It’s tough out there for people looking for affordable starter homes.

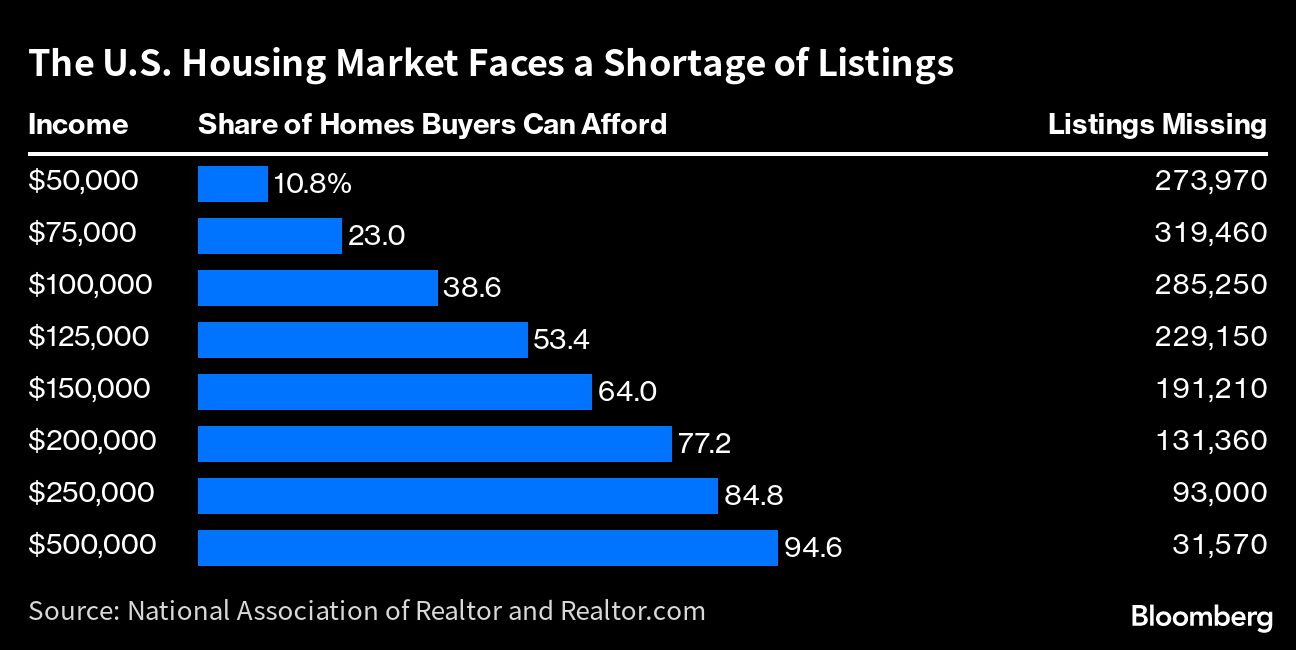

The US housing market, suffering from a shortage of available properties, is missing about 320,000 home listings under $256,000, the affordable price range for buyers who earn as much as $75,000, according to a report from the National Association of Realtors and Realtor.com.

Those buyers, defined in the report as “middle income,” can only afford about 23% of the available listings across the US right now, down from about half just five years ago.

The inventory shortage in the US has been building for years and was exacerbated by the pandemic real estate frenzy. With mortgage rates elevated and prices still high, many would-be buyers are stuck on the sidelines, especially as homeowners who locked in lower borrowing costs are reluctant to move.

“It’s not just about increasing supply,” said Nadia Evangelou, director of real estate research at NAR. “We must boost the number of homes at the price range that most people can afford to buy.”

The report found that buyers need to be making at least $125,000 a year or more to afford half of the US homes on the market. And it noted that affordability concerns persist, despite a slight increase in the number of homes listed. NAR said there were about 1.1 million properties on the market in the US at the end of April, an increase of five percentage points compared to last year.

This article was provided by Bloomberg News.