The significance of a firm’s brand to the consumer during the advisor selection process also shows a wealth dynamic. People with higher levels of wealth are more likely to assign equal weight to the advisor and the brand when choosing an advisor and less likely than consumers with lower levels of wealth to gravitate toward brand-heavy firms. Conversely, investors with lower net worth rely more on the assurance provided by a large firm brand than their high-net-worth counterparts.

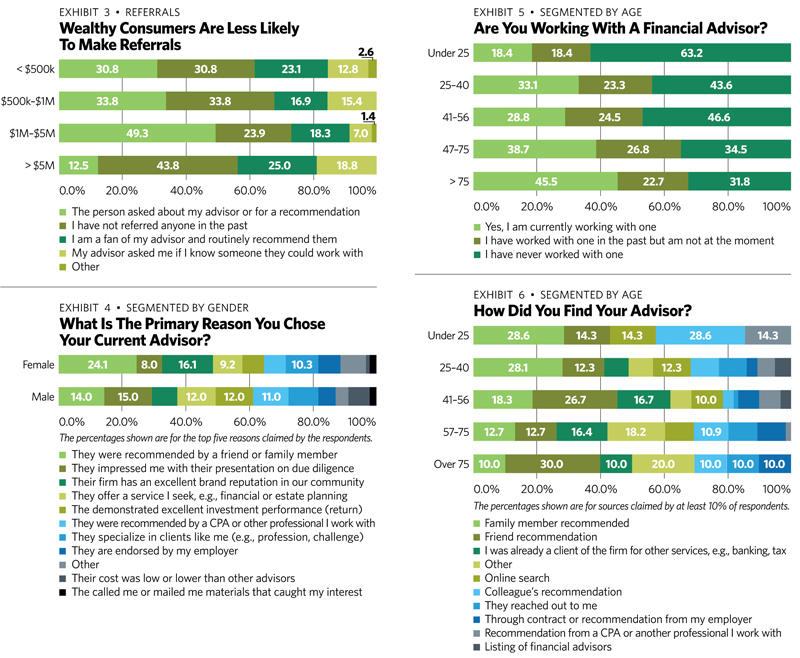

Finally, when looking at referrals segmented by a person’s wealth, we see that wealthy consumers are less likely to make referrals than those with lower levels of net worth. However, they are also the more likely to be raving fans.

Of the consumers surveyed, those with the highest levels of wealth (over $5 million) are the least likely to have referred someone to their advisor (43.8% report that they have not). Compare this percentage to consumers with less than $500,000 in net worth, 30.8% of whom report that they have not made a referral. That said, the highest wealth category also has the highest percentage of raving fans, with 25% of high-net-worth investors reporting that they routinely recommend their advisor.

Behavioral Characteristics By Gender

Women demonstrate some notable differences in how they choose an advisor. When compared to male consumers, women rely much more on the recommendation of friends and family when selecting their advisor and trust sales presentations less.

As shown in Exhibit 4, nearly a quarter of women (24.1%) chose their advisor based on the recommendation of someone with whom they are close, compared to 14.0% of men who did the same. Men, on the other hand, were most swayed by the sales presentation of their advisor (15.0%). The reputation of the firm’s brand in the community is also an important factor to women, with 16.1% of women consumers reporting that this was the primary factor in their advisor selection process.

For men, service menu considerations and investment performance also scored high marks. Male consumers were also much more likely to consider the recommendation of their CPA or other professional in their decision (11.0% of men compared to 6.9% of women).

In addition to considering different primary factors than men when choosing an advisor, women also feel less certain of how to go about selecting an advisor. When asked to identify the main reason they manage their own investments, 23.7% of female respondents without an advisor reported that they either lack the time or the knowledge to pick an advisor compared to 18.8% of male respondents. Women consumers are also much more concerned with the possibility of encountering fraud or receiving bad advice, with 18.5% of women versus 10.3% of men voicing this as a reason behind their reluctance to seek professional advice.

Differences By Age

Much has been written about the differences between generations and the contrasting values they hold. While we certainly note some generational behavioral differences in our sample, we find that level of wealth is a stronger predictor of a consumer’s behavior than age.

The fact that wealth is a stronger behavioral indicator than age shows itself most clearly when looking at which consumers choose to work with a financial advisor. As shown in the graph, the likelihood of working with an advisor increases with an individual’s age, with only 18.4% of Gen Z (under 25 years old) in an advisory relationship compared to 38.7% of baby boomers (57 to 75 years old) and 45.5% of the silent generation (over 75 years old). However, 54.2% of baby boomers and 63.6% of the silent generation have net worth over $1 million. In contrast, only 15.7% of millennials have achieved this level of wealth.

That said, generational differences do seem to play a significant behavioral role during the exploration stage in terms of which sources consumers depend on to find an advisor. When it comes to selecting potential advisors to consider, a steady percentage of investors across age groups rely on the recommendation of someone with whom they are close, either a friend or family member. However, the younger the investor, the more likely it is that the recommendation comes from a family member, perhaps a parent (28.6% of Gen Z). For members of the silent generation, it is more likely that this recommendation comes from a friend (30.0%).

Another key generational trend revealed by the survey is a person’s likelihood to use online search as a method to identify potential advisors. While 14.3% of Gen Z and 12.3% of millennials used online search to find their advisor, this percentage declines with age, shrinking to zero for the oldest investors.