Often it's advantageous to take a look back down the road you've traveled before taking the next step forward. This approach would serve financial advisors well as they consider the best method to come to the aid of clients during the often volatile current market.

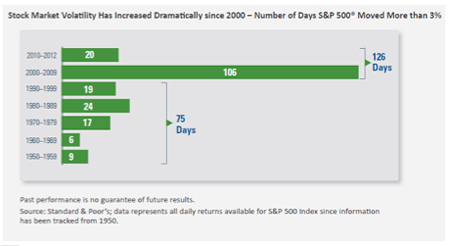

Financial advisors and their clients have been on a tumultuous five-year journey. The Standard & Poor's 500 Index plunged 56 percent from October 2007 to March 2009. Volatility ran rampant -- not just day-to-day price fluctuations but also bigger swings from bullish to bearish trends. The VIX "fear index" reached a record high, capping a decade that was more volatile than the previous 50 years combined.

The pain of this period is still acute. Though the S&P has more than doubled since its 2009 low, it's not quite back to its previous high. Most investors trail the index as they continue to make choices that further delay the date they'll earn back their losses.

In a 2012 survey of more than 700 U.S. investors, Natixis Global Asset Management (NGAM) found 70 percent say they expect lesser returns from their investments because of market volatility. Fifty-eight percent will take on only minimal risk, even when that approach limits their gains, and 57 percent don't plan to cut the cash portions of their portfolios. Meanwhile, as equities rallied, investors withdrew a net $58.9 billion from stock mutual funds in the first eight months of 2012, according to the Investment Company Institute.

So where should financial advisors go from here? What is the road to recovery for their clients? After this half-decade of turmoil, many professionals rightly favor innovative approaches that may reduce the dramatic highs and lows. Twice as many financial advisors say they would prefer to use new techniques in asset allocation and portfolio construction compared with those who would stick with the status quo, according to data from a separate NGAM survey.

Putting Risk First

At this point, advisors need to offer a measure of hope to their clients -- showing them how to link their wishes for safety with their need to grow assets to meet their financial needs. While investors realize what the stock market has cost them, they may not know that traditional portfolio construction methods can be flawed.

The best approach to building portfolios today is to put risk in the driver's seat of portfolio construction. Risk should be the primary basis of asset allocation. To limit volatility, advisors and investors should try to work within a consistent range of risk rather than shoot for a potential range of returns. That way, they can help increase a portfolio's predictability and seek to minimize the volatility that investors have recently experienced.

Limiting risk requires using the broadest possible range of asset classes and investment strategies, not just a conventional 60 percent stock-40 percent bond portfolio. It means making smarter use of those traditional asset classes, mixing such assets as actively managed stocks and inflation-aware bonds to enhance long-term returns and reduce short-term risk.

Of course, enhancing portfolio diversification means investors should seriously consider adding nontraditional asset categories - such as alternative investments and strategies. Depending on one's definition, alternatives include shorting, which can generate returns that aren't correlated to those of traditional assets, as well as long or short exposures to commodities, currencies or real estate for additional sources of return. Another alternative technique, hedging strategies, can help rein in risk.

Making The Case For Alternatives

NGAM's financial advisor study showed that 49 percent of respondents regularly use alternatives with at least some clients and 64 percent would, if they could, use alternatives for clients of all levels of wealth. What's holding them back is the belief that investors wouldn't go along with them.

This hesitancy on the part of clients should not be a surprise to financial professionals. Alternatives are less familiar to investors than stocks and bonds. Only 21 percent of investors say they have a strong understanding of alternatives. By a margin of 48 percent to 10 percent, they say alternatives are riskier than other investments. Similarly, 44 percent of investors agree that they're comfortable investing only in stocks and bonds, while just 19% disagree.

However, advisors who wish to help their clients overcome their trepidations about alternatives must take a leadership role in informing and educating clients about these investments. This is particularly important because 65 percent of investors say they've never had a conversation with their advisors about alternative strategies.

Rather than being discouraged by their clients' unfamiliarity with alternatives, advisors should view this situation as an opportunity to demonstrate the value they bring to the relationship. In fact, 69 percent of investors surveyed say they'd welcome a new approach to investing and 51 percent would use alternatives if their advisors recommended them.

Many clients would be intrigued to learn that, while alternatives are popularly known for taking higher risks to pursue returns, many are designed to seek more modest returns, stick to specific volatility targets and lower portfolio risk. Advisors should assure investors that use of alternatives is intended to fit into a broad array of investments -- alongside stocks, bonds and cash -- to tamp down risk.

Knowing The Clients

Financial advisors recognize there is no silver bullet when it comes to helping clients overcome their fears, get off the sidelines and re-engage the markets in a constructive way.

Many industry experts suggest that advisors should approach clients with a thoughtful argument for change that will allow them to participate in the current volatile markets with a more risk-controlled approach. Starting the

conversation with a focus on risk will help advisors suggest asset allocation strategies that include a mix of traditional and alternative assets suited to the client's needs - allocation approaches that can ultimately increase diversification, reduce risk and help manage portfolio volatility.

Conversations about risk and allocation are as much about understanding clients as about conveying new information. These discussions are a must component for advisors who seek to build trust and put clients on a path to better results.

David L. Giunta is president and CEO of Natixis Global Asset Management - U.S. Distribution (NGAM), where he oversees the distribution activities of the firm's U.S.-based affiliated investment managers. Globally, NGAM had assets under management totaling $711 billion as of June 30.