Organic growth is essential for the long-term success of any wealth management firm. There are two main ways a firm can grow organically: to do more business with current clients or to bring on new clients. Here, we will talk about ways advisors can find “high-quality clients.” That doesn’t just mean someone with a lot of assets. It means people who will work with you in a collaborative fashion; who won’t seek quick, shortcut solutions; who won’t call you up in the middle of the night; and who don’t waste your time needlessly.

The process we share here can help wealth managers generate four times their average annual referrals.

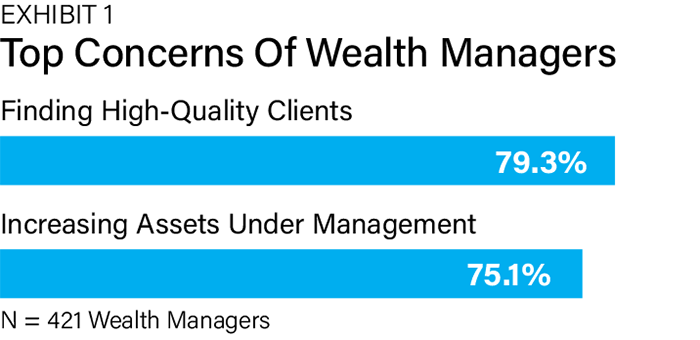

In a survey we performed of 421 wealth managers (Exhibit 1), 79.3% said that one of their biggest obstacles to success was their inability to find such good clients, and three-quarters said they’re worried that this problem will keep them from increasing their assets under management. (For a comprehensive list of their concerns, see an article we published earlier this year, “What are the Key Concerns of Financial Advisors?”)

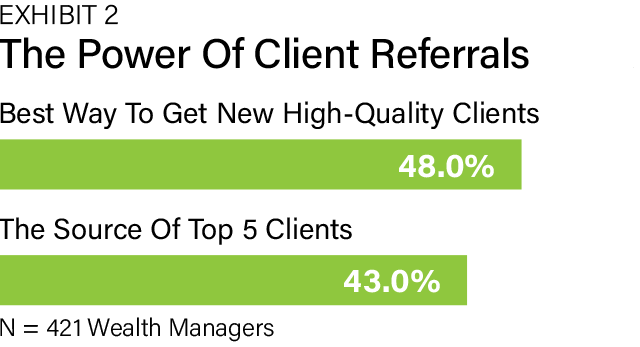

Almost half of the wealth managers surveyed said client referrals are the best way to get new and better clients (Exhibit 2). Forty-three percent reported that client referrals resulted in their best five clients.

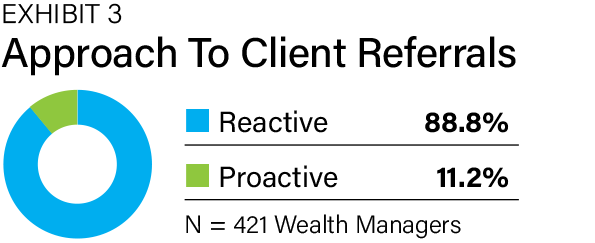

The bad news is that few wealth managers do anything proactive to get these client referrals. Instead, they are reactive and largely wait for the phone to ring (see Exhibit 3). Yet being proactive is sometimes as easy as reminding clients you would be happy to get referrals.

Stepping Up

If you’d like to be more proactive, there are usually some things you must have going for you already:

- You must have already done an excellent job for an existing client. Those clients who are impressed by your results will refer family, friends and business associates.

- The prospect you want will be looking for specific financial services or products. When your current clients are talking with friends and business associates, they will be less likely to think of you unless their contacts are seeking a specific service. They need to know it’s something you can deliver, not just something vaguely tied to what you do.

Remember that a lot of clients are reticent about making referrals. They do not know what to say or how to answer questions, so they take the easy road and do not say anything. When they try to make introductions, sometimes their efforts can be counterproductive. So, again, they have to be satisfied with what you do already and be able to put the pieces together when they see another potential client you could help.

That brings us to the proactive steps you can take. Discovery is critical to this process. It means using open-ended questions with your clients to learn about them and their ecosystems.

Step 1: Determine whom your clients can refer. By asking your clients some specific questions, you can learn about their business and personal networks. There is a good chance some of the people they mention would also make excellent clients for your practice.

Determining whom your clients might want to put you in touch with is easy. For example, think of a successful business owner who has been your client for over five years.

• What are the names of the suppliers to their business?

• What are the names of the business’s customers who also have businesses?

As you are learning about the business, you can probe to learn specifics. Of course, you are not limited to business owners—there are other groups of people your client also knows well. As your client talks about these prospects, you can determine the level of rapport they have with them—you can find out, for instance, how long one of your business owner clients has been working with these other parties. If the relationships are longer, the referrals will likely be better framed.

Step 2: Evaluate referral possibilities. Once you have heard some names, you can check their backgrounds on the internet and probe further to see if they would be good clients for you by checking things like their work and business histories and other connections.

Step 3: Facilitate client introductions. Then, at the appropriate time, you can ask to be introduced to specific individuals. The way you ask makes a lot of difference, and it helps if you can remind your client what specific value you add. If you simply ask a client if they know someone who can use your services, you’re not likely to get a referral.

Instead, for instance, you could ask a client: “When we were talking about your business, you mentioned Bob, the trucking company’s owner. Do you think he would like to also save hundreds of thousands of dollars in income taxes?” Saying something soothing along these lines, and then following up, gives you a better chance of being introduced to Bob and other business owners.

The better you become at this process and its nuances, the more likely you are to quadruple your client referrals.

Jerry D. Prince is the director of Integrated Academy, part of Integrated Partners, a leading financial advisor firm. Russ Alan Prince is a strategist for family offices and the ultra-wealthy. He has co-authored 70 books in the field, including Making Smart Decisions: How Ultra-Wealthy Families Get Superior Wealth Planning Results.