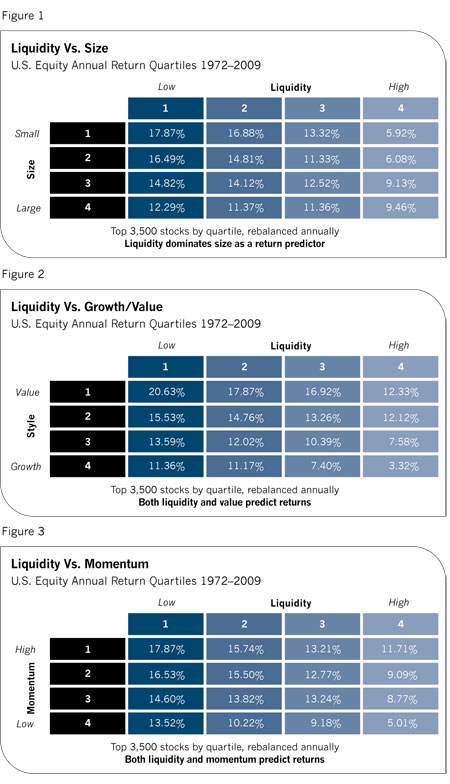

What is so striking about Ibbotson's research is how consistent the return patterns are across different slices of the equity markets. Of course, research has shown that other patterns of performance-like equal-weighted indexes beating their market capitalization-weighted counterparts-work well for sustained periods of time. Until they don't.

Asked about his outlook for the next ten years, Ibbotson voiced concern about the fixed-income markets, which have performed extremely well for the last three decades. This is prompting too many investors to overallocate assets to bonds, wondering why they should invest in stocks if they can earn almost as much or more bonds. These folks could be headed for major disappointment.