You might have noticed it has been a wild year in the financial markets, but at least for one bond manager it has been an exciting ride. That’s not to say he’s gleeful about the volatility and its impact on investor portfolios (including his own fund’s portfolio); rather, it has enabled him to use all the levers available in his unconstrained bond fund and adjust the sails whenever the financial winds shift direction.

“The coolest things about the markets is that they’re so dynamic and interesting, and this is probably the most fun I’ve had in a really long time,” says Rick Rieder, co-portfolio manager of the BlackRock Strategic Income Opportunities Fund. “You have to figure out the crosscurrents of Europe and China and emerging markets, and the front end of the curve versus the back end. It’s a lot to do.”

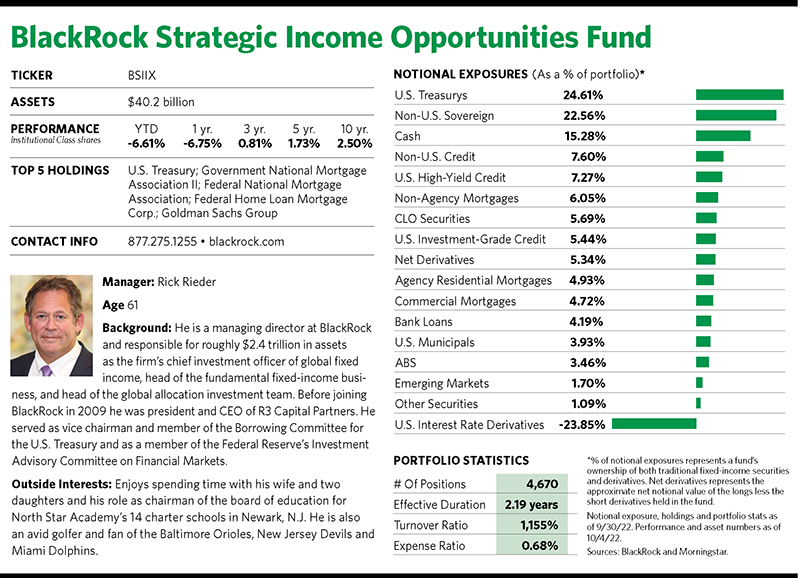

His fund was down 6.61% for the year as of early October, but that was 115 basis points better than the average return of its peers in Morningstar’s nontraditional bond fund category. The fund has consistently outperformed the category average during the past 10 years, landing in the top-quartile rankings during the five- and 10-year periods.

As Morningstar fixed-income analyst Eric Jacobson noted in a report earlier this year, Rieder and longtime portfolio co-manager Bob Miller have made the most of the strategy’s flexible investing approach in changing economic environments ranging from weak and strong credit markets to periods marked by rising or falling interest rates. “That flexibility has helped in several periods of market stress, allowing the strategy to stay out of trouble or outperform peers when rates have risen, and when [rates] have dropped and credit has sold off,” Jacobson wrote.

Rieder and Miller, along with the fund’s other co-manager, David Rogal, don’t follow a benchmark. With an unconstrained strategy they can scan the entire investible fixed-income universe for whatever opportunities they think makes sense for the times. That universe runs the gamut from U.S. Treasurys and high-yield credit to non-agency mortgage-backed securities, collateralized loan obligations and beyond.

“People see unconstrained and they think you’re swinging from the chandelier and taking risks,” Rieder says. “I actually thinks it’s the opposite, because being unconstrained allows you to use more tools. Rather than being tethered to an index or anything that constrains what you can do, the beauty of being unconstrained is that you can take less risk. We can use so many tools to change the direction or duration or diversification or beta of our portfolio.”

Fast-Moving Cycles

Rieder notes that he and his team always build an overlay based on the current economic regime, but that’s been a moving target in a post-pandemic world, one marked by a V-shaped economic recovery fueled by massive monetary and fiscal stimulus policies, and then followed by inflationary pressures worsened by the devastating war in Ukraine.

“We’re literally having full market cycles every month,” he says. “I’m shifting around the portfolio maybe more than I ever have before because the regime is shifting so much.”

He notes, for example, that he generally likes to have the fund’s interest rate exposure at the long end of the curve, but as summer transitioned into autumn this year, his team saw that they could buy yielding assets in the front end of the yield curve as the Federal Reserve became more hawkish about fighting inflation with its aggressive interest rate hikes.