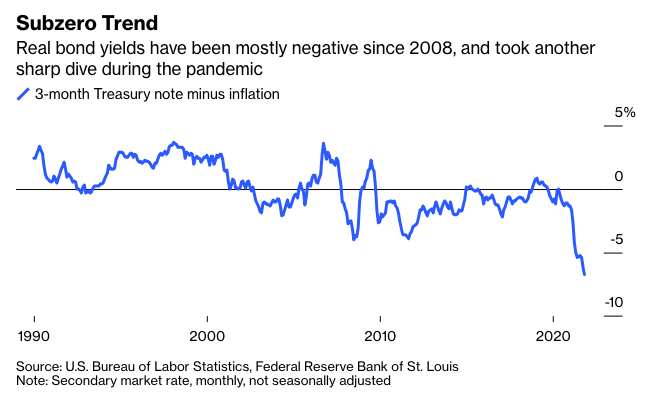

Since the 2008 financial crisis, the real (inflation-adjusted) risk-free rate has been consistently negative, and now it's even more so. Dips below zero here and there are normal, but it's hard to understand why the market would price the risk-free rate in the negative for so many years. Here's why that can be dangerous: Depressing the risk-free rate is presumed to cause excessive speculation, because investors seek out higher returns from riskier assets to reach their investment goals. And it also distorts investors' exposure to risk: They may have more or less than they realize, since the risk-free rate is the baseline for assessing the value of less-safe assets.

Maybe that explains why stock markets around the world are so high and why crypto assets are worth so much despite offering such little value. This may all gradually work itself out, and strong growth and high profits will keep stock prices high. Or perhaps inflation will fall to tolerable levels and central banks will continue their negative-rate policies for another decade and celebrities will keep talking about how crypto is the future.

But if interest rates do suddenly rise, either from persistent inflation, Fed policy or concerns about debt, markets could get shocked back into reality. Stocks could fall and stay low, bond prices will shoot up, and the price of credit will rise to levels investors haven’t experienced in decades. Super-risky assets like crypto will also fall, demonstrating, once again, they don’t hedge anything. By distorting the price of safety, the risk-free rate has become one of the biggest dangers. And when that happens, everything is riskier than it looks.

Allison Schrager is a Bloomberg Opinion columnist. She is a senior fellow at the Manhattan Institute and author of An Economist Walks Into a Brothel: And Other Unexpected Places to Understand Risk.

How Safe Assets Became Investors' Biggest Risk

January 18, 2022

« Previous Article

| Next Article »

Login in order to post a comment