Mertz didn’t respond to Bloomberg instant messages or an email to his Bloomberg address. “Since this fund was founded, it seeks growth in the financial service sector—and it hasn’t changed,” read a quote from Mertz in The Wall Street Journal. Morningstar’s report notes that Russell is the one who tends to focus on banks “and recently cryptocurrencies.” The fund managers argue that investments in Voyager Digital and Mike Novogratz’s Galaxy Digital Holdings are based on following them for years and wagering that they could move beyond crypto and into more traditional financial services. They also say they were concerned about banks with large exposure to commercial real estate during the pandemic and now might feel more comfortable investing in them again.

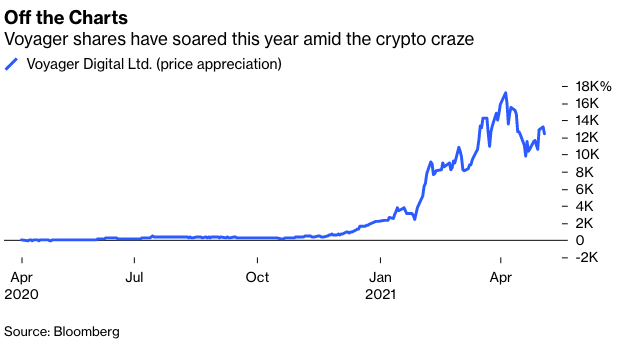

I suppose that’s believable (though just this week Galaxy agreed to buy crypto custodian BitGo Inc., hardly a sign of a pivot into more typical banking). Either way, it doesn’t seem as if it truly matters. According to the fund’s prospectus, “it will, under normal conditions, invest at least 80% of the value of its assets in stocks of companies principally engaged in the banking or financial services industries.” It considers Voyager Digital and Galaxy Digital “investment services,” according to a fact sheet, while Morningstar labels Voyager a tech stock. Even after paring back some of its exposure to Voyager, which has gained a staggering 12,873% over the past year, it remains far and away the largest holding in the fund. Emerald also holds some of the company’s shares in its Growth Fund and Insights Fund.

The next several months should be telling. Given that Emerald Banking and Finance Fund is a mutual fund with a minimum $50,000 investment in its retail share class, it seems unlikely to attract cryptocurious buyers to the same extent as Cathie Wood’s ARK Innovation ETFs, which have a much lower barrier to entry. But given its massive gains, do current investors lock in their profits and exit, or ride this out a bit longer? Bitcoin, for its part, isn’t providing the boost to returns it once was, with its price fluctuating while other options such as Dogecoin soar.

I’m not sure which way the flows will go, but Morningstar is spot on to warn that this fund isn’t quite what it claims to be. Perhaps it’s just a sign of the times that even long-tenured investment managers can be drawn to crypto.

Brian Chappatta is a Bloomberg Opinion columnist covering debt markets. He previously covered bonds for Bloomberg News. He is also a CFA charterholder.