Many builders stock up on vacant land, which provides a tailwind during up markets since it appreciates with housing inventory. Alternatively, when the market softens, undeveloped land often gets marked down and can sink formerly attractive balance sheets. M.D.C. keeps its land portfolio light, instead focusing on generating returns from building.

KB Home (KBH) is another holding trading at compelling valuations. KB takes a different approach to property inventory but one that we believe is also prudent. After the credit crisis, the company focused on selectively acquiring land at attractive rates in markets that feature high household incomes and a scarcity of buildable parcels. The strategy has created operating leverage for the company and should result in significant margin expansion as the real estate market continues to grow. It is trading at just 87% of book value and 10.4x next year’s estimated earnings despite five consecutive years of increasing sales, so we believe the market isn’t fully appreciating the upside opportunity for the stock.

WCI owns or controls 13,500 home sites in the fast-growth Florida market, focusing on coastal areas. In our view, the company has a great supply of land in a robust region. Often builders that hold significant acreage have weaker balance sheets, but WCI is an exception. It has $146 million in cash and less than 20% net debt. Given that the cost of its real estate is largely already realized, we believe its operating leverage results in greater upside potential than downside risk. The company saw new orders jump 53.8% in the second quarter of 2015 and its backlog grow by nearly 45%. As the pace of building quickens, we believe WCI’s land will prove a valuable asset to boost top-line growth. The company’s focus on serving second-home buyers and active adults as well as its higher average selling price of $476,000 provides another unique aspect that diversifies demographic risk in the portfolio.

Beyond the Builders

While owning construction companies is the most direct way to participate in the resurgence of housing, we believe the powerful trend will also affect other industries from raw materials to home décor.

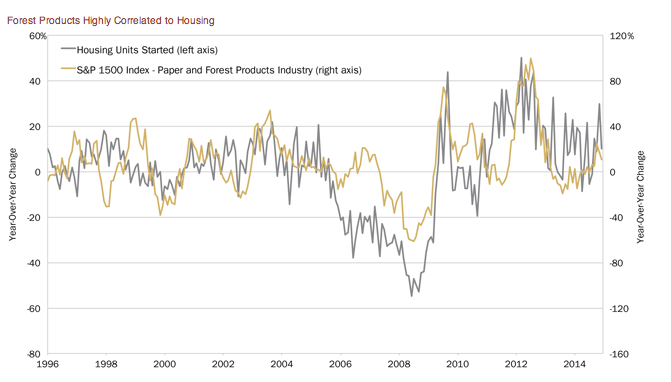

The paper and forest products industry, for instance, is beginning to benefit from housing activity. While pricing has been under pressure for wood products because of softer demand in China, some of the weakness has been offset by demand from domestic construction. Producers expect prices to stabilize and expect demand in North America to continue increasing with the uptick in renovations, remodeling and new construction. When that happens, we believe, performance should resume its historical correlation with housing as illustrated below.

Source: FactSet Research Systems Inc. and Heartland Advisors Inc., 8/31/1995 to 7/31/2015

Housing data is seasonally adjusted

Past performance does not guarantee future results.

Our holdings in paper and forest products generally trade at discounts to their peers in the industry and to their own five-year historical averages. We believe this will give them additional downside protection while lumber prices stabilize.

Another area that should benefit from household formation is specialty retail, which can thrive whether people are building new homes or moving into apartments.

We believe one company set to benefit is Pier 1 Imports (PIR), which operates in the competitive home décor space. Pier 1’s margins eroded after it engaged in promotional discounting and spent to strengthen its e-commerce presence. As its profit levels were compressed, its valuations followed and, based on forward earnings, the stock now trades at a nearly 14% discount to its 10-year median price-to-earnings ratio of 14.8x.