The selloff in emerging markets after Donald Trump’s U.S. presidential election was intense. A closer look reveals that things aren’t as bad as they might seem.

While local-currency bonds suffered their biggest losses last week since 2008 following the Republican’s surprise victory, a gauge of volatility in developing-market currencies remained 16 percent below the levels seen in February. The cost to hedge against foreign-exchange losses is 38 percent cheaper than it was in August 2015 when China’s yuan devaluation rattled global investors.

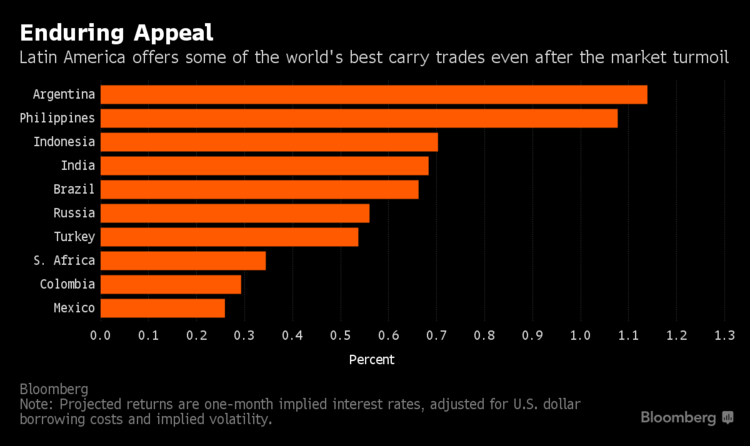

In a global bond selloff fueled by expectations that Trump will increase government spending, emerging-market traders are by no means capitulating. While bracing for the risks of protectionist policies, they’re betting faster growth and narrowing current-account deficits will help most developing countries weather the rout.

The recent declines have “created a great buying opportunity,” said Koon Chow, a strategist at Union Bancaire Privee Ubp SA in London. “We could get to the stage where, in one or two weeks time, U.S. Treasury yields stabilize, and if that happens, emerging markets will come back.”

While it’s too early to call a bottom, Chow said domestic bonds in Brazil and Russia start to look attractive, together with the Colombian and Peruvian currencies. Asian exchange rates are likely to remain under pressure, he said.

More than $1.2 trillion was wiped off the value of global bonds last week as Trump’s win bolstered the view that a government spending splurge may accelerate U.S. growth and inflation. Emerging markets were among the hardest-hit as the real-estate mogul pledged on the campaign trail to pull America out of the Trans-Pacific Partnership, brand China a currency manipulator and build a wall along the border with Mexico.

Restrained Selling

Since the Nov. 8 election, developing-nation local-currency bonds have tumbled 7.3 percent through Nov. 11, the biggest three-day slump since October 2008. The decline cut the bonds’ return this year to 8.5 percent. Investors yanked a record $301 million from BlackRock Inc.’s $8.9 billion emerging-market fixed-income fund on Nov. 10. On Monday, U.S. 30-year yields rose to 3 percent for the first time since January.

In the currency market, Mexico’s peso plunged 12 percent to a record while the Brazilian real and South Africa’s rand have lost more than 7.8 percent each. On Monday, the Malaysian ringgit sank to a nine-month low and South Korea’s won depreciated to the weakest since June.

Still, there are indications that the selloff may be limited. While hedging costs in the currency market increased to a five-month high of 4.3 percent on Nov. 10, they were lower than those of 6.9 percent in August 2015, according to data compiled by JPMorgan Chase & Co. At 11.3 percent, JPMorgan’s gauge of currency volatility is below this year’s high of 13.4 percent set in February.