The 60/40 portfolio has been a mainstay of investing for years. After all, it’s been a winning defensive strategy—allocate the bulk of a fund to riskier equities with the remainder seeking the relative safety of fixed income. But with stratospheric stock markets sparking talk of a bubble, the bond side of the trade risks failing in its role of cushioning returns. Investors need to consider alternative buffers.

If the tide is turning, it would undermine a useful method for navigating markets. Returns by funds from Vanguard Group Inc., BlackRock Inc. and Dimensional Fund Advisors LP that use a 60/40 strategy have outpaced global bonds in recent years, but underperformed stocks.

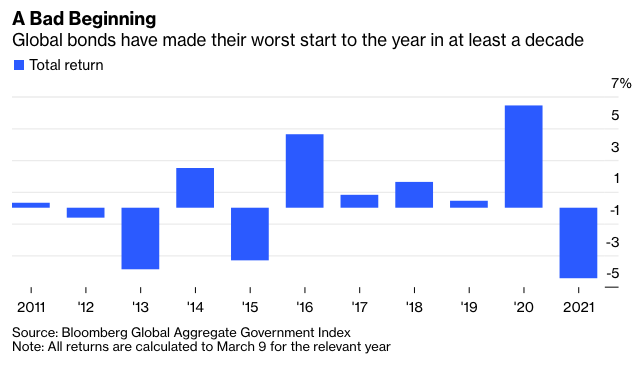

This week two of the world’s biggest sovereign wealth funds, Australia’s Future Fund and Singapore’s GIC Pte, warned that as a four-decade rally in bonds peters out, returns will be harder to generate in the years ahead. Globally, bonds have had their worst start to the year in at least a decade. Once again, the 60/40 strategy is under fire.

The sovereign funds aren’t alone in predicting harder times. AQR Asset Management LLC in January trimmed its expectations for the likely annual return on a 60/40 portfolio of U.S. stocks and bonds. The quant hedge fund expects the strategy to deliver just 1.4% after inflation in the next five to ten years, down from a forecast last year of 2.4% and a 2019 prediction of 2.9%.

With the reflation trade trashing government bonds, here are some suggestions for alternative securities that can be added into the mix and still offer some uncorrelated protection against a drop in stocks.

Counting On Currencies

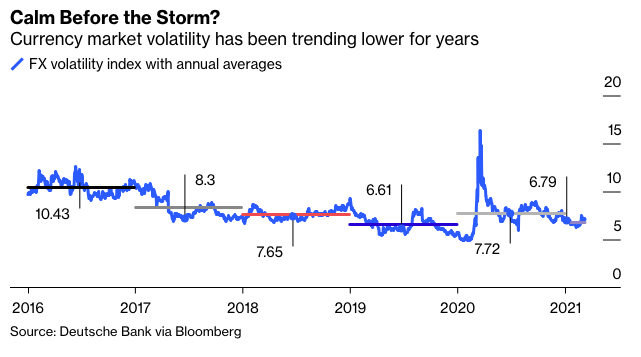

In recent years, the foreign exchange market has become a bit boring, with swings damped by central banks everywhere pursuing similar ultra-low interest rate policies. Apart from a spike a year ago as the pandemic roiled markets, currency volatility has been steadily decreasing, according to an index compiled by Deutsche Bank AG.

That might be about to change. The European Union’s fiscal response to the health crisis has been lackluster compared with the aid packages from the U.S. and U.K. governments. As traders start to anticipate asymmetrical monetary policy responses to contrasting post-Covid economic outcomes, opportunities to profit from corresponding currency shifts may become more widespread.