Let us assume that by the time you’re reading these words the Department of Labor fiduciary rule (DOL 4.0) has been implemented. Individuals operating solely under an insurance license (fixed only insurance agents) are now deemed to be ERISA investment advisor fiduciaries. ERISA fiduciary is a process-based standard designed to ensure that investment advisors act in the best interests of plan participants and beneficiaries, regardless of the specific investments or products involved. It provides flexibility for advisors to select investments that are appropriate for the particular needs and objectives of the retirement plan, while still holding them accountable for following a prudent process in managing those investments.

How will an insurance agent operate in this new environment? The challenges are formidable:

• Lacking an appropriate license, the agent cannot make any sort of recommendations regarding the client’s investments in securities.

• Agents are trained on and spend their careers operating in a product-based business model that bears little resemblance to the process-based ERISA fiduciary framework they have been subsumed into.

• Until now, the industry’s product based operating model has generated sufficient compensation to keep tens-of-thousands of thousands of insurance agents financially viable.

• When the business model is all about the “product,” it cannot simultaneously be all about “process.” Insurance agents, therefore, lack a process for planning within the context of the restrictions imposed on them by their single license and the limited authorities it conveys.

So, to summarize, insurance agents:

• Cannot make investment recommendations.

• Are required to employ a process, but they have none.

• Have no regulatory framework under which they can be paid advisory fees.

• Are unlikely to meet a fiduciary standard when recommending the purchase of a single annuity.

• Are uncertain to remain economically sustainable.

It would be logical to conclude that DOL 4.0 has left agents little hope of remaining viable. But the exact opposite is true. Insurance agents have an enormously important contribution to make to their client’s retirement security, and in a way that investment advisers and financial planners typically overlook. The unanticipated outcome of DOL 4.0 can be the elevation of agents into a position of income planning primacy. Realizing that lofty status, however, requires agents to make a few changes.

Reversal Of Fortune: The Business Process That Will Ensure Agents’ Success

To be successful under DOL 4.0, the agent’s activities will have to be narrowly focused on a critically important aspect of income planning. That is, the construction of an income “floor,” the foundation of safe secure lifetime income that is the vital first building block of the client’s larger income generation strategy. The task of actually building the income “floor” will be secondary to a process that:

1. Examines the investor’s retirement budget

2. Produces a fuller assessment of the investor’s needs

3. Determines sensitivity to key risks that can reduce or negate the investor’s ability to generate income from savings

4. Creates an unambiguous and demonstrable requirement for the agent to recommend annuities to meet the ERISA fiduciary standard

As ERISA fiduciaries, insurance agents must serve their clients’ best interests. In the context of working with retirees, what exactly does that mean? A lot rides on the answer. The answer is clear. It is a perspective I absorbed from the great economist and Nobel Laureate, Robert C. Merton. The answer is the advisor’s efforts to construct an efficacious income “floor” that serves as the stable foundation of the total income plan. As Merton has stated, and as I have parroted many times over, in retirement it’s your income, not your wealth, that creates your standard of living. This principle should be uncontroversial. Yet, it doesn’t stop many investment advisors from ignoring the need to mitigate longevity risk by incorporating a lifetime income annuity into the larger investing strategy. RIAs may fall back on the rationale that they are not licensed to recommend annuities. But that excuse has been invalidated in practice by the emergence of outsourced insurance desks and non-commissionable annuity products that align perfectly with the investment advisor business model and AUM compensation structure.

Another specious yet widely used mechanism that also shortchanges many retirees is the advisor’s reliance upon Monte Carlo simulations that culminate in a supposed a high “confidence factor” that the retiree’s income will continue decades into the future. Worse even is the use of these confidence factors as a proxy for safety. The “safety” is an illusion as demonstrated by research from Wade Pfau and Massimo Young that proves Monte Carlo simulations in the retirement income context are unscientific and arbitrary, and wholly dependent upon capital markets assumptions (CMAs) that vary widely from firm to firm.

These damaging income planning deficiencies are akin to financial “timebombs” with a long fuse, the length of which has been artificially stretched by a “bull” market in equities of unprecedented duration, engineered by a decades long decline in interest rates, combined with unprecedented levels of fiscal stimulus and money creation. When the bow breaks, millions of unprotected retirees will fall.

How Insurance Agents Will Be Elevated Into Income Planning Primacy

DOL has provided insurance agents with an extraordinary opportunity to advance the practice of retirement income distribution planning. This historic opportunity centers on serving the millions-strong legion of retiree clients who need the protection that only annuities can offer. But to seize this opportunity, to catapult agents into the category of income planning practitioner primacy, we first need to move past the suboptimal client segmentation framework that is sufficient while clients are accumulating assets but collapses in abject failure once clients begin to spend down those assets.

The Retirement Stage Failure Of AUM-Based Segmentation

Categorizing investors by their level of investable assets is a perfectly valid framework for matching people with various products and services. However, once the client enters retirement, the AUM segmentation construct becomes mostly useless. Its weakness is driven by the fact that AUM segmentation makes no room for planning techniques and priorities that are of paramount importance to most retirees. Its chief weakness is inadequate assessment of the retiree’s true needs. AUM segmentation provides only a partial picture of the client’s financial dynamics including susceptibility to risks that can reduce or wipe out the retiree’s capacity to generate income from savings. Therefore, in practice, many advisors ignore these threats to long-term retirement security, a tragic outcome and a moral failing that will, I believe, inevitably cast embarrassment if not shame on some in the investment advisor community.

How Insurance Agents Become Indispensable Post DOL 4.0

What will make fixed only insurance agents indispensable once they are categorized as ERISA investment advisor fiduciaries? The answer is a process. A process that is relevant to the needs of the expansive category of retirees I call constrained investors. The process holds these defining characteristics.

• Purpose built for income planning

• Transparent

• Easy to explain

• Provides a superior assessment of the retiree’s needs

• Enables the construction of a personal “flooring” strategy

• Mitigates key risks that threaten the continuation of retirement income

• Demonstrates that the agent must recommend annuities to comply with the fiduciary standard

If you are beginning to think that what I’m describing turns the insurance business on its head, well, you’re right. In terms of retirement income planning, it turns everything on its head.

Defining And Serving The Constrained Investor

I have been working on the Constrained Investor planning framework for years. It has long been the underpinning of my company’s retirement income planning solution, The Income for Life Model. The Constrained Investor process has been instrumental in helping advisors attract over $100 billion in client assets. During the calamitous market breakdown of 2008 2009, I saw first-hand how Constrained Investor planning helps clients remain fully invested.

Why Constrained Investor Is A Revolutionary Innovation

In the dynamic landscape of income planning, the stakes are high for all parties. Yet, a considerable portion of the financial advisor community persists in recommending a deficient income-generation methodology. The repercussions of unsustainable market conditions, combined with unprecedented fiscal and monetary stimulus, have led to inflation, an irrational stock market, rising interest rates, and heightened economic uncertainty. This section explores the shortcomings of the prevalent market-based approach to income distribution planning and introduces an alternative paradigm known as Constrained Investor. An important innovation prior to DOL 4.0, Constrained Investor emerges as the best and most actionable strategy to protect both agents and insurers in an ERISA fiduciary marketplace.

Traditional investment advisors typically advocate for a purely market-based approach to income distribution planning, emphasizing Assets Under Management (AUM) segmentation. While effective for asset accumulation, this construct falls short during the decumulation phase. Why? Wealth-based segmentation makes no room for issues that are critical to the income planning of most retirees, including the mitigation of risks that can reduce or even wipe out the investors’ capacity to create income from savings. At a minimum, all constrained investors require the inclusion of “flooring” in the overall retirement income strategy to protect against longevity risk.

Constrained Investor client segmentation replaces AUM segmentation, or "wealth segments" with three more meaningful categories of investors. All retirees will fit into one of the three categories:

• Underfunded investors

• Overfunded investors

• Constrained investors

This paradigm shift expands the assessment of client needs by examining the crucial relationship between the amount of investable assets and savings-generated "must-have" monthly income, fostering a more comprehensive understanding of retirement preparedness.

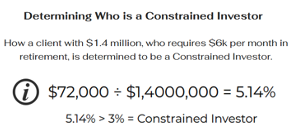

Changing The Income Planning Equation

Advisors are sometimes surprised at how much money some constrained investors have accumulated, i.e., $10 million, or more. With an assets-to-income ratio of 5.4%, a client with AUM of $20.6 million—who requires an income of $80,000/month—is very much a constrained investor (the largest constrained investor case on record, implemented by a Securities America registered rep). To determine if a client is constrained, we use the income-to-assets ratio (income required to fund a minimally acceptable lifestyle (MAL) divided by assets available to produce income). If the resulting percentage is 3%, or more, the client is a constrained investor.

Constrained Investor redefines income planning by prioritizing risk mitigation for those with limited margin for investment losses. This represents most retirees with accumulated assets. By incorporating safe monthly paychecks and guaranteed lifetime income, this approach alters investor behavior dynamics, enabling retirees to remain invested in risk assets through even the worst market conditions.

Addressing The Income Gap

Constrained Investor shifts the planning focus away from the total amount saved and toward the critically important relationship between savings and the income required to fund a minimally acceptable lifestyle. The income-to-assets ratio identifies the constrained investors as those with a percentage ratio of 3% or more. Surprisingly, even clients with substantial AUM may fall into the constrained investor category, emphasizing the importance of understanding this nuanced approach.

Annuities Are Essential In Constrained Investor Income Planning

It is essential to recommend annuities to constrained investors. My Financial Advisor magazine article received a #1 ranking for 2023. The article articulates the requirement to recommend lifetime income annuities. Criticizing the widely used systematic withdrawal plan, I described why the investment advisor’s failure to recommend annuities could breach fiduciary duty.

Agreement On Both Sides Of The Aisle

DOL 4.0 and NAIC best interest are not taking place in a vacuum. There is a larger retirement security issue facing millions of Americans. This fact spotlights and amplifies the impact of DOL 4.0.

In today’s fractured political climate, it can appear that Republicans and Democrats agree on nothing. But there is one area of universal agreement. That is, the United States faces an acute retirement security crisis that can only be managed through innovation. Liberals such as Bernie Sanders and Elizabeth Warren, and conservatives like Ted Cruz and Marco Rubio are all in perfect alignment when it comes to the urgent need for innovative retirement security solutions.

'Boomer' Women’s Retirement Represents an Extraordinary Business Opportunity

Constrained Investor planning offers a special level of applicability to the strategically important business opportunity represented by “boomer” women’s retirement. To capitalize, agents will need an actionable solution specifically designed for the women’s market. In recent years, insurance carriers have given much attention to this market opportunity through countess emails and webcasts. But it’s hard to find even one well-constructed, technology-driven, “flooring” focused and actionable platform that has been given to insurance agents to address the women’s market.

Building Women’s Loyalty And Capturing Assets

Unlike the retirement income strategies typically recommended by most financial intermediaries, including RIA and financial planner practitioners, individuals who tend to serve-up more investment risk than the female “boomer” is comfortable taking on, Constrained Investor aligns perfectly with women’s preferences for risk reduction, confidence and security. These preferences have been documented in multiple research studies. Agents who seek to market to “boomer” women should focus on messaging that centers around the investing attributes that “boomer” women most favor:

• “A strategy that employs annuities to enhance your retirement security. It provides a foundation of safe, lifetime retirement income as well as tax-deferred growth of savings. At a time of economic uncertainty and heightened risks, it is meeting a need that many women share."

• “A personalized annuity laddering strategy for a portion of your assets, the strategy builds confidence by strengthening your financial security in retirement.”

• “A strategy for women (and men) who wish to avoid subjecting their all of their savings to market risk, and who crave the security provided by guaranteed income that lasts for life.”

Say Goodbye To The Gloom

It is inarguable that constrained investors must be protected against risks that threaten the continuation of their income. An insurance agent taking the necessary steps to protect them against these risks is categorically operating in the client’s best interests. As I stated at the beginning of this article, all that agents need to do to remain successful is to implement a few changes.

• Embrace of the appropriate “flooring- focused” process

• Analyze the client’s budget

• Test the budget against the income-to-assets ratio

• Design a “flooring” strategy that is formalized in a written plan document

• In your marketing rely upon objective, client-facing educational tools that explain the needs and challenges constrained investors face in retirement

Many insurance industry participants Are understandably upset by the illogical classification of insurance agents as ERISA investment advisor fiduciaries. The industry will try hard to win multiple legal battles with the goal of seeing the DOL fiduciary rule vacated. This is an outcome I also hope for, just as I hope for a regulatory reform that allows insurance agents to be compensated via advisory fees. However, if Court challenges are unsuccessful, and if the fiduciary rule remains in place, every insurance agent should know that he or she has unique qualifications and the capacity to play a vital role in retirement and planning while meeting an ERISA fiduciary standard.

The key, as I’ve attempted to illustrate, is having the right kind of process and applying it to the correct area of focus: The building of the essential “floor” component of the larger income strategy. Practicing in an ERISA fiduciary marketplace, an agent should proudly hold himself or herself out as the “flooring” expert, no more and no less. This is the secret sauce of long-term professional success.

In conclusion, agents should recognize the shortcomings of the income planning approaches taken by many financial advisors, “plans” that are little more than the reverse of dollar cost averaging. Surely, for some overfunded investors this approach is appropriate. But for the millions of America’s constrained investors, it clearly is not.

Want to achieve the greatest success of your career? Stop thinking expansively and start thinking narrowly and strategically. Too often in the past, agents have tried to associate themselves with buzz words and concepts of investing. Your role as a fiduciary is a precious one. It is precious because you provide the liability minimization expertise that is often tragically overlooked other professionals. So, proudly proclaim the importance of the vital role that you play in income planning. Build millions of “floors” for our nation’s millions of constrained investors.

Wealth2k founder, David Macchia, is an entrepreneur, author and public speaker whose work involves improving the processes used in retirement-income planning. Macchia is the developer of the Constrained Investor planning framework. He is developing income planning tools and processes for use by ERISA fiduciaries. He is also creating solutions to mitigate the threat to human financial advisors that is posed by emerging AI competitors. His website is www.wealth2k.com.