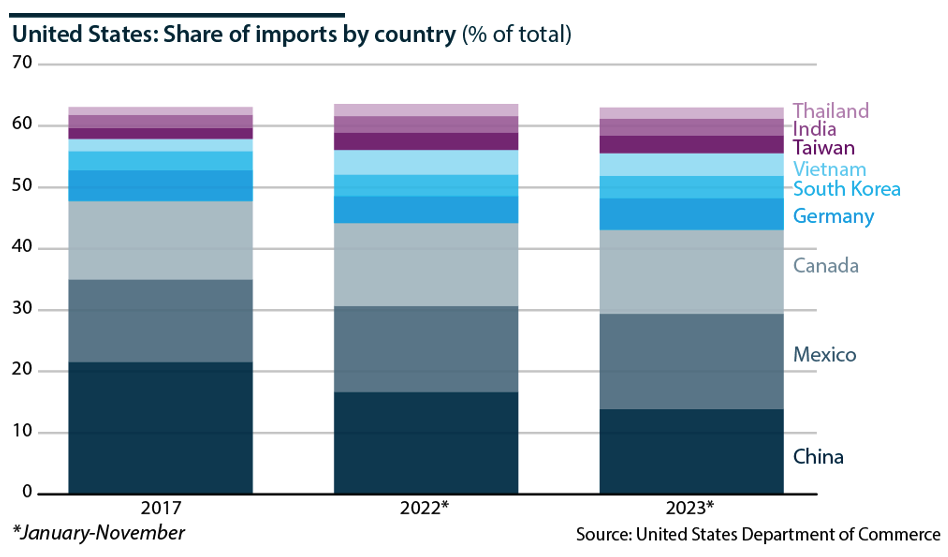

China was the largest exporter to the United States for 17 years. According to the U.S. Commerce Department, it lost that status to Mexico last year.

This underscores the impacts of the Biden administration’s fostering of diversification of U.S. companies' supply sources and import substitution for strategic products.

Yet, the “derisking” and “friendshoring” of supply chains does not necessarily presage China-U.S. economic decoupling.

Instead, it reshapes the bilateral relationship as Chinese firms establish a strong position within the United States' diversified supply networks to end-run geopolitical and economic challenges.

Policy Changes

China's share of U.S. imports increased steadily from 4.8% in 1992 to a peak of 21.6% in 2017. It began to decline as of 2018 with then-President Donald Trump's imposition of punitive import tariffs. It has now fallen to shy of 13%.

The Biden administration is considering further tariff hikes on Chinese electric vehicles, solar power equipment and less advanced semiconductors. A decision is expected to be made in the first half of this year.

Government policies aside, U.S. importers' reorientation from China to other suppliers is incentivized by China's rising labor and other costs and the growing competitiveness of suppliers in other Asian developing countries and Mexico.

Reverse imports by U.S. firms operating in China have been affected by the relocation of production facilities to other countries due to rising costs, a shrinking workforce and tightening security regulations, among other factors.

• HP is shifting the production of millions of laptops from China to Thailand and Mexico and plans to move some production to Vietnam.

• Lego chose to build its first USD1bn carbon-free factory not in China, but in Vietnam.

Between 2017 and 2022, U.S. imports of made-in-China smartphones dropped by more than 10%, while imports from India increased five-fold. Imports of Chinese laptops fell by 30%, while their imports from Vietnam quadrupled.

China's share of U.S. imports of the goods Washington lists as ‘advanced technology products" declined from 36.8% to 23.1% over the same period. Vietnam and Taiwan acquired the largest shares.

China's share of imports of “critical goods” rose from 6.2% in 2002 to 17.9% in 2017 but dropped to 11.1% in 2023. The Department of Homeland Security defines critical sectors where threats could have “potentially debilitating national security, economic and public health or safety consequences.”

Nonetheless, China remains the United States' primary overseas source of supply in the communication and information technology sectors, even though between 2017 and 2023, its shares of U.S. imports declined from 62% to 44% and from 46% to 27%, respectively, according to the Federal Reserve Bank of St Louis.

In other critical sectors such as chemicals, critical manufacturing, healthcare and public health, food and agriculture, metals, and energy, import dependency on China is below 10%.

Mexico, Vietnam, India, Thailand, South Korea and Taiwan are the countries most eroding China's US market share.

China's Response

To avoid high tariffs and other obstacles posed by Washington, Chinese companies are moving production for the U.S. market to Mexico and South-east Asian countries.

They usually relocate only the final stages of production, such as assembly of parts and materials supplied from China.

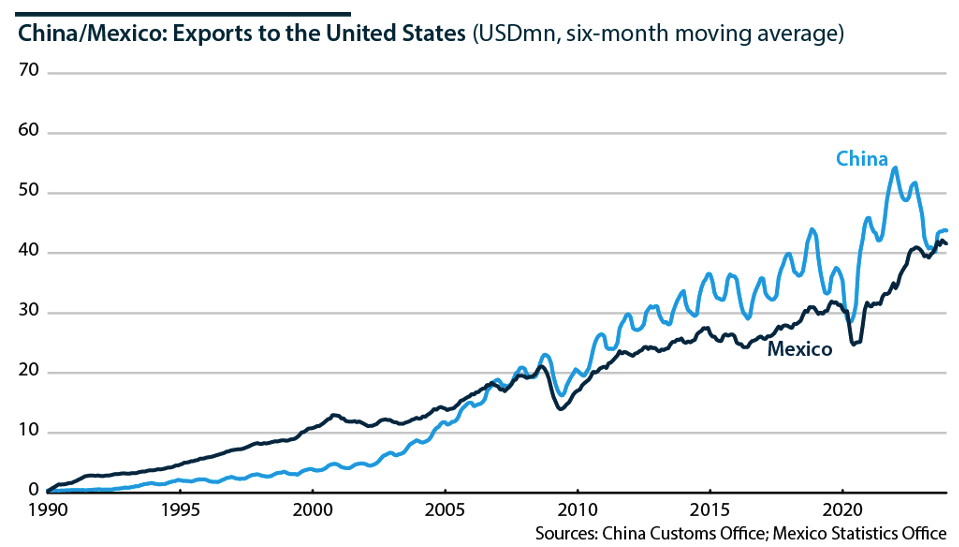

Mexico's ascent to become the leading exporter to the United States has been primarily driven by Chinese companies' direct investment into export-oriented industries there. China-focused industrial parks have sprung up around Monterrey and other Mexican cities a short truck drive from the US border.

Chinese companies that have recently established or plan to establish operations in Mexico include appliance and electronics manufacturer Hisense, automakers JAC Motors and SAIC Motor, construction and mining machinery manufacturer Lingong Machinery Group and solar panel manufacturer Trina Solar.

Related exports of production inputs from China are also soaring; countries enhancing their shares of the U.S. market are increasing imports of Chinese components, materials and equipment.

Evolving Trade

Chinese customs' statistics notably show a smaller decrease in China's U.S.-bound exports than U.S. Department of Commerce data. U.S. companies may be underreporting their imports from China with the aim of tariff evasion.

At the same time, Chinese firms are increasing their presence in the supply chains of the countries taking their U.S. market shares and expanding the U.S.-bound exports by their local affiliates.

Consequently, diversification of U.S. supply chains will reshape Chinese-U.S. economic interdependence rather than decouple it.

Election Uncertainty

This election year will resound with U.S. politicians vying to sound tough on China, and Washington's sanctions and Beijing's countermeasures will likely increase in strategic sectors.

Former President Donald Trump's assertion that if reelected, he would impose a universal 10% import tariff and up to 60% tariffs on Chinese goods adds an unpredictable wildcard for 2025.

However, China will remain one of the United States' key economic counterparts. Overall U.S. economic exposure to China will fall much less than import numbers suggest as Chinese firms increasingly supply components and semi-manufactures to Mexico and other rising exporters to the U.S. market.