021 for the first time in a decade. The price-rent ratio for just the rental properties rose, too, but remains well short of its 2005-2006 peak.

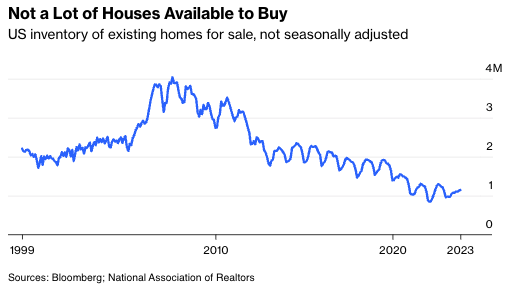

That’s reassuring, although it still feels as if something has to give in the U.S. housing market. The sharp rise in mortgage rates since the beginning of 2022 has made borrowing to buy a house much more expensive, which ought to put downward pressure on prices. But homeowners with low-rate pre-2022 mortgages face a strong financial disincentive to sell, so the supply of homes available to buy remains near its 21st-century lows, and prices haven’t adjusted to the new rate reality.

My Bloomberg Opinion colleague Matt Levine suggested last month that a way to break this logjam would be to allow homeowners with low-interest rate mortgages to buy their loans at market value—which would be much lower than their face value. Lots of readers informed him that homeowners can do this in Denmark. Guess what: In Denmark, house prices fell 8% from mid-2022 to mid-2023.

Justin Fox is a Bloomberg Opinion columnist covering business, economics and other topics involving charts. A former editorial director of the Harvard Business Review, he is author of The Myth of the Rational Market.