The baby boomer generation comprises people born between 1946 and 1964. They amassed tremendous wealth, as they were in the right place at the right time. After the Second World War, the economy skyrocketed, creating enormous prosperity. The baby boomer generation is the wealthiest one today. Moreover, many will benefit from the silent generation—their parents—who will pass down about $85 trillion by the century halfway mark.

While healthcare costs and longer lives will likely cut into the money the baby boomers will pass to their inheritors, many of whom are millennials, trillions of dollars will be handed down. Because of the great wealth transfer, the millennials will become the wealthiest generation in history.

This macro perspective is helpful, but for wealth managers, it does not necessarily translate into business. Knowing this slow-moving trend will reset much of the wealth management industry is informative and insufficient. Wealth managers must be aware of actions they can take today if they choose to benefit.

When Inheritors Inherit

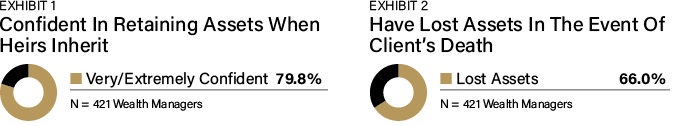

When 421 wealth managers were asked about their expectations of retaining assets when their clients pass their wealth to their inheritors, their answers were very encouraging (Exhibit 1). About 80% believe they will retain family assets after the death of their clients. They anticipate working with the inheritors without much of a change.

Confidence notwithstanding, 65% of these wealth managers reported losing assets when a client died (Exhibit 2). The inheritors usually pull all the business away from their parents’ professionals, including wealth managers, lawyers and accountants.

There could be other reasons for losing assets than the inheritors deciding to fire their parents’ wealth managers. For example, money could have been needed to pay off debt. Nevertheless, many wealth managers lose assets when their clients die. So, what might happen because of the great wealth transfer, and what are they doing about it?

What Wealth Managers Are Doing About The Great Wealth Transfer

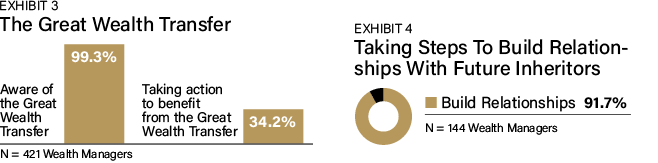

Nearly all wealth managers know of the great wealth transfer (Exhibit 3). It has received much attention within the wealth management community and the rest of society. However, only about a third of wealth managers say they are taking steps to benefit when baby boomers die and their wealth transitions across generations.

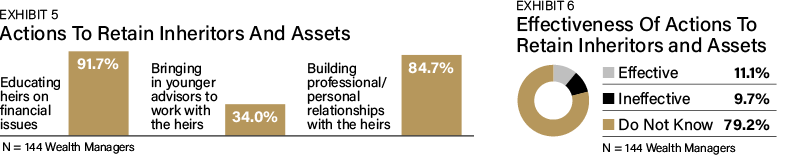

Of the wealth managers taking action, 92% report they aim to avoid “asset leakage” by seeking to build relationships with future inheritors (Exhibit 4). This takes several primary forms, as seen in Exhibit 5.

The value of this approach is presently unknown (Exhibit 6). There is limited data and experience to say if building such relationships will indeed prevent “asset leakage.” While there may very well be instances where this approach is very effective, there are also likely to be situations where it is not.

Although there is no solid empirical evidence, most of the research on inheritors shows that they are very likely to choose their professionals to work with instead of relying on the professionals engaged by their parents. What is evident is that there is a very high probability that many wealth managers will lose the assets of their baby boomer clients when they pass away. However, there is a solution for many wealth managers and their clients that benefits all.

‘Lives In Trust’

An often-superior approach to building rapport with future inheritors is “lives in trust.” This approach is only viable when it fits the needs and wants of baby boomer clients. Baby boomers will use trusts and other legal structures to transfer and protect wealth when appropriate.

Depending on circumstances, these structures may result in wealth managers investing the money of baby boomers for generations. For example, dynasty trusts can last decades, if not longer. Charitable trusts often extend 30 years. Critically, the most crucial benefit of trusts is that they meet the needs and wants of the family.

To deliver value to the baby boomers with the related result of managing assets for inheritors, wealth managers can take their clients through the lives-in-trust process:

• Step 1: Prompt the discussion: The wealth managers must often start the conversation. Discussions with their baby boomer clients about the ability of heirs to handle inheritances can be difficult, resulting in many clients looking to put off the conversation. Also, focusing on family objectives, such as creating a pool of money for great-grandchildren and later generations, can lead to the need for trusts.

• Step 2: Determining preferred outcomes: It is helpful when wealth managers drill down on the intentions of the baby boomers, including their confidence in the ability of the inheritors to manage wealth. Wealth managers must go from ideas to specifics regarding what the baby boomers want to accomplish.

• Step 3: Identify and evaluate possibilities: By knowing what clients want, various types of trusts can help them achieve their goals, so wealth managers must determine which possibilities are most viable.

• Step 4: Helping clients make smart decisions: Often, there is more than one viable option. So, wealth managers are responsible for providing all the relevant information to their clients, such as the advantages and drawbacks of different choices so that they can make smart decisions.

• Step 5: Taking action: Based on client decisions, wealth managers help facilitate or implement the desired course of action.

Wealth managers who want to capitalize on the great wealth transfer and do the best job for their clients must incorporate lives in trust as part of working with baby boomers. This does not mean that building stronger relationships with inheritors should be abandoned. For many baby boomers, lives in trust is a powerful solution to their goals and concerns.

Jerry D. Prince is the director of Integrated Academy, part of Integrated Partners, a leading financial advisor firm. Russ Alan Prince is a strategist for family offices and the ultra-wealthy. He has co-authored 70 books in the field, including Making Smart Decisions: How Ultra-Wealthy Families Get Superior Wealth Planning Results.