What will the next 10 years look like in the U.S. stock market? As we often do, we refer you to one of our favorite songs, “I Can Only Imagine,” and a book by George Friedman, The Next 100 Years. We believe the best performing securities of the next 10 years will be very different from the securities and the sectors that currently capture the “popular imagination” of investors.

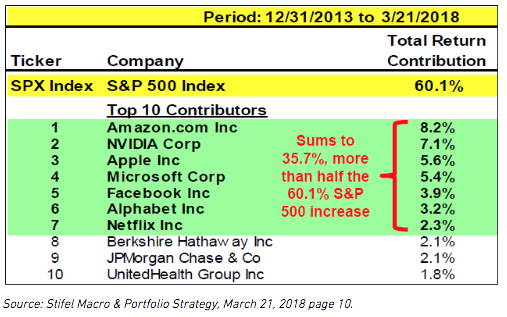

“I Can Only Imagine” is a song that tries to imagine what heaven will be like. We can’t tell you what heaven looks like, but we can tell you what stock-picking hell looks like. For us, stock-picking hell comes when a narrow group of stocks attain and maintain momentum based on the “popular imagination” of most investors and lose any connection to historical valuation norms. To understand this, see the chart below:

We have lived this for four and a half years while growth investing, based on extrapolating today’s popular themes, has trounced value investing over the last 10 years.

In George Friedman’s book, he argued that nobody would have predicted in 1900 what happened during the 20th Century. There was the Panic of 1907, World War I, the Bolshevik Revolution in Russia, the Roaring Twenties, the Great Depression, the emergence of Adolf Hitler’s Third Reich in Germany, World War II, the Cold War, a man on the Moon, the Civil Rights Movement, oil embargoes, the breakdown of the Soviet Union and the advent of the Internet.

Ten years ago, we were in the throes of the worst stock market decline in 80 years. Oil was $145 per barrel. Could anyone have expected at that point that the best performing stocks over the next 10 years would be very futuristic, high P/E stocks like some of those listed on the chart above? Would they have imagined a 9% compounded return from the S&P 500 Index? Who, back then, thought oil stocks would be one of the worst industry performers 10 years later? Only contrarians thought that “peak oil” was a theory in search of a major defeat in May of 2008 or that stocks were a great long-term buy.

We can only imagine what the next 10 years will be like, but we know a few historical facts. First, narrow popularity has historically ended badly for the stock market (1929, 1972, oil stocks in 1981, tech bubble in 1999, real estate bubble in 2005). Here is what John Kenneth Galbraith says about markets captured by “popular imagination:”

“Speculation, it has been noted, comes when popular imagination settles on something seemingly new in the field of commerce or finance.”

Second, the minority always wins at the expense of the majority:

“Investing is the only sphere of life where victory, security and success goes to the minority and never to the majority.” —John Maynard Keynes