We all are reeling from the gimmicks and shock unleashed on the public by the meteoric rise of ChatGPT and its ability to imitate humans while giving many of the populus direct contact to AI for the first time. As the dust settles and the fanfare subsides there will be massive disruption and long-term structural shifts across many industries.

While Financial Advisor Magazine has already raised the existential question of whether AI applications like ChatGPT will ultimately replace advisors (see Can ChatGPT Replace Advisors?), one area on the positive side that will be interesting for advisors to watch will be the implications for how they acquire and scale new clients, specifically through referrals.

Most Advisors Do Referrals the Wrong Way, If At All

Most advisors know referrals are the most important source for new clients, but most of them either don’t proactively ask for them or, when they do, it’s done using an open-ended generic request like “do you know anyone that…” to which the client responds, “let me think about it and get back to you.”

Asking for specific referrals can dramatically increase the probability of actually getting an introduction. The data proves that referred leads are 4 to 5 times as likely to convert to clients. Despite knowing this, most advisors are either too busy or too fearful to ask for specific introductions.

Using ChatGPT To Write Referral Requests

Here is where the new ChatGPT chatbot can help. Assuming an advisor has identified some specific prospects connected to their client or an existing relationship, AI applications like ChatGPT can be helpful in not only drafting potential referral request e-mails or scripts, but may offer for the first time the ability to scale customized requests to dozens or hundreds of their existing clients and relationships.

Below are three case studies and specific examples of how advisors can use ChatGPT or AI applications in getting new clients by giving the AI chatbot context, then requesting it write the referral for the advisor using three scenarios:

The first involves asking for referrals where the relationship between the prospects is not apparent.

The second provides the context of the prospects sharing a board (could be corporate or non-profit but in this case I choose non-profit) and

The third involves a liquidity event and what it could look like in the future when AI incorporates the ability to ingest news and events

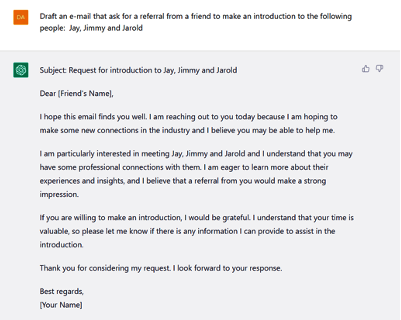

Scenario 1: Asking for an intro from my client to three specific prospects with no apparent connection between them

What I told ChatGPT:

“Draft an e-mail that asks for a referral from a friend to make an introduction to the following people: Jay, Jimmy and Jarold”

Observation & Result:

One area I thought it did well in particular without any prompt from me was its phrase “I am hoping to make some new connections in the industry.” We often use this type of phrasing in our coaching and included it without any prompting.

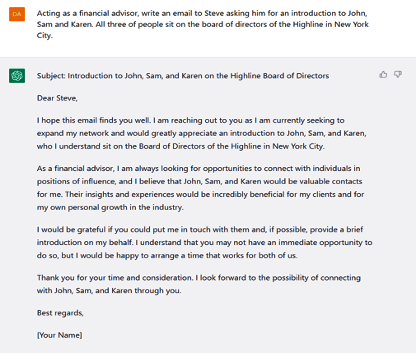

Scenario 2: Specific Context Where the Prospects Share the Same Board

Here is similar request but in the context of letting ChatGPT know the specific context of the prospects being on the same board as well as giving it the angle of writing from the perspective of a financial advisor.

It does a great job of incorporating the specific relational context of the prospects all sharing the same board a well as including the angle now of being a financial advisor in specific.

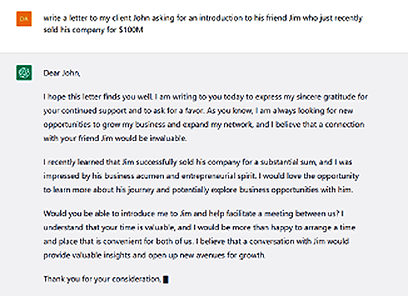

Scenario 3: Money in Motion Scenario–Context: The Future – Liquidity Driven Events and Referrals using AI’s Ability to Track News and Information Across the Web

A future scenario for this type of chatbot AI technology, which also has the ability to monitor news and aggregate information from across the web, could look something like this (note: this is not available yet in this application as they have limited its access to the complete internet):

• The AI has a list of prospects that you have given it

• The AI scours news for transactions like IPO or selling of the company

• It looks at your existing CRM of clients and relationships

• It then maps the path to that individual who just had a liquidity event

• It then generates an e-mail or script based on that event, that prospect and connecting with your services

This will make typical money in motion strategies, where advisors get wealth alerts and then try to reach out to a prospect, anachronistic in terms of prospecting.

Conclusion

There will be significant technological aftermath following the introduction and integration of technologies like ChatGPT. For advisors, one very specific benefit would be leveraging such technologies to help draft new referral requests for prospect introductions. The trend to watch will be how the AI learns to better frame and position such requests by watching seasoned advisors, adjusting and incorporating relevant information, profiles and current events.

David Friedman is the co-founder of WealthQuotient and the co-author of “Build Your WealthQuotient: A Data-Driven Referral Methodology to Access and Engage the World’s Wealthiest Prospects”. Mr. Friedman is also the former co-founder of Wealth-X, the world’s leading global database of ultra high net worth dossiers.