With the presidential election now 7 months away. Trump 2.0 must be taken very seriously indeed.

• A strong Trump candidacy probably contributes to a strong stock market before the election.

• Attempts to pick “red” and “blue” stocks and sectors would be very unwise.

• De-globalization, tariffs and a weaker dollar are likely after a Trump victory.

• The critical post-election question: Would Trump go through with attacks on main economic institutions?

Trump 2.0

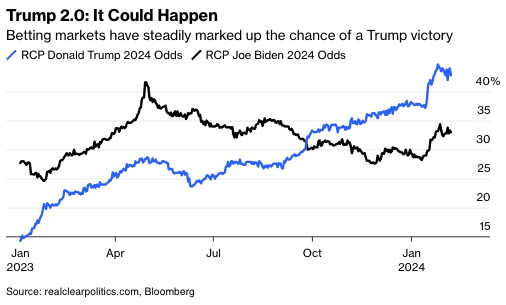

Yes, it could definitely happen. Everyone grasps that now. Donald Trump’s current dominance of the Republican nomination process, and his increasingly strong showing in polls for the November election, weren’t foreordained. Indeed, at the beginning of last year, he appeared to be almost out of it. Now, his chances are seen as close to 50/50, and clearly positioned better than anyone else. In testimony to how weak Biden is perceived to be, the candidate that bettors rank third, Michelle Obama, has an 8.5% chance:

So Trump is back, and a second Trump term is probably the base case at this point. And, as the man himself would doubtless point out, the S&P 500 is at a new record and has almost taken out the 5,000 level. How will the prospect of Trump 2.0 affect markets over the nine months that still have to be endured between now and the election, and what exactly would he change that would make a difference?

Stock-Picking

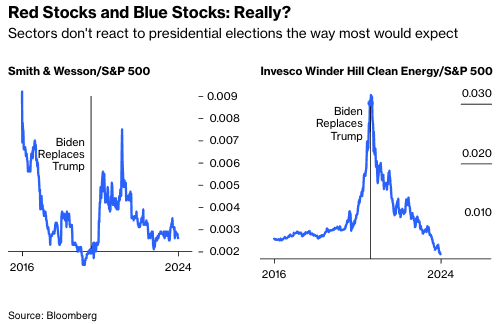

Despite initial appearances to the contrary, attempts to pick stocks that will benefit from a Republican or Democratic president have worked out terribly in the last eight years of extreme polarization and division. Christopher Harvey of Wells Fargo expects analysts to introduce or update their “red” and “blue” baskets of favored stocks in the coming weeks to help clients position for one party of the other. “Heck,” he admits, “even we got swept up in the blue/red stock frenzy back in 2020.”

But since election day in November 2020, the S&P 500 is up 53%, while the Nasdaq Green Energy index (which might be positively correlated with the Democrats) has fallen by 27%, and the S&P large-cap Oil & Gas index is up 230%, despite the defeat of the party of “Drill, Baby, Drill!” Harvey adds that both defense stocks and large-cap banks, normally regarded as partial to Republicans and not Democrats, have outperformed by more than 66% under Biden. “These relative performances,” he says, “have been entirely at odds with the conventional political wisdom/outlooks as they relate to clean energy/climate change, defense spending levels, and financial market regulations under a Democrat administration.”

For another illustration, look at how Smith & Wesson, the ultimate pure-play gun stock, and a leading clean energy ETF have performed since Trump won the election in 2016. Despite his close allegiance to the Second Amendment, Smith & Wesson tanked during his term. Meanwhile, the the rise and fall of clean energy is almost the inverse of what would have been expected under Trump (who made a point of leaving the Paris climate agreement) and Biden (who has pledged huge sums of federal money to alternative energy):

Long story short, it’s really not worth trying to predict how various political outcomes might affect individual stocks. When it comes to asset allocation, however, it might be different.

Surviving 2024

How exactly will the campaign affect the next nine months? It’s been a popular call that the Federal Reserve would do what it could to help Biden. That presumably involves cutting rates, and so Trump’s growing political ascendancy has added to the confidence with which investors have bet on a Fed pivot. Jerome Powell and his colleagues have managed to douse speculation that cuts are coming as soon as next month, and are dealing with intense questions about their independence. Slashing rates before it’s obvious that it’s safe to do so would only invite invective from Trump and compromise any sense of the Fed’s independence. In any case, monetary policy works with a lag; interest rate cuts now are unlikely to improve the economy in any perceptible way before the election.

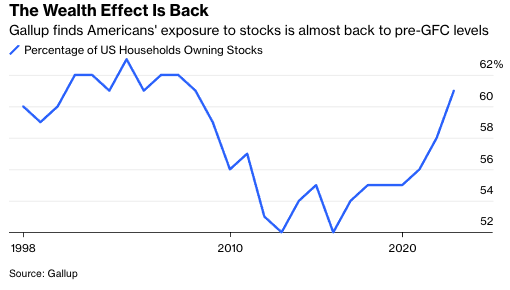

Therefore, the simplistic notion of the Fed cutting to help its friend in the White House looks far-fetched. But there are other ways that politics could move the Fed. Stock ownership by Americans is almost back to its highs before the 2008 crisis shattered confidence. That means that the so-called “wealth effect” is real.

With their 401(k)s and IRAs in great shape, Americans are wealthier and spend accordingly. It’s very useful that they do so at a time of high budget deficits. A stock market crash in the next nine months would likely doom Biden’s chances (much as it did John McCain’s in 2008). It would also wreck the Fed’s hopes of securing an economic soft landing. The last few weeks have shown that the market is anxious about the short-term rates outlook. Stocks took a dive after Powell said that a March cut was unlikely, then rallied to fresh records after Wednesday’s big 10-year Treasury auction passed off well. Whatever the Fed’s motivation, the political rise of Trump is a strong force toward lower rates over the next nine months. Rather than risk a crash, the central bank might acquiesce in permitting a melt-up.

And After The Election...

What happens to economic policy after a Trump victory? In his first term, he appointed Powell, a sitting Fed governor, as chair, even though there were candidates who would have represented a big change from the status quo. Various Goldman Sachs alumni served as economic advisers, overseeing a policy largely in line with Republican orthodoxy. But a second term could be very different. Trump has said that he wouldn’t reappoint Powell, and analysts are braced for a potential sharp politicization of the central bank.

Marko Papic of Clocktower Group cautions investors to be ready for Trump 2.0 to mark a big change in direction. With the federal deficit at historic levels, there’s little space for fiscal expansion — but Papic suggests that this is exactly what he might provide, satisfying the demand from his base for economic populism:

What are his priorities on the fiscal side? Like how is he stimulating the economy? Well, there is the extension of tax cuts and corporate tax, but I would say that even if he didn’t have any plans, the bond market would still riot. Because one thing we know he may not have plans for, he will want to spend money, and even if he doesn’t, we know one thing he won’t do, which is he is not going to do austerity unless he’s forced to by the bond market. That’s why I’m not bullish on stocks under Trump.

On this account, the Fed would then be required to do a mop-up job by buying bonds to stop yields from spiking out of control — or, in other words, yield curve control, a form of financial repression. The immediate effects might be pretty good; the long-term impacts on capitalism less so. For everyone else, the dollar would be weakened, which would be fine for a populist second term, as it would act as an effective higher tariff for other countries hoping to import to the U.S.

The main argument against this is that Trump may be mad, but he isn’t stupid. His current program involves taking on the administrative, or “deep,” state, so arguably institutional constraints would weaken. But still. Ian Harnett of Absolute Strategy Research in London argues as follows:

I would’ve thought that whoever he appoints as Treasury secretary would advise very strongly against playing fast and loose with the world’s reserve currency that allows the U.S. to borrow more cheaply in the global markets. If you lose that confidence in the underlying institutions of the United States because of political interference in the Federal Reserve, then there would be a high price to pay for that. I doubt that President Trump will do that; I think he might surprise people by a fairly conventional choice.

Trump needs to be taken seriously but not literally, to borrow another phrase. His rhetoric suggests that he’ll try harder to do economic populism properly this time, but past behavior suggests he wouldn’t take things too far. Markets have not priced in any such outcome. They must in any case guard against the real possibility of a second Biden term with a Republican Congress, which would probably result in austerity, an outcome with very different risks. Any and every indication of where Trump will fall on this continuum will move markets. Buckle up.

John Authers is a senior editor for markets and Bloomberg Opinion columnist. A former chief markets commentator at the Financial Times, he is author of The Fearful Rise of Markets.