Salespeople of all stripes know the drill. Go to the morning pump-up sessions. Hit the revenue targets. Move product or move along.

The playbook for selling everything from phones to time shares also crops up in a rarefied environment -- the Manhattan offices of JPMorgan Chase & Co.’s elite wealth-management unit. There, private bankers working with JPMorgan’s richest customers are encouraged to steer client assets into certain funds and instruments that generate rich fees for the bank, according to several former employees.

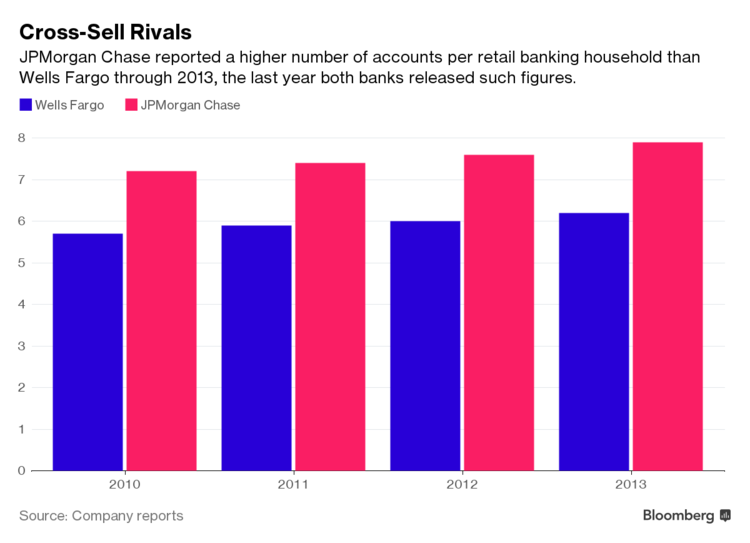

How banks cross-sell -- essentially, a “would you like fries with that” approach -- has come under regulatory scrutiny after revelations last year that Wells Fargo employees opened millions of fake accounts in clients’ names to reach sales targets. Wells Fargo admitted to a lapse and has changed its incentives. But the scandal brings an old question about banking into sharper focus: When do bank’s incentives for employees put the customer second?

There’s nothing illegal about cross-selling. Every company wants to sell its own stuff, and JPMorgan, the nation’s biggest bank, is no different. It stands out because it has so many in-house investments to offer its clients, including the biggest pool of in-house mutual funds in the U.S. banking industry. Several former employees at the private bank said the pep talks and reward system to sell such products made them uncomfortable: They felt pressured to push certain investments even when they believed others might be better for their clients.

No one is accusing JPMorgan of making up false accounts. The bank says it serves its wealthy clients by offering a wide range of investment options and discloses that it favors its own products. It doesn’t pay its bankers commissions, said Darin Oduyoye, a bank spokesman. The system benefits bank and client alike, he said.

“Clients have a number of options in financial providers,” Oduyoye said. “One of the reasons they choose JPMorgan as their primary bank is because we can offer a full breadth of investments, banking, lending and wealth advisory services. Clients expect to hear from us about all of these capabilities.”

Pay Scorecard

Seven people who worked in various roles across J.P. Morgan Private Bank in the last few years, three of them as recently as mid-2016, said they functioned less as advisers than as salespeople.

The ex-employees said days started with an 8 a.m. sales meeting in the “war room” high above Park Avenue. Then came client calls, with employees tracking sales targets on whiteboards. They would gather again before quitting time to hear about some handpicked investments -- what to sell and how to sell it. Bankers’ compensation “scorecards” measured how much revenue they were generating, these bankers said, but didn’t address how their clients’ investments were performing.

They and another dozen or so people familiar with the private bank agreed to describe its operations as long as their names weren’t used because they still work in related businesses. Current employees of the private bank declined to discuss it.