It’s not really arguing about the specific provisions—should we change the inflation indexing to the Consumer Price Index for the Elderly, the CPI –E [an inflation measure geared to rising costs faced by the elderly, such as medical expenses]. The big question: Is this program important enough to people that we as a nation want to pay up and maintain current benefit levels, or are people willing to split the reform between benefit cuts and tax increases somehow.

Where do you stand on that?

Surveys say that Americans want—and this is my instinct—to pretty much maintain current benefit levels. When I look at how much money, or how little money, people have in 401(k) plans, I just don’t see any other sources of retirement income out there. So I’d argue for fixing it on the revenue side. But I do believe in democracy, and if the American people writ large want to do it on the other side, in benefit cuts, we should do it.

The first proposal you analyzed in a recent paper was legislation proposed last year by Representative Sam Johnson, a Republican from Texas who is chairman of the House Ways and Means Social Security Subcommittee. What does he propose?

The Johnson proposal wants to cut benefits sharply so that the reduced benefits match the current income for the program. He would raise the age when you can collect full benefits to 69, cut benefits for above-average income earners, and reduce cost of living adjustments (COLAs) for people making more than $85,000 ($170,000 for couples). For those who would get COLAs, he would use a chain-weighted Consumer Price Index. [That index “employs a formula that reflects the effect of substitution that consumers make across item categories in response to changes in relative prices,” according to the Bureau of Labor Statistics website.]

What would the impact of that be on average Americans?

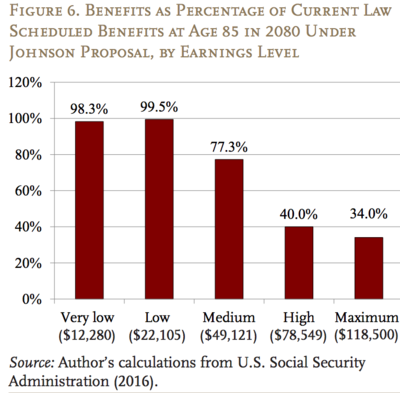

I looked at the ratio of proposed to current benefits at different points on the earnings scale. Since doing away with COLAs has a bigger impact as retirees age, I looked at individuals who were 85 years-old. It has no impact on the benefits of lower earners. But medium earners—which I calculate as having an income of $49,121—would see benefits cut to 77 percent of what they would get under current law. [That would be for someone born in 1995, turning 85 in 2080.] Those making $118,500 would get 34 percent of what they would get under today’s benefit schedule.

What does the other proposal, from Representative John Larson, the Connecticut Democrat who is the ranking member of the House Ways and Means Social Security Subcommittee, suggest?

His proposal, a few years old, has some small enhancements to benefits and two big revenue changes. He would raise the total payroll tax paid by employers and employees by 0.1 percent a year until it reaches 14.8 percent in 2042. And he would have the payroll tax apply to earnings over $400,000. The current cap on wages that the payroll tax is applied to is $127,200. [The current gap between $127,000 and $400,000 would not be subject to payroll tax.]It would also use a different measure of inflation when adjusting benefits—the CPI-E. This rises faster than the inflation measure used now, the CPI-W, the CPI for Urban Wage Earners and Clerical Workers. The income threshold for the taxation of Social Security benefits would be raised. [The threshold at which a portion of one’s Social Security benefit gets taxed hasn’t been adjusted since 1984. It is $25,000 for singles and $32,000 for married couples.] Larson would raise it to $50,000 for singles and $100,000 for marrieds. His proposal would also increase the “special minimum benefit” that goes to long-term low earners or people with sporadic work histories.