The only way the Richardsons could get a loan for the inexpensive condo was to wrap it into a 10-year mortgage that also included their paid-off house. If they’d been a young couple with modest incomes, equally good credit, and enough savings to cover the down payment, they’d still be paying rent.

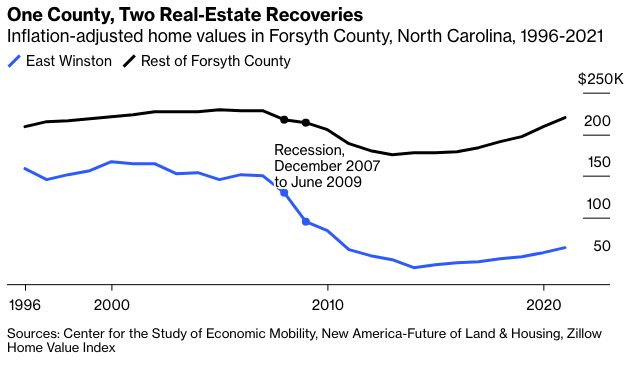

Killing off the small-dollar mortgage market has been an economic catastrophe in East Winston and other lower-income, often historically Black and Latino, neighborhoods. Would-be homeowners can’t buy and longtime homeowners can’t sell. Despite population growth, the inflation-adjusted value of a house in East Winston has fallen from about $150,000 in 2007 to just under $64,000 today, using the Zillow Home Value index. (The nadir was $39,825 in 2014.)

Massive amounts of hard-won local wealth have been wiped out. “We calculated that in real terms, every $1,000 invested in property in East Winston in 1996 is now worth $430; by comparison, every $1,000 invested elsewhere in the county is now worth $1,290,” says the study. The low-dollar houses that do sell mostly go to bargain-hunting investors paying cash rather than to would-be owner-occupants.

Eager to rein in mortgage lenders, legislators behind Dodd-Frank didn’t grasp what the law might mean for borrowers who would otherwise qualify for modest loans. Neither did the regulators at the CFPB. Rare is the policy maker who can even imagine a single-family home today selling for five digits.

People who live in low-dollar houses don’t walk the corridors of power. But their supposed representatives do.

We might call regulations that destroy the value of low-dollar homes “structural racism.” We might call them the law of unintended consequences at work. Or we might simply call them a scandal—and get to work rectifying the damage.

Virginia Postrel is a Bloomberg Opinion columnist. She is a visiting fellow at the Smith Institute for Political Economy and Philosophy at Chapman University and the author, most recently, of The Fabric of Civilization: How Textiles Made the World.